- ADA’s worth has dropped by over 10% within the final week.

- Coin accumulation has misplaced momentum on the day by day chart.

- Buyers have most well-liked to take away liquidity from the ADA market.

Cardano (ADA) has trended downward for the reason that 12 months started, shedding 11% of its worth within the final seven days, based on information from CoinMarketCap.

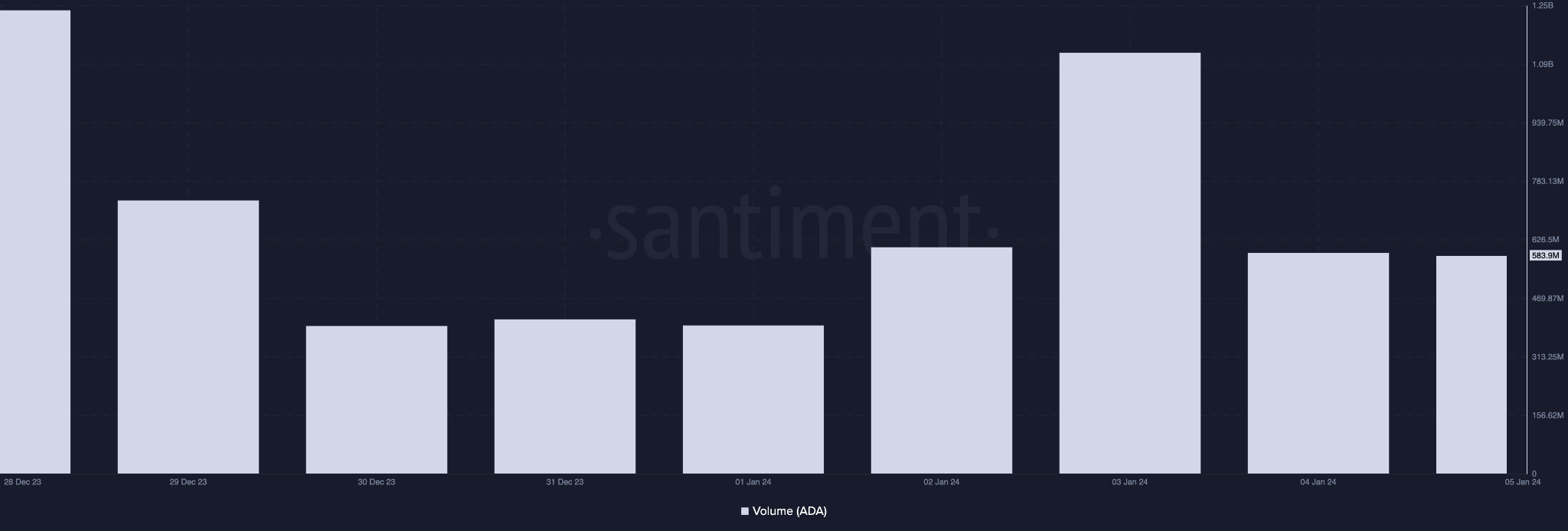

Attributable to low value motion, day by day buying and selling quantity has additionally plummeted considerably. Knowledge from Santiment confirmed that ADA’s day by day buying and selling quantity has fallen by 52% within the final week. For context, on December 29, the coin’s buying and selling quantity totaled $1.24 billion. Whereas, as of January 4, it closed the day with a buying and selling quantity of $591 million.

Cardano Buying and selling Quantity (Supply: Santiment)

Promote-off Exercise Rallies

The decline in ADA’s value within the final week is as a result of decline in accumulation amid an increase in coin sell-off. An evaluation of its value motion on a day by day chart confirmed that market members have favored coin distribution for the reason that starting of the 12 months.

ADA/USD 24-Hour Chart (Supply: TradingView)

For instance, readings from ADA’s Parabolic SAR (Cease and Reverse) indicator confirmed the dotted traces that make up the indicator resting above the coin’s value at press time. It has been positioned on this method since January 3.

The Parabolic SAR indicator is used to determine potential development course and reversals. When its dotted traces grasp above an asset’s value, it implies that the market is in a downtrend. Many merchants interpret it because the time to exit lengthy positions or provoke quick positions.

Confirming the rise in promoting strain, ADA’s key momentum indicators declined at press time. Its Relative Energy Index (RSI) was 45.45. Likewise, its On-Stability-Quantity (OBV) was 44.63 billion, witnessing a 1% lower for the reason that 12 months started.

At these values, these indicators confirmed ADA shopping for momentum has dwindled. Poised to cross under its middle line, the coin’s Chaikin Cash Circulation (CMF) rested on the zero line. A CMF worth under this line is an indication of weak spot out there because it suggests capital outflow, recognized to lead to a value decline.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.