- Chainlink’s September surge units the stage for October’s bullish momentum.

- Low LINK alternate deposits sign optimism for a possible worth rally.

- LINK’s journey to $10 hinges on breaking by the $9 resistance.

Chainlink (LINK) has captured headlines not too long ago, after hovering 38% in worth in September. 2023. Considerably, this rise positioned it among the many top-performing property within the high 20 crypto rankings. In addition to this spectacular feat, there’s a prevailing sentiment. The momentum means that October may witness Chainlink bulls pushing even more durable.

Nonetheless, it was greater than only a sturdy efficiency that garnered consideration. Notably, Chainlink’s capability to combine off-chain worth feeds by blockchain infrastructure performed a job. Consequently, the cryptocurrency benefited massively from the asset tokenization and Actual World Asset (RWA) pattern.

Low Alternate Deposits Sign Optimism

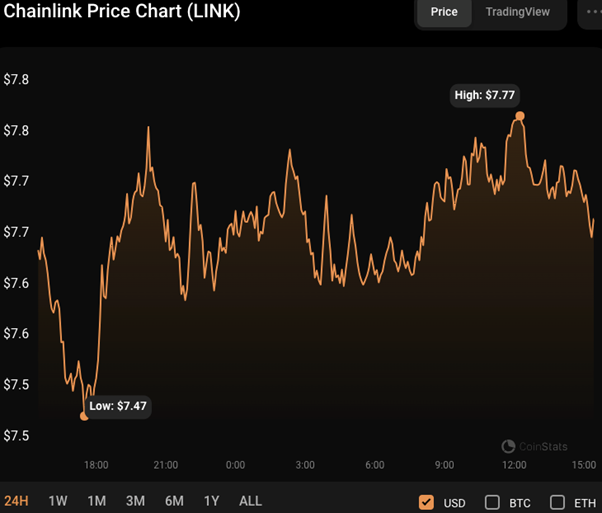

Final month, media circles buzzed about Chainlink’s high efficiency. And now, LINK’s worth has retraced a bit under $8. But, on-chain metrics trace on the bulls rallying once more. The info from CryptoQuant reveals that LINK’s alternate provide dipped to 152 million tokens not too long ago.

Remarkably, these are the bottom alternate reserve ranges since Chainlink launched its staking program in June 2022. When alternate provide diminishes in a bull market, it normally implies a shift. Consequently, optimistic holders are transferring tokens to long-term storage. Therefore, with provide at historic lows, a surge in market demand may spark a Chainlink worth rally.

In the direction of the $10 Mark?

Chainlink’s journey to the $10 mark appears fairly attainable when contemplating International In/Out of Cash Round Worth information. The info showcase the entry worth distribution of LINK’s present holders. Furthermore, these information recommend that if Chainlink bulls surpass the preliminary resistance close to $9, the rally may rapidly escalate to $10.

The info present that 43,500 addresses acquired 46.45 million LINK tokens at roughly $9 every. If these traders resolve to take early income, it’d induce a bearish pattern. Nonetheless, if the expected provide squeeze happens as a result of drop in alternate reserves, the LINK worth may comfortably contact $10.

Moreover, Chainlink’s stability is anchored by a big variety of holders. Particularly, 68,300 addresses maintain 535.8 million LINK, all bought at a mean of $7. This group will undoubtedly present appreciable assist. However, if LINK fails to keep up the essential $7 assist degree, bears would possibly drive the value towards $5.

LINK/USD Technical Evaluation

On the LINK/USD worth chart, the Chaikin Cash Stream (CMF) is within the adverse sector with a price of -0.06 and trending increased, indicating that the optimistic momentum is rising. If the CMF goes into the optimistic zone and continues to climb, it could indicate extra buying strain and a attainable advance within the LINK/USD worth. Consequently, merchants could learn this as a sign to contemplate establishing lengthy stakes or sustaining present bullish holdings.

However, the stochastic RSI pattern ranking of 84.32 implies that the LINKUSD worth could also be overbought within the close to time period. This degree would possibly lead to a interval of consolidation or a worth correction. Merchants could think about taking beneficial properties on lengthy accounts or beginning brief positions throughout this consolidation or correction to capitalize on a attainable adverse drop within the LINK/USD worth.

In conclusion, the street forward for Chainlink is lined with alternatives and challenges. The important thing indicators trace at a possible rise, however there’s an inherent danger since indicators level to a consolidation interval.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be answerable for direct or oblique harm or loss.

Common Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.