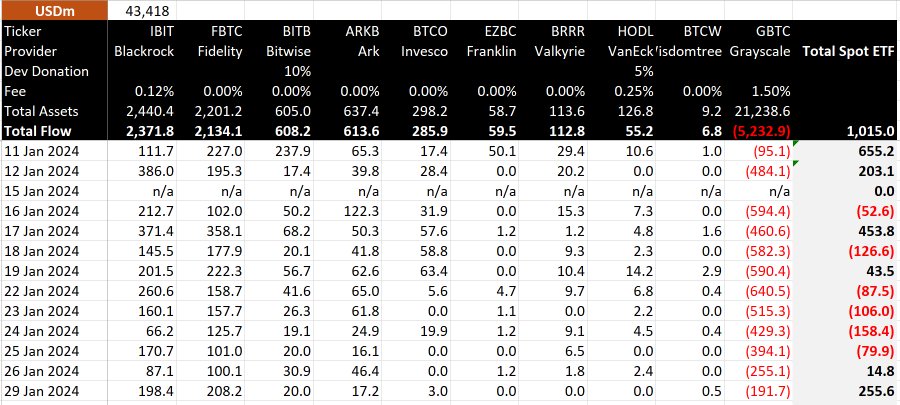

Grayscale’s Bitcoin Belief (GBTC) is experiencing a slowdown in outflows, with slightly below $200 million withdrawn from the fund on Jan. 29.

Knowledge from BitMEX Analysis signifies a complete outflow of round $192 million throughout this reporting interval. Notably, this marks the bottom outflows for the reason that fund’s inception, surpassing solely the preliminary day of buying and selling when withdrawals amounted to $95 million.

In the meantime, a have a look at the new child 9 exhibits that the inflows into the funds maintain offsetting that of Grayscale.

The Constancy Clever Origin Bitcoin Fund (FBTC) emerged as a standout, concluding the twelfth buying and selling day with the very best influx at $208 million. Compared, different funds, together with BlackRock’s IBIT, skilled a $198 million influx. ETFs corresponding to BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, whereas others reported zero inflows.

The strong buying and selling actions contributed a internet influx of $255.6 million throughout the twelfth buying and selling day.

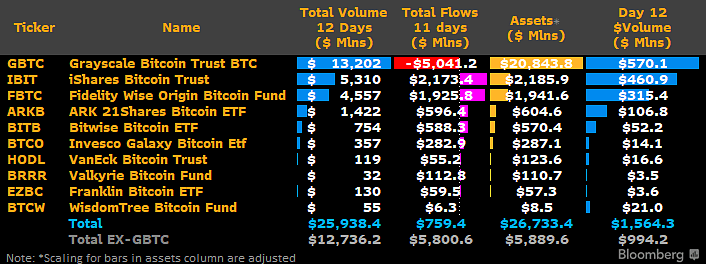

GBTC maintains ‘liquidity crown’

Nevertheless, Grayscale’s GBTC stays the highest cryptocurrency ETF in liquidity, as Bloomberg Intelligence analyst James Seyffart noticed.

Regardless of latest outflows, GBTC’s buying and selling quantity reached $570 million on Jan. 29, surpassing BlackRock’s IBIT by $110 million and reaffirming its market dominance.

Following its latest conversion, Grayscale’s ETF has skilled substantial outflows totaling greater than $5 billion. Analysts attribute the outflows to profit-taking maneuvers by traders uncovered to its earlier internet asset worth low cost.

Moreover, the fund’s comparatively excessive 1.5% administration charge is cited as an element that has led some traders to shift in the direction of competing ETF suppliers corresponding to BlackRock and Constancy, who cost a decrease charge of 0.25%.

As of Jan. 29, the outflows have resulted in Grayscale’s ETF’s Belongings Below Administration (AUM) dropping to roughly $21.431 billion (equal to 496,573 BTC) from its year-to-date peak of practically $29 billion (623,390 BTC), as reported by the fund’s official web site. This knowledge signifies that fund customers have divested over 100,000 models of the main cryptocurrency for the reason that approval of the ETF conversion.