- Ondo Finance, backed by Coinbase, expands into Asia Pacific, capitalizing on 73% weekly ONDO token surge.

- Firm opens its first APAC workplace and appoints Ashwin Khosa as VP for Enterprise Improvement within the area.

- The strategic transfer aligns with Ondo’s dominant place in tokenized securities, focusing on APAC’s digital asset fervour.

Ondo Finance, a outstanding US-based issuer of tokenized securities backed by Coinbase, is making headlines with its strategic enlargement into the Asia Pacific area.

This transfer comes amidst a exceptional 73% weekly surge within the worth of its ONDO token, showcasing the platform’s rising affect. The corporate’s entry into the dynamic APAC market is about to capitalize on the area’s fervent curiosity in digital belongings, fueled by a thriving crypto neighborhood and evolving regulatory frameworks.

Ondo Finance’s footprint in Asia Pacific

Whereas formally saying its strategic enlargement into Asia Pacific, Ondo Finance additionally introduced the inauguration of its first workplace within the Asia Pacific area, marking a calculated transfer to faucet into the escalating enthusiasm for digital belongings.

Whereas the particular location stays undisclosed, the corporate’s founder and CEO, Nathan Allman, expressed his enthusiasm for the enlargement. He highlighted the lively and quickly rising crypto neighborhood within the Asia Pacific, emphasizing the enchantment of Ondo’s tokenized publicity to U.S. belongings.

To spearhead this strategic transfer, Ondo Finance has enlisted the experience of Ashwin Khosa because the Vice President of Enterprise Improvement for Asia Pacific. Khosa, with a decade of institutional enterprise improvement expertise in Hong Kong, brings invaluable insights into the nuances of on-chain finance and the Asia Pacific market.

This enlargement aligns seamlessly with Ondo’s current dominance within the tokenized securities realm, boasting almost 40% of the worldwide market share. The platform’s three fundamental tokenized merchandise—OUSG, OMMF, and USDY—allow world buyers to entry key US-based asset lessons in a tokenized format.

ONDO token value motion

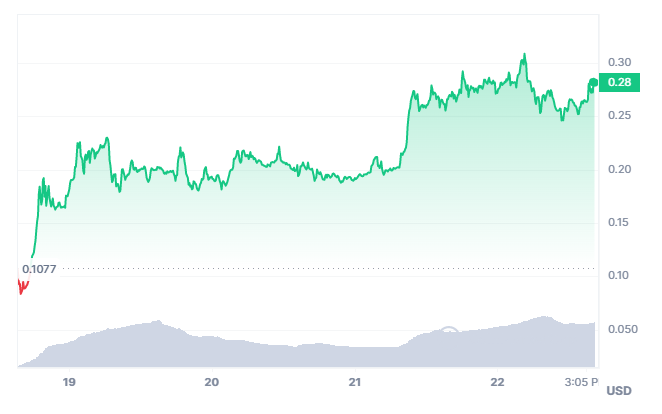

The enlargement into Asia Pacific comes on the heels of a exceptional 73% weekly enhance within the worth of Ondo Finance’s ONDO token. At press time, ONDO was buying and selling at $0.2812, up 3% in 24 hours.

ONDO value chart

ONDO value chart

This surge displays rising confidence and curiosity within the platform and its tokenized choices.

Ondo Finance has been actively shaping its future panorama with strategic collaborations. Notably, partnerships with Mantle Community and Solana have gained consideration, emphasizing the collaborative efforts to convey USDY to their respective blockchain networks.

Moreover, the Ondo Basis’s current bulletins, together with a factors program and a proposal to unlock the ONDO token, additional underline the platform’s dedication to advancing on-chain finance and increasing its world affect.