- Cheeky Crypto argues that BTC has help ranges at $50,798 and $51,219.

- The analyst anticipates a Bitcoin rebound, focusing on costs within the $55k vary.

- Nevertheless, he lacked confidence in HBAR’s potential to maintain its bullish trajectory.

In a current market evaluation on the Cheeky Crypto YouTube channel, an analyst mentioned the potential for Bitcoin to surpass the $55,000 threshold. He examined BTC’s candlestick patterns within the four-hour timeframe.

Following the examination, the analyst highlighted that Bitcoin now has a help degree of round $51,219, contemplating BTC’s 50-day easy shifting common. On the identical time, he proposed that if the $51,219 help fails to endure, the main target may shift to the 50-day exponential shifting common (50EMA). This 50EMA supplies an extra help degree for BTC at $50,798.

Apart from, he recognized the presence of a midlevel pattern line, beforehand a resistance space that has now reworked into help. With these elements in play, the analyst anticipates a Bitcoin rebound. Particularly, the Cheeky Crypto presenter set his sights towards the $54,755 areas and past for BTC. Notably, Bitcoin at present hovers round $52,190.

Moreover, contemplating the projected targets, the analyst famous that the commerce alternative is to open a protracted place for Bitcoin at its present market worth. He urged viewers to set a step loss on the decrease help threshold of $50,798.

Additionally, the analyst identified that this level gives a risk-reward ratio of roughly 1.87. Moreover, he cautioned in opposition to rising the danger of being liquidated by lifting the stop-loss too excessive.

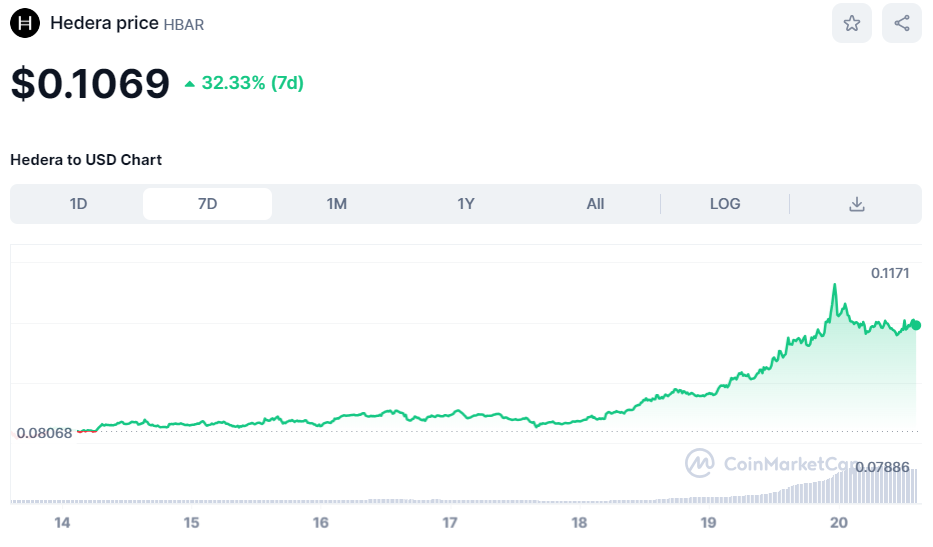

In a parallel evaluation session, the analyst on the Cheeky Crypto channel assessed the potential for Hedera Hashgraph (HBAR) to maintain its bullish momentum. Notably, HBAR has surged by over 30%, shifting from $0.08068 to $0.1171 over the previous seven days.

HBAR seven-day chart | CoinMarketCap

Contemplating HBAR’s current bullish efficiency and a noticeable retracement, the analyst expressed a insecurity within the asset’s potential to maintain its bullish trajectory.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.