- STX outperformed different belongings within the prime 50 aside from BCH following the Grayscale announcement.

- STX hit an overbought level however nonetheless has a greater efficiency than BTC.

- If the MFI reaches 80, then STX could plunge, and the goal may very well be between $0.44 and $0.47.

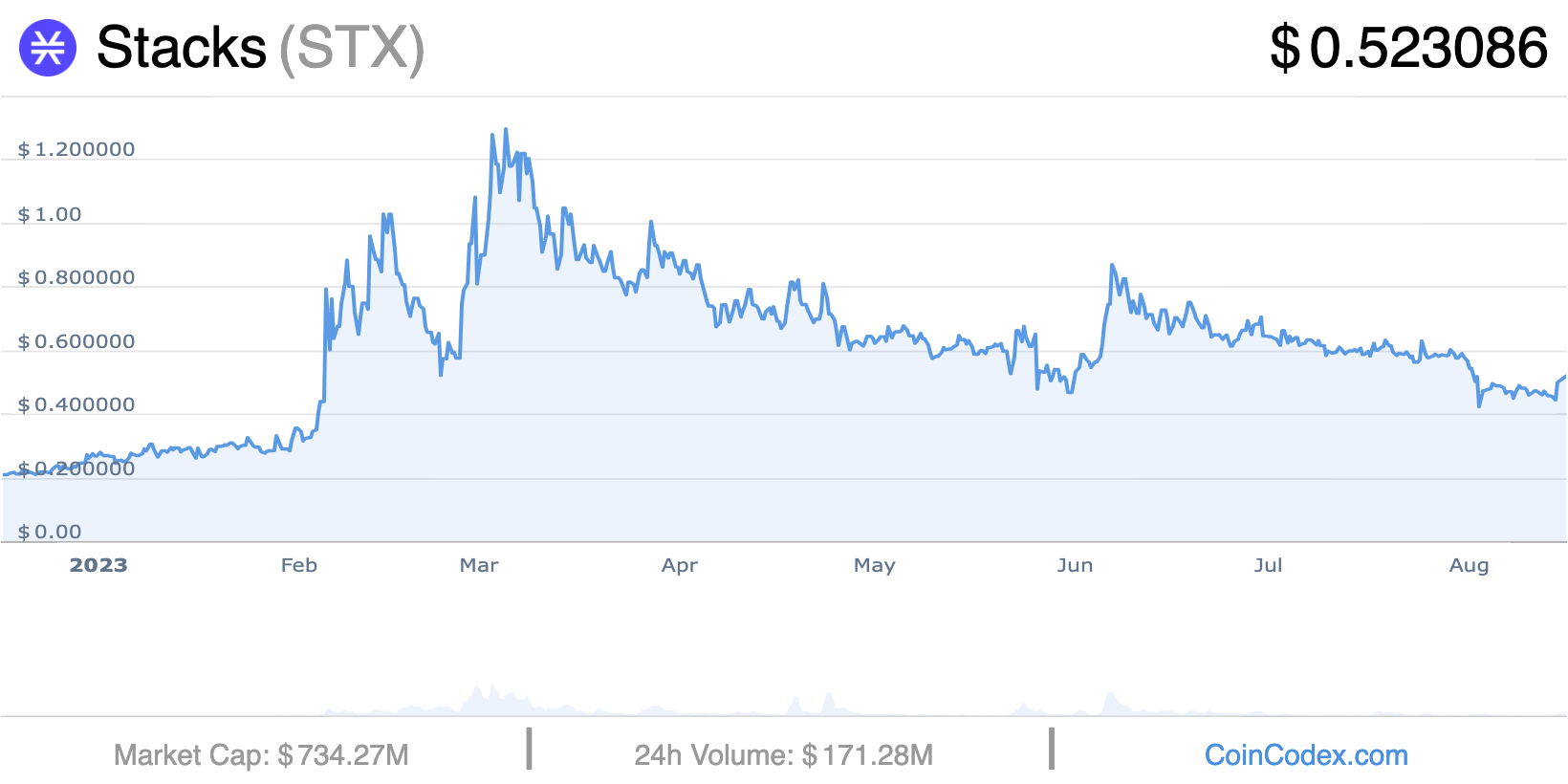

After Grayscale’s partial win over the U.S. SEC, with regard to the Bitcoin (BTC) ETF utility, the value of Stacks (STX) surged. In response to CoinMarketCap, STX carried out significantly better than different cash within the prime 50, aside from Bitcoin Money (BCH).

At press time, STX’s worth is $0.52— an 8.28% hike within the final seven days. Though Stacks enjoys a surge in worth when Bitcoin has a constructive outlook, it additionally has its personal fundamentals backing it.

STX and BTC: One in all a Type

For the unfamiliar, Stacks is Bitcoin Layer Two (L2) for good contracts. As an L2, Stacks permits settlement and quicker transactions on the Bitcoin blockchain utilizing the Proof-of-Switch consensus mechanism.

Proof of Switch regulates the interplay between two actors in Stacks, particularly the miners and stackers. For miners, on the Stack community, their operate is to lock Bitcoin in a wise contract to take part in validating Stacks transactions and, in flip, get rewarded in STX.

Then again, Stackers maintain STX tokens and briefly lock their tokens within the community in change for the BTC locked by miners as rewards

This 12 months, STX has not had solely the backing of Bitcoin. Nevertheless, the introduction of Bitcoin Ordinals and its adoption additionally ensured that the token gained extra traction. On a 12 months-To-Date (YTD) foundation, STX has elevated by 143% in opposition to the U.S. Greenback (USD), and it’s additionally up 47.68% in opposition to BTC.

Stacking for the Future

On the time of writing, STX’s volatility was at a really excessive degree, the Bollinger Bands (BB) indicated. Additionally, after the value hike throughout the week, STX hit the higher band of the BB, which suggests it was overbought.

In consequence, the value dropped from $0.54 to $0.52. With the growing volatility, it’s doubtless that STX trades in a wider vary within the quick time period. If promoting stress overtakes demand, STX could fall between $0.44 and $0.47.

Nevertheless, if shopping for momentum outweighs sell-offs, the value could attain as excessive as $0.56. In response to indications from the Cash Movement Index (MFI), STX presently has a very good shopping for momentum at 77.31.

Sometimes, an MFI studying above 80 is taken into account overbought. However when the MFI is 20 or beneath, it’s thought of oversold. To keep away from a big plunge, STX could must keep away from touching the overbought degree threshold.

Though STX could not rally anytime quickly, it has the tendency to comply with in Bitcoin’s path every time BTC’s worth will increase. In the long run, STX could probably beat its All-Time Excessive (ATH) if Bitcoin does the identical.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be chargeable for direct or oblique harm or loss