- Chainlink surges 61% weekly, driving the wave of optimistic crypto market sentiment.

- Bitcoin ETF anticipation boosts LINK’s market cap, however buying and selling quantity dips.

- LINK faces resistance at $11.4 and $12.00 after failing to interrupt $11.26, whereas MFI indicators potential promoting stress.

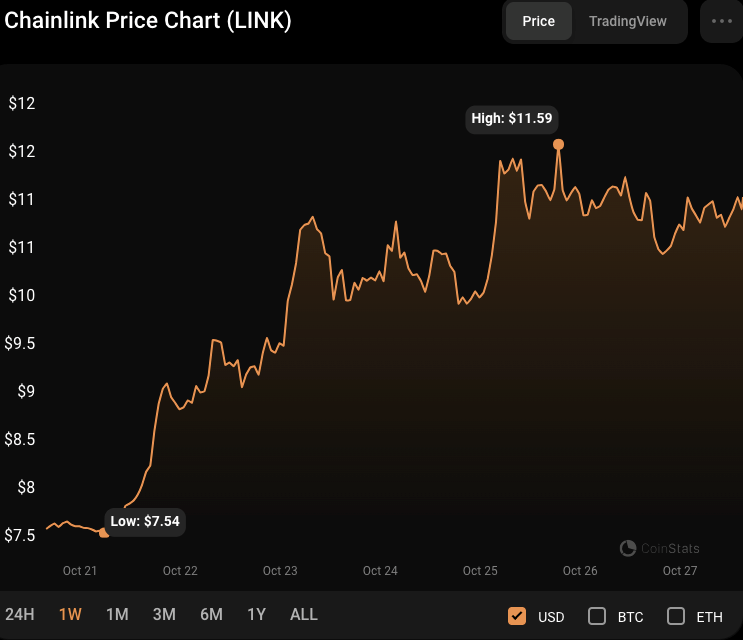

Within the current week, the Chainlink (LINK) market has proven bullish dominance, gaining greater than 61% from an intra-week low of $7.54 to a excessive of $11.8 earlier than seeing a modest retracement.

The present worth enhance in Chainlink could also be linked to the overall optimistic feeling within the crypto market over the previous week, fueled by the expectation of Bitcoin ETFs hitting the market quickly.

This occasion has resulted in a big enhance within the worth of Bitcoin, which has benefited the broader market. Moreover, the market capitalization of LINK elevated by 1.73% to $6,178,888,812, however the 24-hour buying and selling quantity decreased by 3.61% to $768,131,501. Revenue-taking by sure buyers who’ve skilled substantial earnings within the current worth spike may clarify the drop in buying and selling exercise.

Nevertheless, optimistic momentum has waned within the earlier 24 hours, with LINK failing to interrupt past the intraday excessive of $11.26. If the detrimental momentum breaks by way of the intraday low of $10.45, the following assist degree to watch is round $10.00.

Alternatively, if the assist degree holds and the bullish pattern continues, the next important resistance ranges are $11.4 and $12.00. These resistance ranges could also be difficult for LINK to beat, because the current worth enhance could have prompted merchants to take earnings and promote.

Conversely, if market sentiment stays favorable and demand for LINK is powerful, it may break previous these resistance ranges and proceed its upward pattern.

LINK/USD Technical Evaluation

On the LINK/USD worth chart, the Keltner Channel bands are trending increased, indicating possible optimistic momentum out there. With the higher, center, and decrease bands touching $11.79775, $10.73256, and $9.55275, respectively, this reveals important assist and resistance at these worth ranges.

With inexperienced candlesticks rising above the center band, the worth motion displays the bullish angle, suggesting that consumers are in cost and driving the worth upward. Moreover, the tightening of the Keltner Channel bands signifies a discount in volatility, which could contribute to a extra constant rising pattern within the LINK/USD market.

Nevertheless, the Cash Move Index (MFI) goes south with a rating of fifty.75, indicating that the market is underneath some promoting stress. This pattern may limit the worth’s upward trajectory and shortly lead to a consolidation interval.

If the MFI continues to lower and goes under 50, it might recommend a change in market sentiment towards promoting. This degree may trigger a short lived pullback or correction within the worth of LINK/USD as sellers acquire extra management.

In conclusion, Chainlink’s current bullish surge could face resistance, however its potential for additional features stays tied to market sentiment and Bitcoin ETF developments.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.