- Whale Alert noticed that 3,900 BTC was transferred from an unknown pockets to a different nameless pockets.

- BTC is priced at $30,145.01, after witnessing a 1.66% fall in seven days.

- The cryptocurrency’s present uptrend degree might set off an oversold occasion quickly as merchants search income.

Whale Alert notified the crypto group that 3,900 BTC, valued at roughly $117,580,367, was transferred from an unknown pockets to a different nameless pockets. Though the rationale behind this switch was not talked about, there might nonetheless be a risk that BTC’s value could also be affected by the whale’s switch.

Primarily based on CoinMarketCap, BTC is priced at $30,145.01, after witnessing a 1.66% fall in seven days, on the reported time. Furthermore, BTC’s market cap fell by 0.44% to $585,571,151,277 in sooner or later. Nevertheless, BTC’s demand continues to prevail within the crypto group because the buying and selling quantity elevated by 25.85% to $9,330,370,578. Presently, BTC is residing within the purple zone after going through a slight tumble over the week.

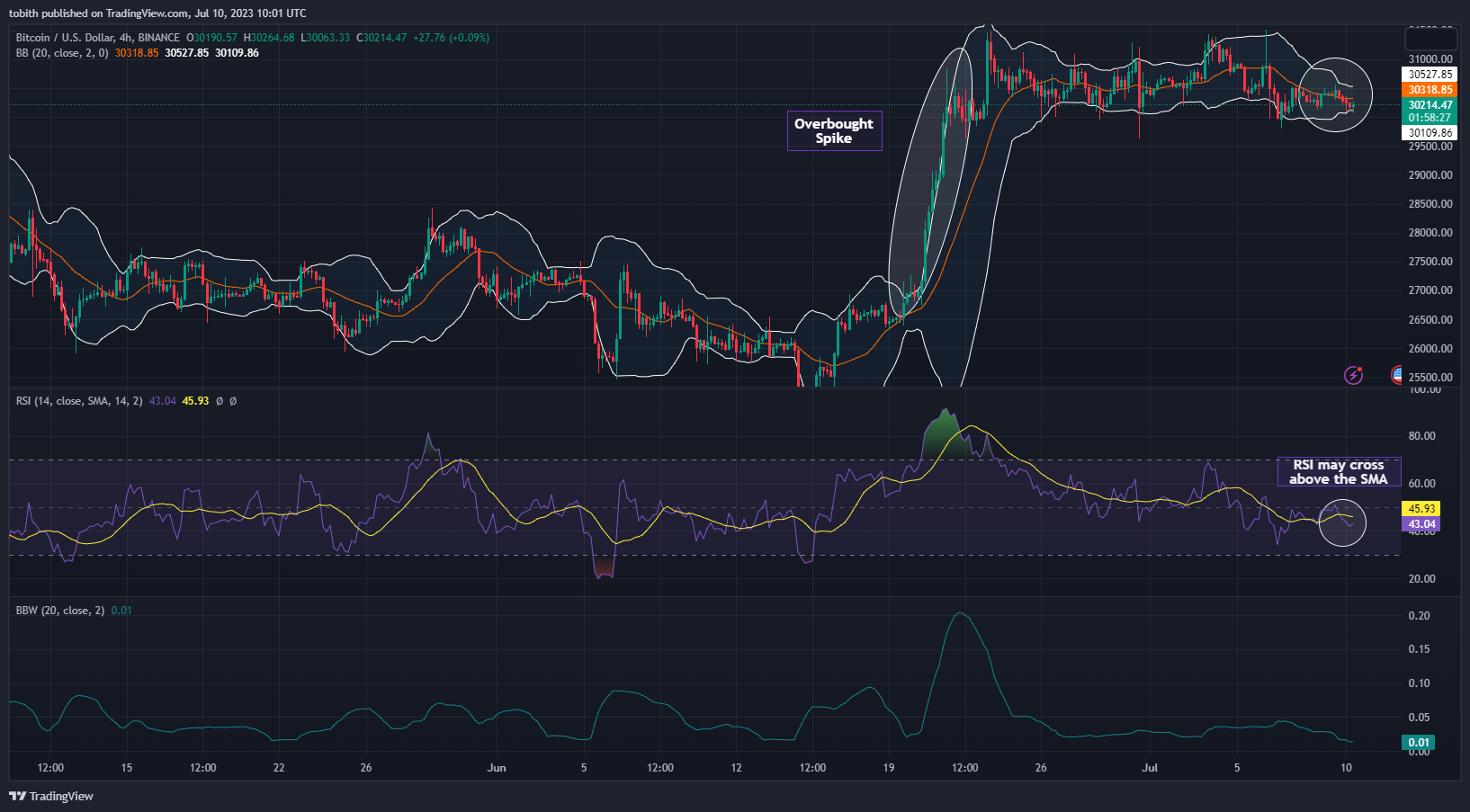

Wanting on the charts, BTC is at present buying and selling within the decrease half of the Bollinger Bands. Furthermore, the newly-formed candlesticks’ wicks have touched the decrease band, indicating that BTC could attain the oversold area quickly. Wanting on the Bollinger Band Width (BBW) indicator, the BBW is transferring horizontally which may very well be an indication that the hole between the higher and the decrease band of the Bollinger Band indicator could scale back. When the hole between the higher and the decrease band contracts, merchants count on the market volatility to scale back.

The RSI is at present valued at 43.65, which is taken into account a weak area by most merchants as it’s valued between 50 and 30. Though the indicator exhibits indicators of a bullish crossover, the RSI might once more fall beneath the SMA. Furthermore, there may very well be a risk that merchants could search to revenue from the latest surge by promoting which might set off BTC to succeed in the oversold area.

As soon as BTC reaches the oversold area, merchants might as soon as once more begin buying BTC within the hopes of witnessing a bull run sooner or later market. Presently, merchants want to attend for affirmation concerning the following bull run sooner or later as the present indicators present that BTC would possibly transfer to the oversold area quickly.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value evaluation, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat, Coin Version and its associates is not going to be held responsible for any direct or oblique injury or loss.