The crypto market is at the moment charged with stress, anticipating the U.S. Securities and Trade Fee’s impending resolution on the primary spot Bitcoin ETF. Amidst divided opinions over whether or not the SEC will approve the ETF within the coming days or postpone the choice once more, a detailed evaluation of Deribit’s Bitcoin choices market reveals merchants bracing for appreciable value actions in January.

As of Jan. 5, the overall open curiosity in Bitcoin choices on Deribit is 228,646.70 BTC, representing a notional worth of $10.05 billion. This substantial determine signifies a excessive stage of market participation and curiosity in Bitcoin’s future value actions.

The dominance of name open curiosity, comprising 162,694.50 BTC in comparison with put open curiosity at 65,952.20 BTC, suggests a bullish sentiment amongst traders. They seem like anticipating or hedging towards a possible enhance in Bitcoin’s value.

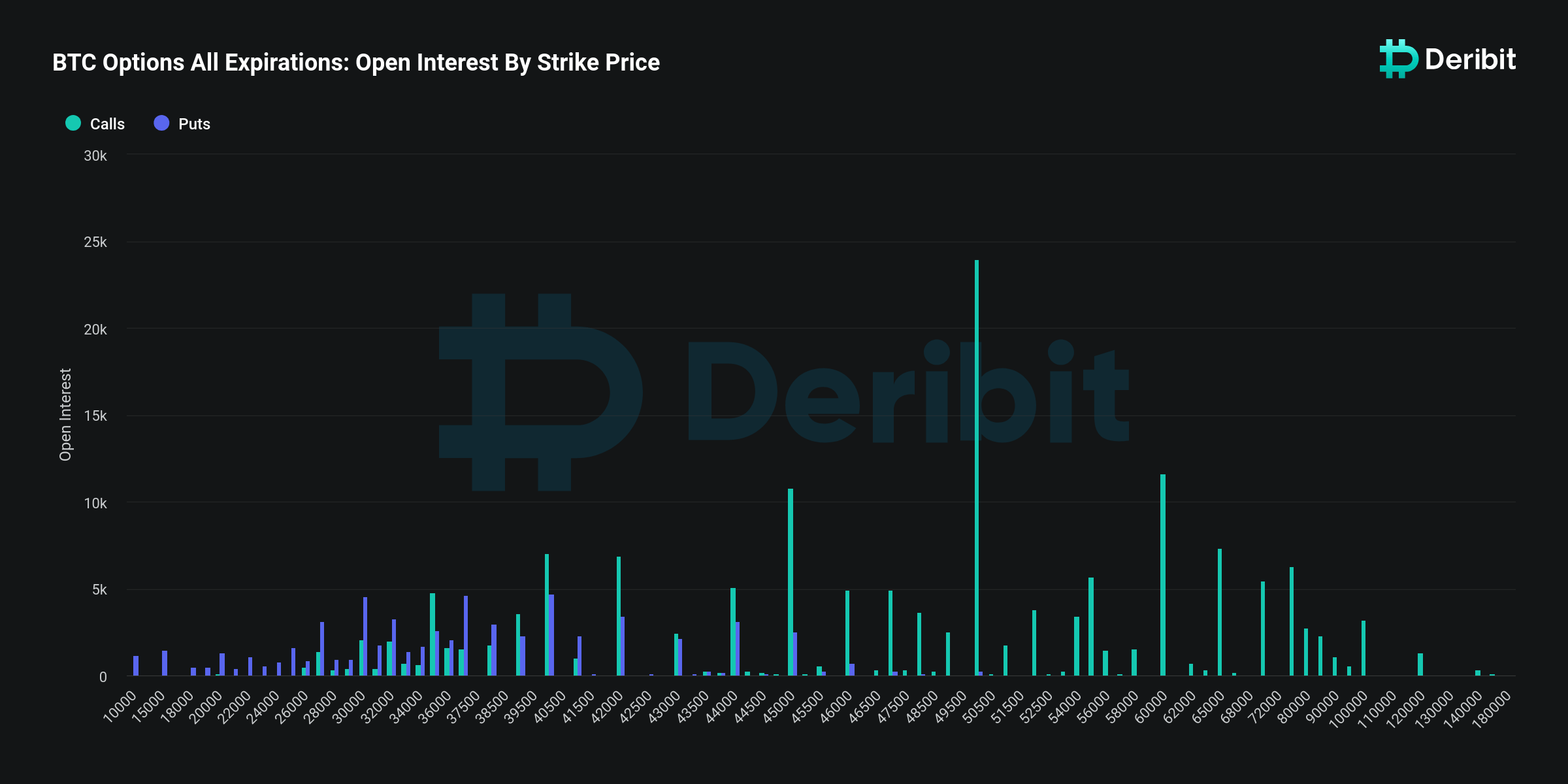

The breakdown of open curiosity by strike value additional reinforces this bullish sentiment. The very best focus of name choices is on the $50,000 strike value, with a worth of $1.05 billion. This stage could possibly be considered as a major psychological and monetary threshold that many traders are betting Bitcoin will attain or surpass. The following highest focus is on the $45,000 and $60,000 strike costs, indicating optimism for even larger costs, although with lesser conviction than for the $50,000 mark.

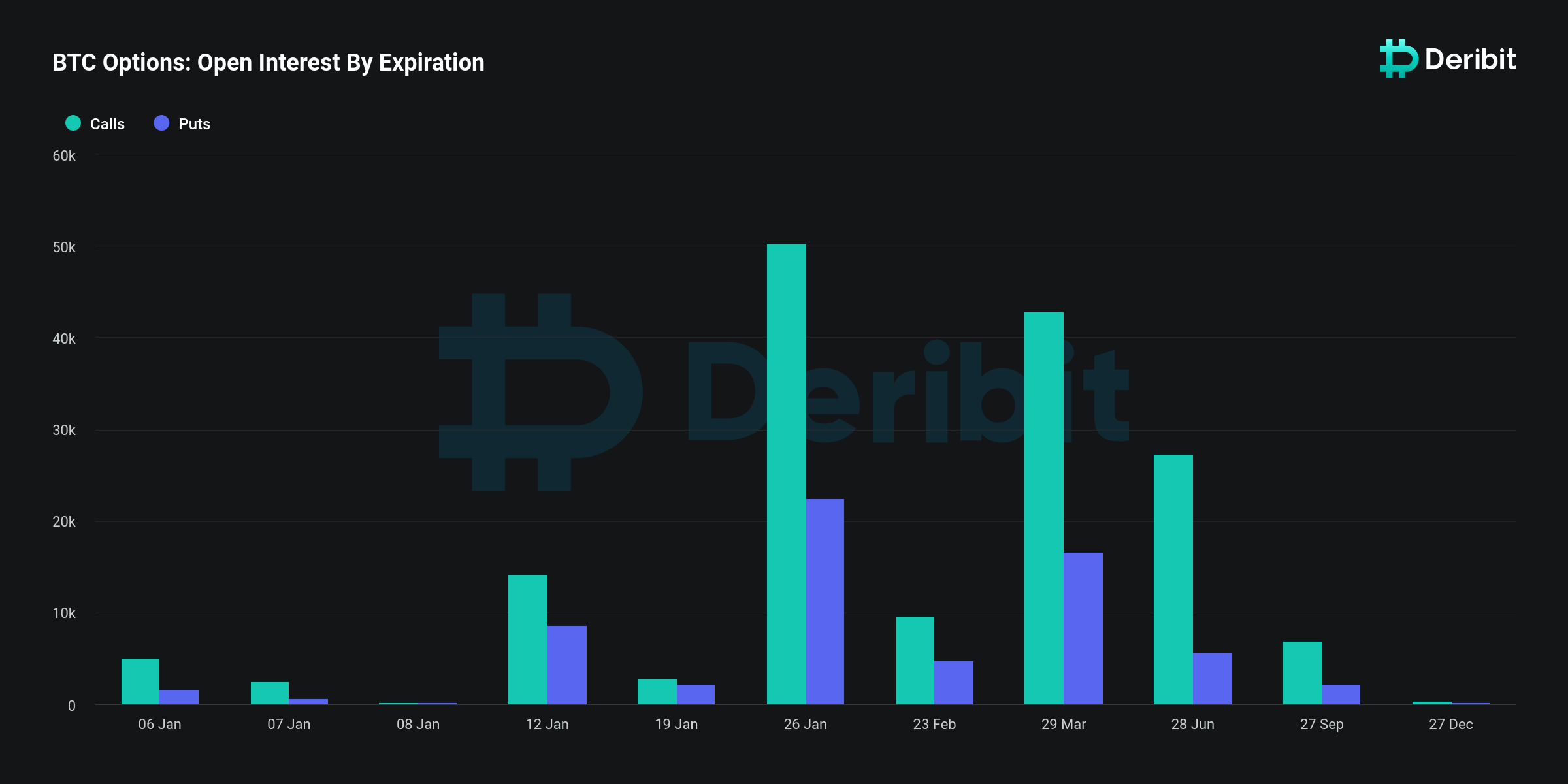

Relating to open curiosity by expiration, the info reveals a heavy focus of name choices for the Jan. 26 expiration, with $2.21 billion in calls versus $988.49 million in places. This means that the bullish sentiment is extra pronounced for the medium time period, with a big a part of the market anticipating vital developments surrounding the Bitcoin ETF to happen earlier than this date.

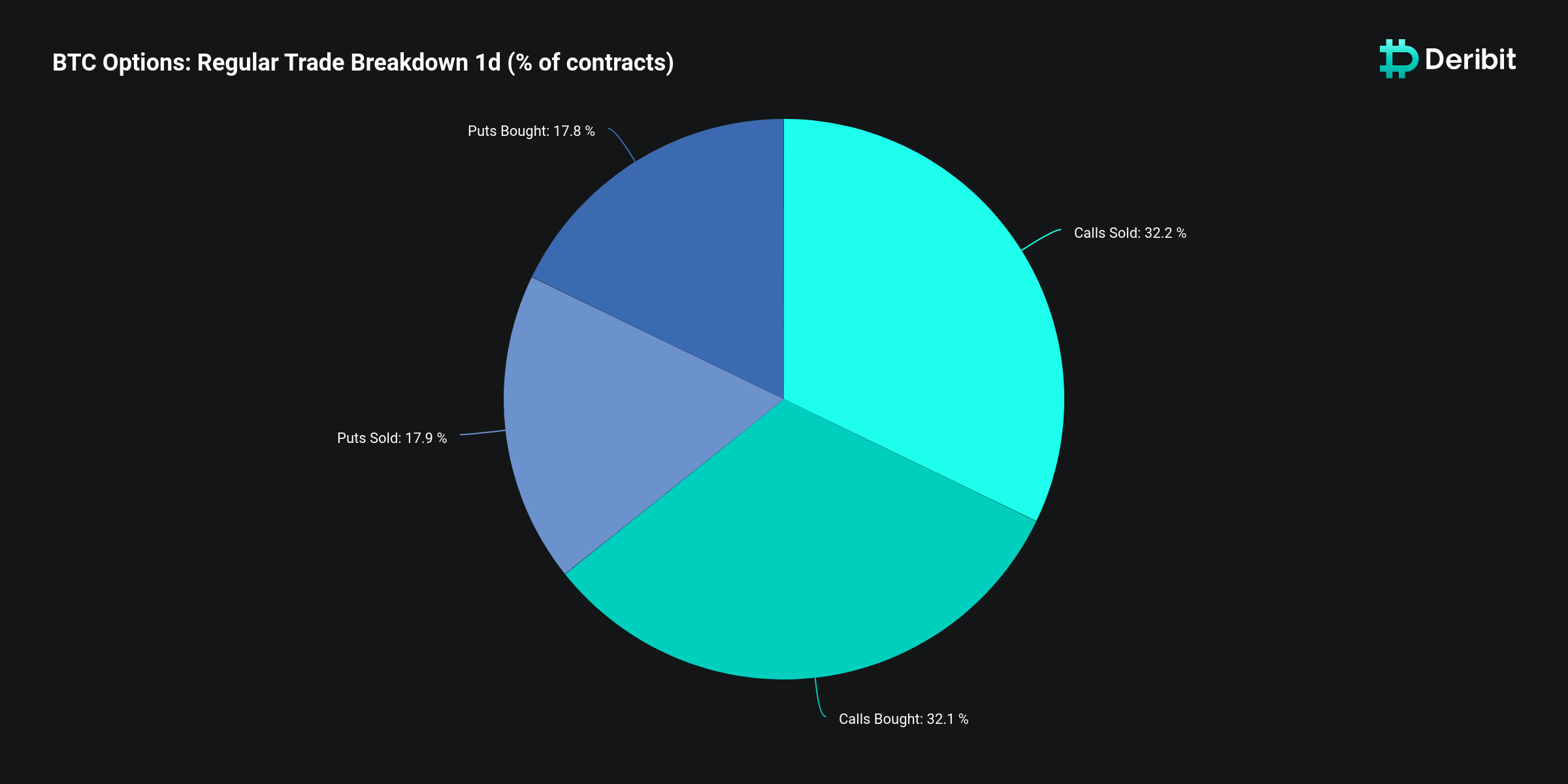

The common commerce breakdown, exhibiting virtually equal percentages of places and calls purchased and bought —17.8% and 17.9% for places, 32.1% and 32.2% for calls, respectively — signifies a balanced market when it comes to buying and selling actions. The information reveals {that a} larger share of market individuals are engaged in name possibility transactions in comparison with places. This means a stronger curiosity in betting on or hedging towards a rise in Bitcoin’s value. The steadiness between calls purchased and bought can be practically equal, suggesting that for each investor speculating on a value rise (by shopping for calls), there may be virtually an equal variety of traders (or maybe the identical traders in numerous transactions) who’re both extra cautious or seeking to revenue from promoting these choices.

Knowledge from Deribit displays a predominantly bullish sentiment, with traders exhibiting a robust perception within the potential for Bitcoin’s value to extend, significantly in the direction of the $50,000 stage within the quick to medium time period. Nonetheless, a considerable quantity of put choices and balanced commerce actions point out a cautious method amongst merchants, with many getting ready for additional volatility.