Coinbase Prime, the crypto platform explicitly designed for institutional traders, trusts, and high-net-worth people, has seen a dramatic enhance in buying and selling exercise following the U.S. spot Bitcoin ETFs launch.

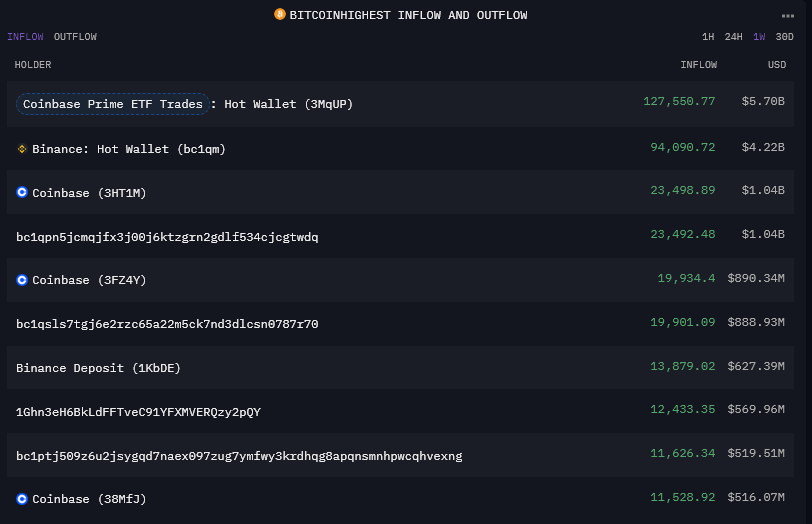

StarCrypto evaluation recognized a scorching pockets at Coinbase Prime that has surged to the highest of the Bitcoin influx chart over the previous week. This pockets, used for buying and selling actions throughout the platform, noticed modest inflows and outflows within the tons of of thousands and thousands over the course of a month all through 2023. Nevertheless, over the previous week, it has seen $5.7 billion in inflows and an equal quantity of outflows. Traditionally, Binance’s scorching pockets has dominated the stream leaderboard, and from the information analyzed, this seems to be the primary time Coinbase Prime has surpassed Binance over 7 days.

Over the previous 30 days, Binance nonetheless leads with round $14 billion in inflows and outflows, whereas Coinbase Prime flags barely behind at round $12 billion. It’s value noting that different buying and selling wallets are tagged as belonging to Coinbase Prime on Arkham Intelligence. Nevertheless, this pockets seems to deal with massive transactions.

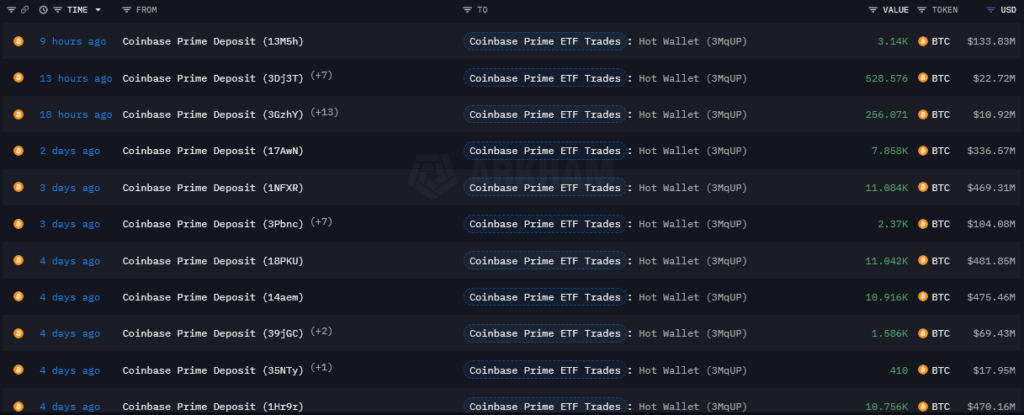

The surge in exercise may be seen via the desk under, which reveals solely transactions larger than $10 million. Up to now 4 days alone, there have been a number of deposits of over $400 million in a single transaction.

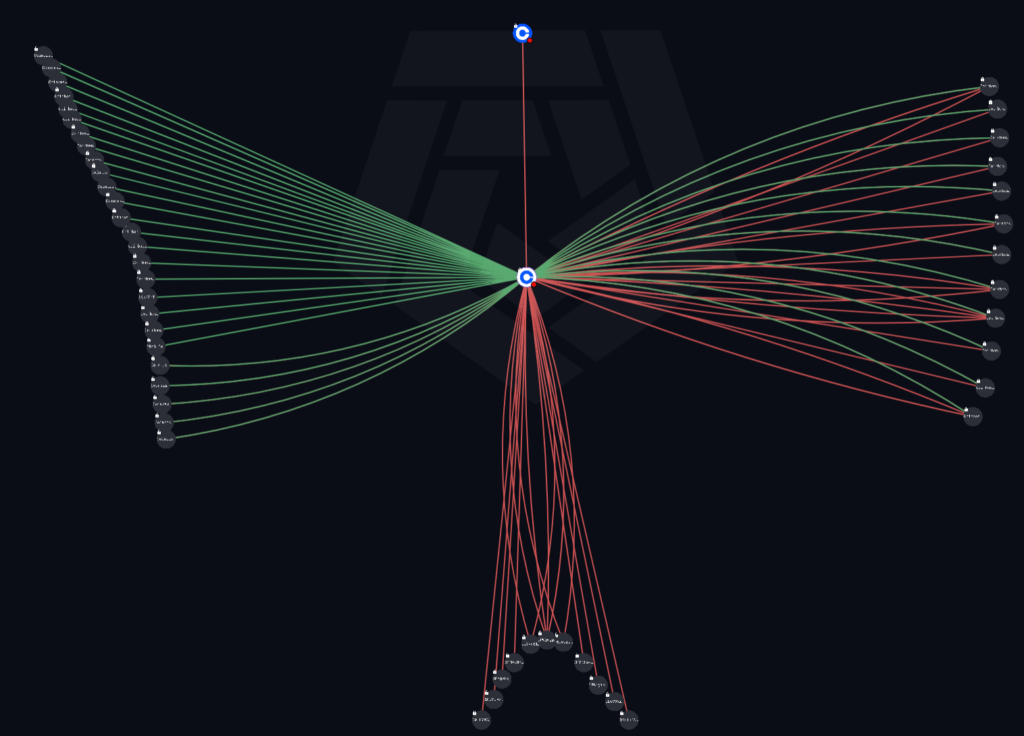

The under visualization reveals the stream of transactions over $50 million for the Coinbase Prime scorching pockets. The left cluster is tagged as Coinbase Prime deposit addresses, and all solely stream into the pockets. The cluster to the fitting accommodates wallets additionally tagged as Coinbase Prime deposit addresses however present inflows and outflows. The wallets within the backside cluster are untagged and present solely outflows from the new pockets. The highest outlier is the Coinbase change, which reveals a single $78 million outflow.

Speculatively, the left cluster could present deposit addresses for establishments, the fitting wallets could be the buying and selling wallets, and the underside wallets might be chilly storage. At current, none of that is verifiable, however it could probably align with the information acknowledged within the ETF prospectuses relating to how Bitcoin buying and selling works for the funds. Bear in mind, the above solely reveals transactions larger than $50 million, or round 1,100 BTC.

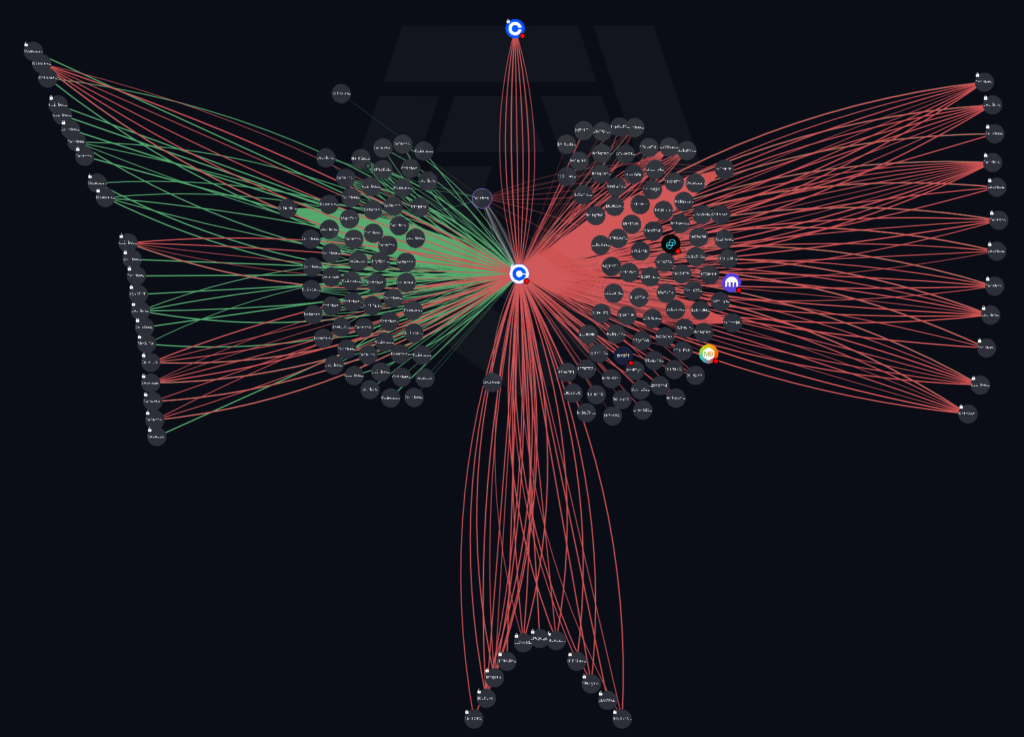

The under diagram contains transactions as little as $1,000 with all of the above wallets locked into place. Notably, the underside cluster nonetheless reveals no inflows, whereas dozens of recent wallets have entered the sector at these decrease values.

Making an attempt to determine and analyze wallets associated to ETF exercise could give necessary insights into the Bitcoin market ought to buying and selling volumes proceed to observe the launch knowledge. With CoinShares reporting round $17.5 billion in buying and selling quantity amongst crypto monetary merchandise final week, this exercise will influence the spot Bitcoin value in a different way.

The value at which the ETFs worth Bitcoin each day is calculated via the CF Benchmarks Index, BRR, which stands for the Bitcoin Reference Charge. This charge is calculated between 3 pm and 4 pm GMT every day by analyzing a variety of transactions throughout a number of exchanges. The BRR is then used to calculate the online asset worth for the funds and, thus, the worth of the Bitcoin it holds. This charge and the truth that share creations and redemptions occur exterior of normal buying and selling hours add a brand new dynamic to Bitcoin buying and selling that has not been an element till now.