- Cboe is planning on itemizing 5 ether exchange-traded funds (ETFs) on July 23

- It is going to start buying and selling spot ETFs from the 21Shares Core Ethereum ETF, Constancy Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, and VanEck Ethereum ETF

- Bitwise’s CIO Matt Hougan believes Ethereum ETFs might see round $15bn in web flows of their first 18 months available on the market

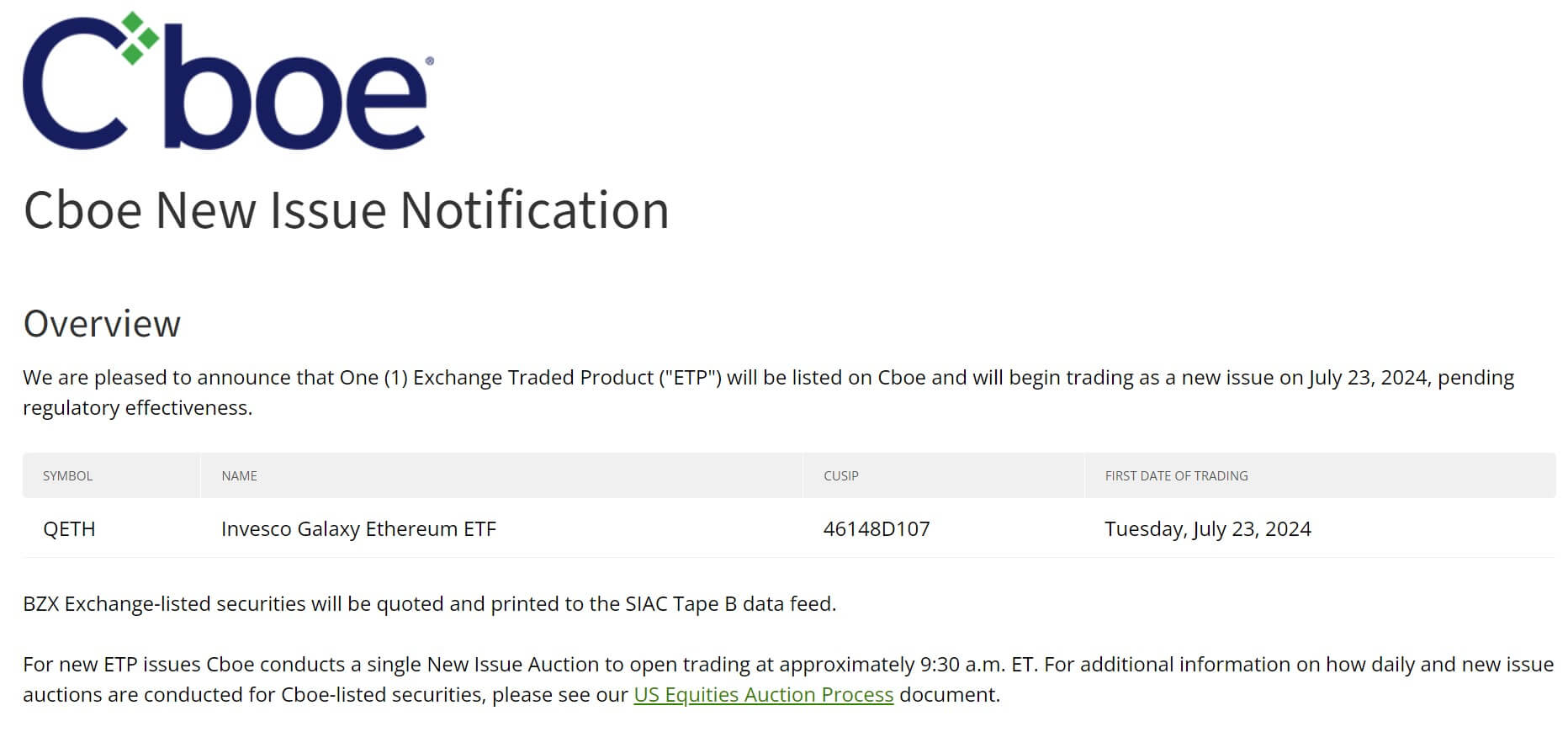

The Chicago Board Choices Trade (Cboe) intends to checklist 5 ether exchange-traded funds (ETFs) on July 23, “pending regulatory effectiveness,” Cboe introduced.

The 5 spot ether ETFs anticipated to start buying and selling are the 21Shares Core Ethereum ETF, Constancy Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, and VanEck Ethereum ETF.

In Might, the US Securities and Trade Fee (SEC) permitted rule modifications to identify ether 19b-4 filings; nevertheless, earlier than they’ll launch, their S-1 registrations must be permitted by the regulator.

Earlier this month, the SEC required asset managers to submit their finalised S-1s by July 16. Asset supervisor Bitwise filed an amended S-1 kind on July 3. One in every of its amendments included a six-month charge waiver of as much as $500m.

Because the July 23 launch date creeps nearer, all eyes will likely be on the SEC and people eager to launch a brand new funding product available in the market. In June, Bitwise’s CIO, Matt Hougan, said that Ethereum ETFs might see round $15bn in web flows of their first 18 months available on the market.

Solana ETF

Eager so as to add extra funding merchandise for its buyers, Cboe submitted two purposes to checklist spot Solana ETFs on its platform earlier this month.

The trade has requested the SEC to approve the listings of its 21Shares and VanEck Solana ETFs. Submitting the 19b-4 kinds, the SEC has till March 2025 to decide.

On the finish of June, VanEck filed an S-1 kind with the SEC, making it the primary US firm to take action. Equally, 21Shares additionally filed its personal S-1 software with the SEC in June, stating on X that they “consider this can be a vital step for the crypto trade.”

With elevated curiosity in Bitcoin ETFs and now Ethereum ETFs set to start out buying and selling on Cboe, asset managers need to different sorts they’ll probably present to buyers, pending regulatory approval from the SEC.