Like a phoenix rising from the ashes, Bitcoin has as soon as once more defied critics and bounced again from predictions of its demise.

The main cryptocurrency has confronted a whole lot of so-called “obituaries” declaring it useless or doomed to fail since its creation in 2009. But Bitcoin has proven longevity and resilience within the face of fixed critiques. In line with 99bitcoins, the most recent recorded ‘demise’ was again in April when the worth declined from $31,000 to $27,500.

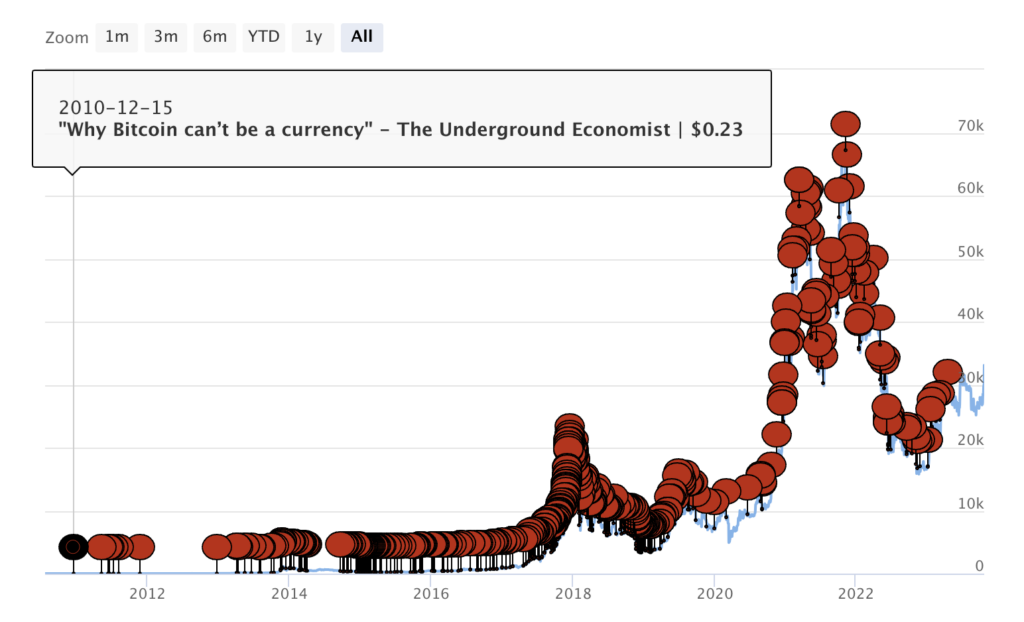

Reviewing the historic ‘obituaries,’ CNBC and Bloomberg seem most ceaselessly, with 35 and 24 articles calling for the demise of Bitcoin, respectively. Headlines included ‘Bitcoin Is Nonetheless Doomed, ‘Bitcoin Is A Decentralized Ponzi Scheme,’ and ‘Bitcoin Isn’t The Future Of Cash.’

Whereas the cryptocurrency’s long-term trajectory relies on many elements, its skill to repeatedly recuperate from crashes and criticism is noteworthy. The cryptocurrency continues to search out renewed life after every metaphorical funeral.

Bitcoin’s current bullish motion and endorsement from BlackRock brings its value to round $34,000 as of Oct. 24, following a interval of stability across the $27,000 mark between March and October, up 78% over the previous 12 months.

Accompanying the most recent peak was a spike in buying and selling quantity, signaling elevated shopping for stress.

Bitcoin died and rose once more.

The variety of predictions of Bitcoin’s demise typically elevated over time as crypto went extra mainstream. From only a handful within the early years, obituaries numbered within the a whole lot beginning in 2017 when Bitcoin costs spiked.

Critics typically declared Bitcoin useless throughout main value crashes, with clusters of obituaries round occasions in late 2017, early 2018, March 2020, and mid-2021. Volatility prompted accusations of bubbles bursting, just like the 2013 headline “The Bitcoin Bubble Has Burst,” when the worth was simply $84.

Each consultants and informal commentators have foretold Bitcoin’s failure. Sources vary from mainstream media to particular person bloggers, displaying broad skepticism.

Initially extra measured, criticism grew extra hyperbolic over time. Early headlines expressed doubt, whereas later proclamations labeled Bitcoin a rip-off, Ponzi scheme, or a bubble able to pop like 2021’s “Bitcoin Is Worse Than A Madoff-style Ponzi Scheme” within the Monetary Occasions.

Some sources persistently predict Bitcoin’s downfall regardless of being confirmed incorrect by its continued survival. An ongoing need by some to see cryptocurrency fail seems current.

The explanations cited developed from Bitcoin’s incapability to perform as cash to lack of regulation, environmental hurt, and competitors from different cash. But, the core narrative of impending collapse persevered.

Whereas Bitcoin has been proclaimed useless 474 occasions, it endures, whether or not rising from ashes or rising from every’ demise.’ The recurring story of underestimation stays unfinished, with Bitcoin’s subsequent chapter nonetheless unwritten.

All eyes fall on the extremely anticipated spot Bitcoin ETF from BlackRock because the funding agency seems to be so as to add Bitcoin to its trillions of {dollars} value of property underneath administration.

If Bitcoin is useless, why did nobody inform Larry Fink?