Coinbase-backed Base has the very best transaction charges amongst Ethereum layer-2 networks as a result of present wave of consideration it enjoys amongst crypto merchants.

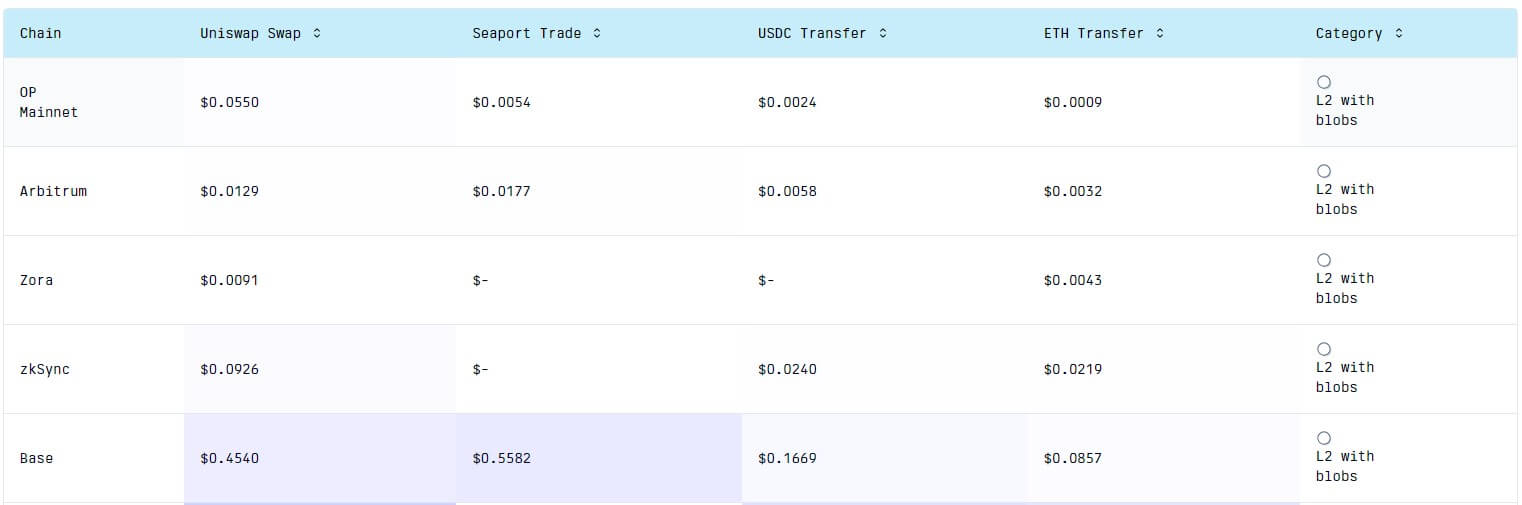

Gasfees information exhibits that Base is the priciest layer-2 protocol amongst scaling options which have carried out the Dencun Improve’s Blobs characteristic. The characteristic considerably reduces transaction charges and enhances throughput for layer-2 networks by permitting for a extra environment friendly and cost-effective method to put up rollup information.

Certainly, the typical transaction price on Base hovers between $0.0857 and will attain as excessive as $0.5582 for a mean NFT commerce on Seaport in comparison with the typical transaction price on Optimism, which ranged between $0.0009 and $0.0550.

In the meantime, the blockchain community confirmed this excessive price scenario, noting that it was brought on by “excessive community visitors.” Nonetheless, it claimed the issue had been corrected as of press time.

Why Base transaction charges spiked

Crypto analyst Kofi attributed the scenario to heightened bot buying and selling actions prepared to pay the “excessive precedence charges.”

One other on-chain information analyst, Michael Silberling, offered a extra complete perception into the elevated price phenomenon. He highlighted automated actors specializing in memecoins and arbitrage alternatives on the Base community as key contributors to the price surge.

Silberling famous that these merchants usually exhibit decrease sensitivity to charges than common customers, thereby sustaining the elevated community charges on Base on account of elevated demand.

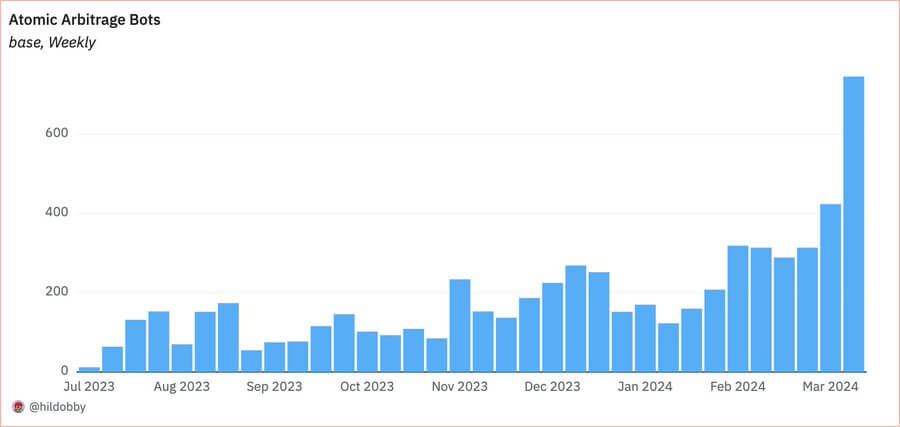

Notably, a dune analytics dashboard curated by analyst Hildobby confirmed that the variety of atomic arbitrage bots on Base had seen an uptick not too long ago.

Base DEX quantity surge

The elevated bot buying and selling exercise has pushed the every day buying and selling quantity of decentralized exchanges (DEXs) on the Ethereum Layer 2 community to a brand new excessive of $374 million the previous day.

This milestone displays Base’s rising reputation amongst crypto merchants following the profitable completion of the Dencun improve. In response to information from DeFiLlama, transactions on the platform have soared by 71% over the previous week, reaching round $1.5 billion.

As well as, the full worth of property locked on the community has spiked to a brand new excessive of $775 million.

The put up Coinbase-backed Base leads in Ethereum layer-2 charges amid buying and selling exercise surge appeared first on starcrypto.