Introduction

With the surge in reputation of digital property, platforms like BTSE have gained prominence amongst crypto lovers and merchants. In recent times, BTSE has distinguished itself within the cryptocurrency change business resulting from its user-friendly interface, in depth vary of supported cryptocurrencies and fiat on/off ramps, and revolutionary buying and selling choices. This BTSE Change Evaluation 2023 will take an in-depth take a look at the platform, its key options, supported cryptocurrencies, buying and selling choices, charges, safety, buyer assist, and extra.

BTSE Overview

Based in 2018, BTSE, brief for “Purchase, Commerce, Promote, Earn,” is a worldwide cryptocurrency change that gives a wide selection of companies, together with spot and futures buying and selling, investing, and simple crypto purchases. BTSE goals to bridge the hole between conventional fiat markets and the crypto world by offering a easy, safe, and environment friendly buying and selling platform. Notably, BTSE helps greater than 150 cryptocurrencies, over 10 fiat currencies, and 1,000+ totally different buying and selling pairs.

The change facilitates crypto purchases by numerous fiat fee strategies, together with credit score/debit playing cards and financial institution transfers. It additionally gives a buying and selling expertise with two distinct markets — spot and futures — the place customers can commerce all of the out there pairs in an expert and superior buying and selling interface.

BTSE goes a step additional by introducing funding alternatives, permitting customers to earn returns on their cryptocurrency holdings. Choices embody staking, fastened and versatile financial savings, and lending, offering avenues for asset progress.

BTSE Crypto Change Particulars

| Web site | https://www.btse.com/ |

| Native token | BTSE Token |

| Variety of registered customers | 1.4 million |

| Variety of supported cash/tokens | 150+ |

| Variety of supported buying and selling pairs | 1,000+ |

| Variety of supported fiat currencies | 10+ |

| Out there on cellular | Sure |

| Headquarters | British Virgin Islands |

| 12 months based | 2018 |

Historical past Overview

BTSE, established in September 2018, is underneath the management of CEO Henry Liu. The change’s imaginative and prescient is to advertise the widespread adoption of user-friendly and versatile crypto-based monetary companies that earn the belief of establishments.

The change touts a number of technical benefits, together with minimal downtime, a high-performance buying and selling engine able to executing over a million order requests per second, a self-hosted infrastructure, horizontal scalability, and the safe storage of 99.9% of consumer funds in chilly storage.

Platform Interface

BTSE’s homepage boasts a clear and beginner-friendly interface, with a give attention to simplicity and ease of use, designed for merchants of all expertise ranges. The intuitive format ensures environment friendly navigation, permitting customers to seamlessly have interaction in actions akin to cryptocurrency purchases and buying and selling whereas staying knowledgeable about market circumstances.

Key Options and Features

BTSE gives a spread of options and features, together with:

- Instantaneous shopping for and promoting of crypto property with fiat currencies

- Zero-fee crypto conversions

- A various choice of over 150 crypto property and 1,000+ buying and selling pairs

- Cell functions for each iOS and Android

- Spot and futures markets

- Leverage of as much as 100x

- A number of incomes and funding choices

- Minimal downtime for a easy buying and selling expertise

Supported Fiat Currencies, Cryptocurrencies, and Buying and selling Pairs

BTSE at present helps over 150 cryptocurrencies, encompassing common cash akin to Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Cardano (ADA), amongst others. Customers should purchase and commerce these cryptocurrencies towards numerous fiat currencies just like the US Greenback (USD) and Euro (EU), in addition to outstanding stablecoins akin to Tether (USDT) and USD Coin (USDC). BTSE actively adjusts its listing of supported crypto property in response to group calls for.

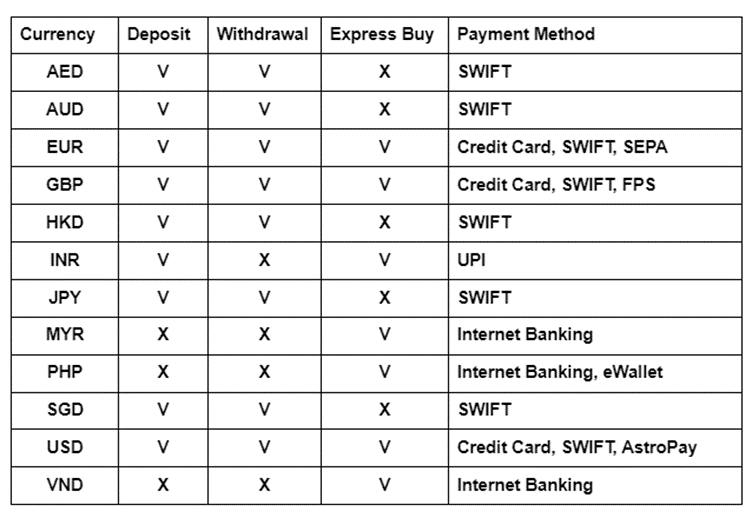

Moreover, BTSE allows deposits, withdrawals, and on the spot crypto purchases in additional than 10 fiat currencies, together with USD, EUR, SGD, AUD, AED, and JPY, amongst others, offering flexibility to customers worldwide.

Companies

Specific Purchase and OTC Buy

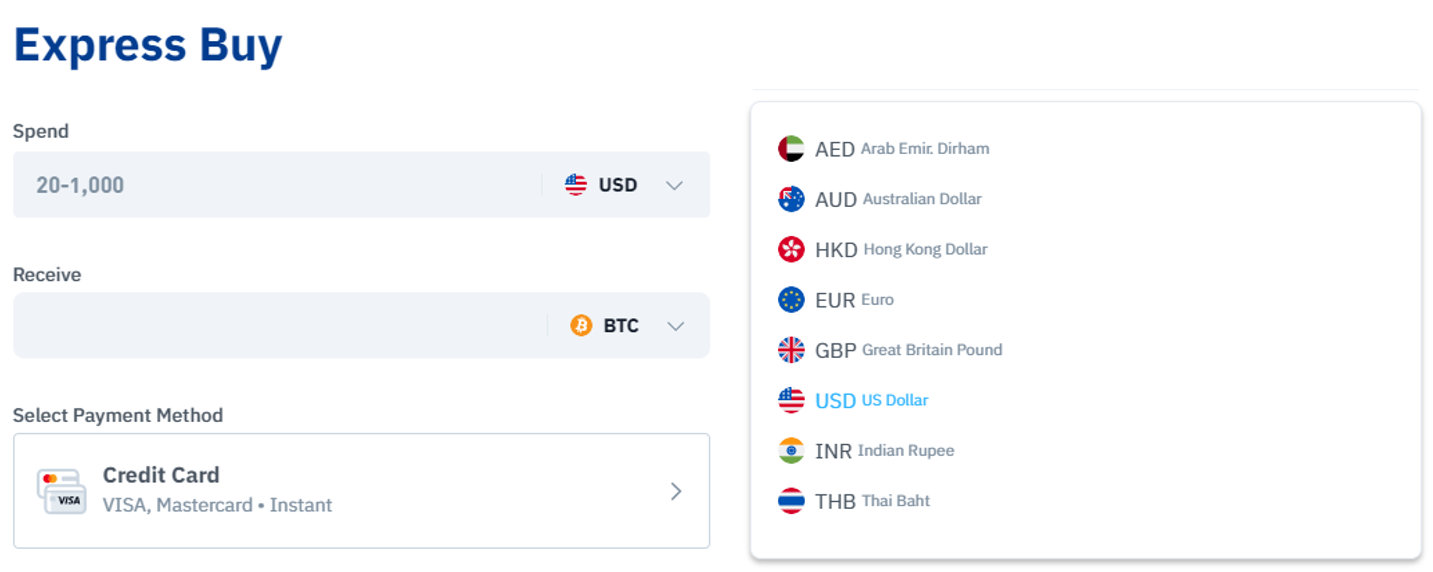

To start with, BTSE supplies a user-friendly technique to buy cryptocurrencies utilizing conventional fiat currencies and cryptocurrencies.

The Specific Purchase characteristic permits for fast purchases of assorted cryptocurrencies, akin to BTC, ETH, USDT, USDC, and FDUSD, with a number of fee choices, together with credit score/debit playing cards and AstroPay.

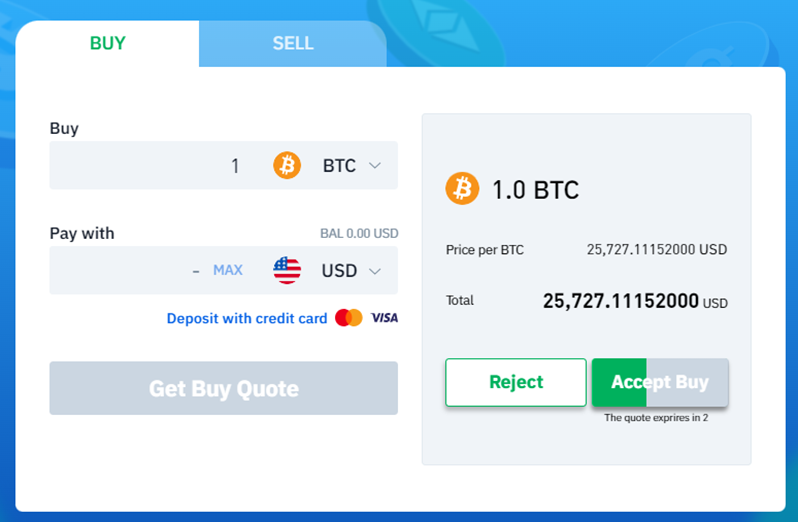

BTSE’s OTC part supplies customers with the liberty to purchase and promote crypto property, providing a large alternative of over 80 cryptocurrencies. Customers benefit from the flexibility to make funds utilizing both their fiat or crypto deposits with out being restricted to traditional strategies. Furthermore, when promoting crypto property, customers have the comfort of receiving fiat foreign money immediately of their financial institution accounts.

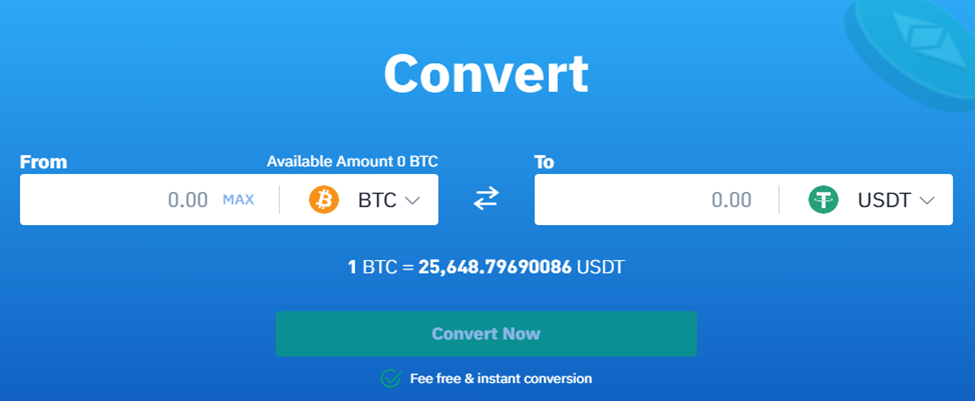

Convert Crypto

Along with facilitating crypto-to-crypto exchanges, BTSE additionally gives customers the comfort of changing supported cryptocurrency property immediately into fiat foreign money property and vice versa. With BTSE’s Convert perform, customers can simply choose the property they want to change and provoke the conversion course of with a single click on.

Spot Buying and selling

BTSE supplies a spot buying and selling characteristic that permits customers to purchase and promote cryptocurrencies at real-time market costs.

Futures Buying and selling

Merchants can even have interaction in futures buying and selling, enabling them to take a position on the longer term value actions of assorted cryptocurrencies. BTSE gives numerous futures contracts, together with BTC, ETH, LTC, XRP, and others, with a most leverage of as much as 100x. Most contracts are perpetual futures, although for large-cap cryptocurrencies akin to Bitcoin and Ethereum, time-dated futures can be found.

Bot Copy Buying and selling

BTSE additionally gives a novel characteristic that allows customers to repeat the buying and selling methods of profitable merchants, gaining insights and doubtlessly enhancing their possibilities of worthwhile futures trades. All customers must do is transfer funds into their futures pockets and choose a dealer’s technique to repeat.

BTSE Earn

BTSE Earn gives customers numerous methods to develop their property, together with Staking, Fastened and Versatile Financial savings, and Lending choices. Customers can stake their property to earn excessive returns, deposit funds into versatile or fastened financial savings accounts, and earn curiosity by lending their property to BTSE’s capital pool.

Moreover, BTSE gives a testnet buying and selling platform for novices to follow buying and selling with out utilizing actual funds. The change additionally supplies incentives akin to a referral program, associates program, VIP program, BTSE token staking program, and a rewards hub.

Charges and Limits

BTSE implements a clear payment construction for its companies, providing aggressive charges for spot buying and selling, futures buying and selling, and different transactions. The charges and limits schedule is clearly outlined on the BTSE web site, permitting customers to have full visibility of the prices related to their trades and different transactions.

Convert Crypto Charges

BTSE supplies customers with a conversion characteristic that facilitates cryptocurrency and fiat foreign money exchanges freed from cost. The easy interface ensures the transactions on the platform are processed immediately, simplifying the buying and selling course of.

Spot Buying and selling Charges

These spot buying and selling charges are deducted from the foreign money that the consumer receives throughout a commerce. Reductions on these charges can be found primarily based on the consumer’s VIP degree, which is set by their month-to-month buying and selling quantity and BTSE Token steadiness. The upper the consumer’s VIP degree, the decrease their charges will likely be.

Moreover, particular reductions are offered for market makers primarily based on their contribution to the change’s whole quantity. Market maker charges may be enticing, as high-volume market makers can profit from rebates.

Futures Buying and selling Charges

Future buying and selling charges are charged when customers open and shut futures contract positions. The charges are calculated primarily based on the Notional Worth of a consumer’s positions and are subtracted from the consumer’s margin steadiness. Notional Worth = Mark Value [USDT] * Place Measurement [Crypto Units].

Much like spot buying and selling charges, reductions can be found for lively merchants primarily based on their VIP degree. Market makers additionally get pleasure from particular charges, with decrease charges for increased buying and selling volumes.

Fiat Deposit and Withdrawal Charges

Observe that non-USD SWIFT deposits totaling lower than the equal of $100 USD at prevailing change charges incur a $3 USD deposit payment. You will need to bear in mind that non-USD fiat deposits and withdrawals could end in extra costs, akin to financial institution charges, remittance charges, or switch charges. These charges are decided and utilized by the respective servicing banks, not by BTSE.

Crypto Deposit and Withdrawal Charges

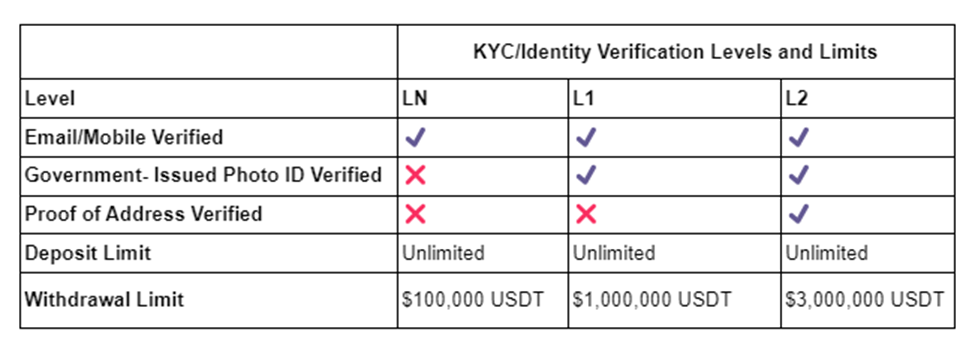

BTSE applies zero charges for crypto deposits and ranging withdrawal charges relying on the cryptocurrency. The change additionally units crypto withdrawal limits primarily based on a consumer’s KYC Id Verification degree.

Cost Strategies

BTSE helps numerous fee strategies, together with financial institution transfers, credit score/debit playing cards, and cryptocurrencies. This supplies flexibility for customers to deposit and withdraw funds in a means that fits their preferences.

Safety

BTSE locations a powerful emphasis on safety, implementing sturdy measures to guard consumer funds and private info. The platform makes use of superior in-house know-how and infrastructure, chilly storage for many funds, and a consumer insurance coverage fund to reinforce safety.

KYC Course of

Whereas customers can start buying and selling on BTSE with a easy electronic mail deal with or cellular quantity, the change encourages customers to finish the Know Your Buyer (KYC) verification course of. Finishing KYC verification unlocks entry to the platform’s fiat foreign money options, together with increased withdrawal limits.

Cell Software

BTSE gives a cellular utility for each iOS and Android units, permitting customers to entry their accounts and commerce on the go. The cellular app gives a seamless and user-friendly expertise, with all the important thing options and functionalities out there on the desktop model.

Buyer Help

Customers can attain out to BTSE’s buyer assist staff by sending an electronic mail or submitting a ticket for a report. Sometimes, the staff responds inside an hour, though some inquiries could require as much as 24 hours for decision, relying on their complexity. BTSE maintains an lively presence on numerous social media platforms, together with Twitter, Telegram, Discord, and LinkedIn. As well as, BTSE gives a assist desk with a assist chatbot designed to handle normal platform-related queries.

Execs and Cons

Listed here are among the professionals and cons of utilizing BTSE:

| Execs | Cons |

| Person-friendly interface | No NFT market |

| Out there crypto and fiat withdrawals | |

| Huge choice of cryptocurrencies and buying and selling pairs | |

| Modern buying and selling options like bot copy buying and selling | |

| Crypto Staking, Financial savings, and Lending companies | |

| Cell utility out there |

Closing Rating

| Companies supplied | 4 |

| Cryptocurrency assist | 4 |

| Charges | 4 |

| Safety | 4 |

| Evaluation Rating | 4 |

Abstract

In conclusion, BTSE gives a complete cryptocurrency change with a mess of options and companies catering to each inexperienced persons and skilled merchants. Its dedication to safety and clear payment construction are notable strengths, making it a useful choice for these looking for to interact in cryptocurrency buying and selling and funding. Nevertheless, customers must be conscious of charges related to sure transactions and keep knowledgeable in regards to the change’s insurance policies relating to crypto property.

FAQs

BTSE was based in 2018.

BTSE helps over 150 cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Cardano (ADA), amongst others.

BTSE implements a clear payment construction. Customers can discover detailed details about buying and selling charges on the BTSE web site.

BTSE supplies two main buying and selling markets: spot and futures. Customers can have interaction in real-time spot buying and selling or take part in futures buying and selling with leverage of as much as 100x.

Sure, BTSE gives a cellular utility for each iOS and Android units, enabling customers to commerce on the go.