- COMP elevated by 155% within the final 30 days and the TVL adopted swimsuit.

- Bulls’ try to revive demand at $72.12 has been neutralized by promoting strain.

- COMP could pull again to $65.56 relying on EMAs and Stoch RSI development.

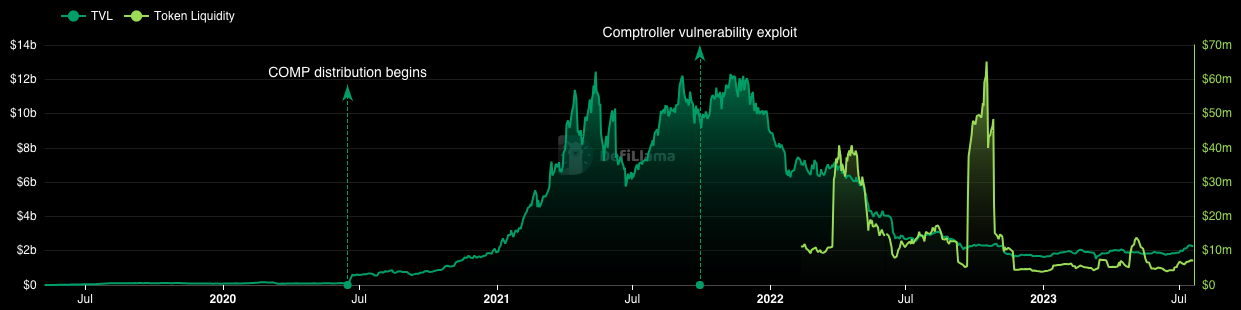

Within the final 30 days, Compound Finance’s (COMP) Complete Worth Locked (TVL) has grown by 22.09%. Based on TVL aggregator DefiLlama, Compound’s TVL development was rather more than Lido Finance (LDO) and Aave (AAVE) throughout the similar interval.

TVL and Worth Spike

For context, the TVL reveals the overall worth of property locked or staked in decentralized Purposes (dApps) working beneath a DeFi protocol. Due to this fact, the rise in Compound’s TVL signifies that traders perceived the protocol to be extra reliable.

Just like the TVL, the liquidity in Compound additionally adopted the identical path. The expansion in liquidity means that there was a rise in token swaps and the slippage require was not extraordinarily excessive.

Equally, COMP’s worth has extremely grown during the last 30 days. Based on CoinMarketCap, COMP elevated by over 155% throughout the mentioned interval. However with the TVL exceeding the market cap, COMP might nonetheless be thought of undervalued.

COMP Dangers a Downtrend

From a technical perspective, COMP’s uptrend started with a pointy shopping for demand at $52.58. After rising to $76.42 on July 15, the value fell as profit-taking overrode shopping for strain. In between the autumn, bulls tried to revive demand at $72.12. However the effort was quenched by promoting strain.

As of this writing, the Superior Oscillator (AO) was -0.15. Sometimes, a constructive AO implies that the 5-period Shifting Common (MA) was greater than the 34-period Shifting Common (MA). However because the indicator was unfavourable, it signifies that the gradual MA was higher than the quick MA.

Due to this fact, COMP, whose 24-hour efficiency was a 4.32% improve, might quickly succumb to a downtrend.

Moreover, the Stochastic Relative Power Index (RSI) was 76.17. As an indicator measuring an asset’s momentum, the Stoch RSI is taken into account overbought when it reached 80. Conversely, when the indicator hits 20, it’s oversold.

At press time, the RSI confirmed that COMP may very well be near reaching an excessive excessive. If the Stoch RSI hits 80, then merchants could must be careful for a pullback.

Additionally, the Exponential Shifting Common (EMA) indicated that COMP may very well be on the verge of halting its bullish streak. On the time of writing, the 20 EMA (cyan) was above the 50 EMA (yellow).

However this crossover occurred round $55.59 on July 9. Since then, the 50 EMA continued to shut in on the 20 EMA. If the 50 EMA flips the 20 EMA, then COMP could don’t have any different possibility than to retrace and goal $65.56.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held chargeable for any direct or oblique injury or loss.