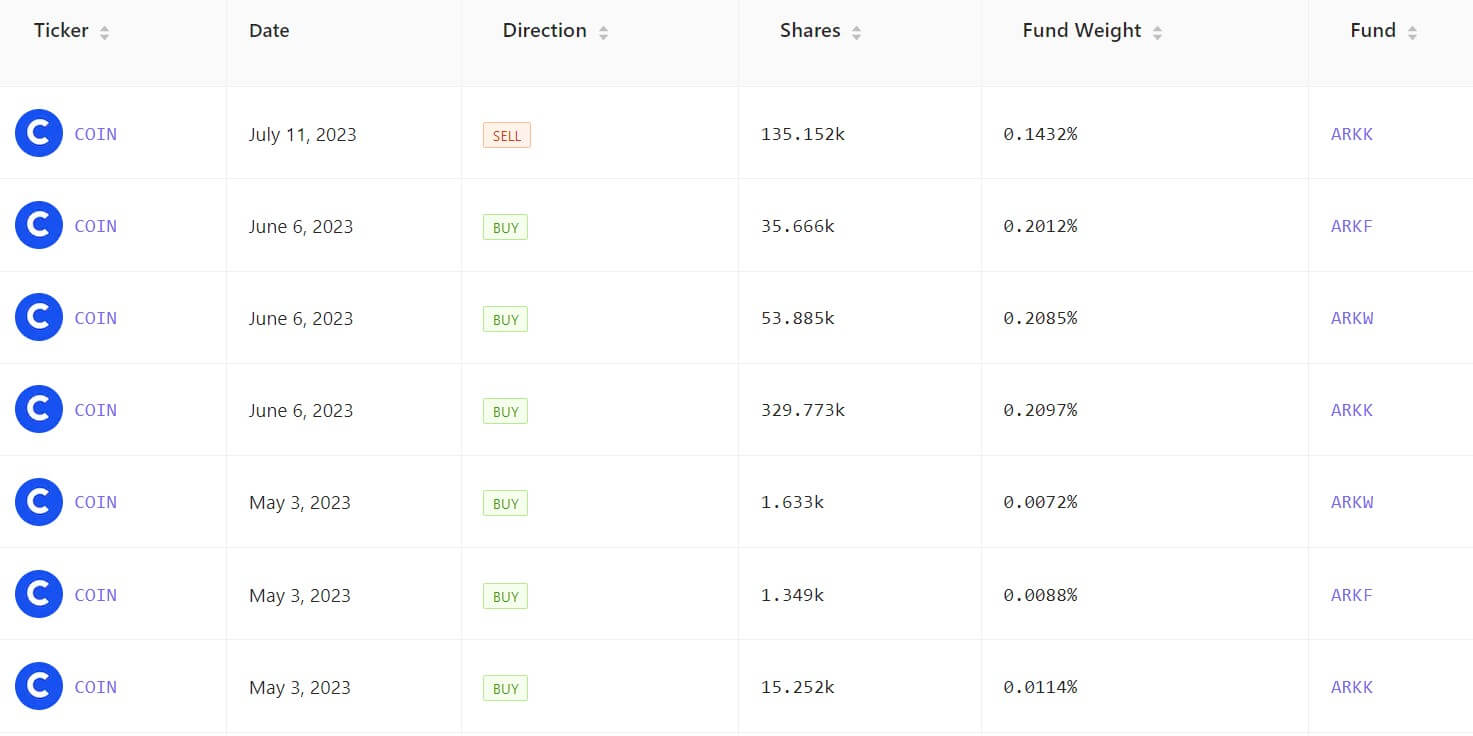

Ark Make investments Administration bought 135,152 Coinbase shares for $12 million on July 11, based on information from Cathiesark.

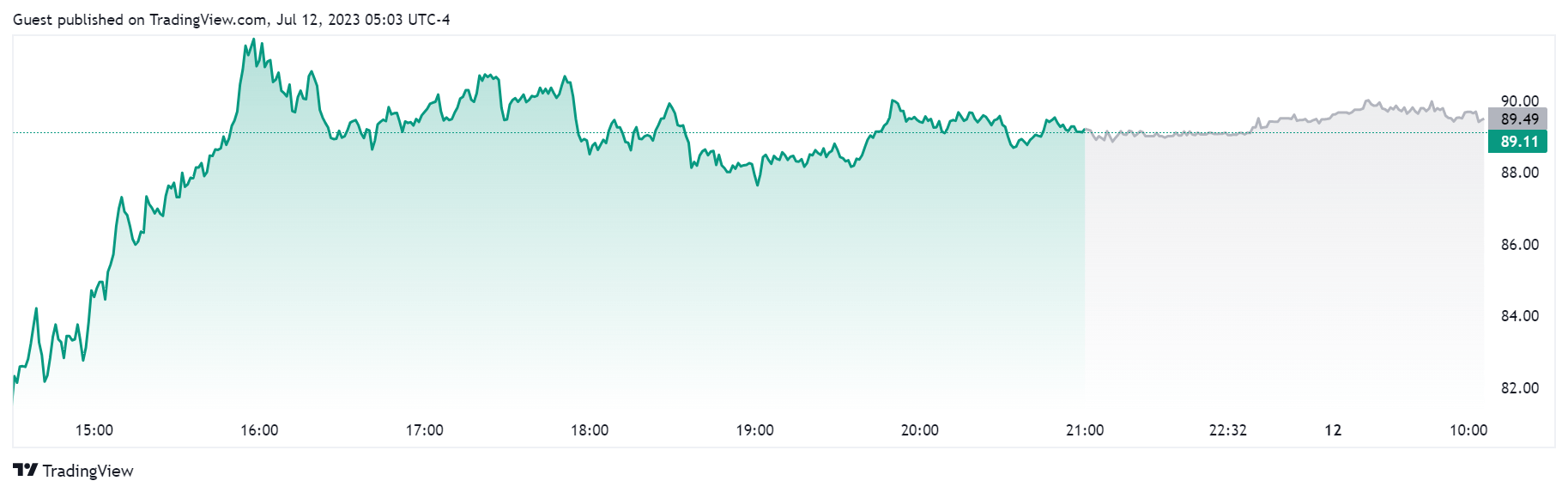

On July 11, COIN rallied to a one-year excessive of $90, persevering with its largely constructive worth efficiency of a latest whereas. Over the last 30 days, Coinbase inventory has outperformed Bitcoin’s (BTC) worth, rising by over 60%, whereas BTC gained lower than 20% throughout the identical interval.

Coinbase position in Bitcoin ETF purposes

With a number of conventional monetary establishments making use of for a Bitcoin exchange-traded fund (ETF), most have chosen the trade as a companion for his or her surveillance-sharing settlement.

The U.S. Securities and Change Fee (SEC) returned the purposes filed in June over an absence of readability and comprehensiveness. The regulator acknowledged that the proposals didn’t determine or element the spot Bitcoin trade that would offer a surveillance-sharing settlement, forcing most candidates to refile and title Coinbase as their companion.

Regardless of the SEC lawsuit, market observers have argued that these partnerships underscore Coinbase’s legitimacy as a U.S. monetary establishment.

Cathie Wooden bullish on Coinbase

For the reason that starting of the yr, Cathie Wooden has maintained a bullish stance on Coinbase shares regardless of the regulatory uncertainty surrounding the trade.

Wooden acknowledged that the SEC motion in opposition to Binance may not directly profit Coinbase, as, not like Binance, Coinbase will not be accused of any felony exercise.

In an indication of her conviction, Wooden’s funding fund acquired over 400,000 Coinbase shares following the regulatory scrutiny. Based on Cathiesark information, Ark Make investments is likely one of the largest shareholders of the trade, holding over 11 million COIN shares throughout all funds.

The put up Cathie Wooden’s Ark Make investments unloads $12M Coinbase shares as COIN rallies to one-year excessive appeared first on StarCrypto.