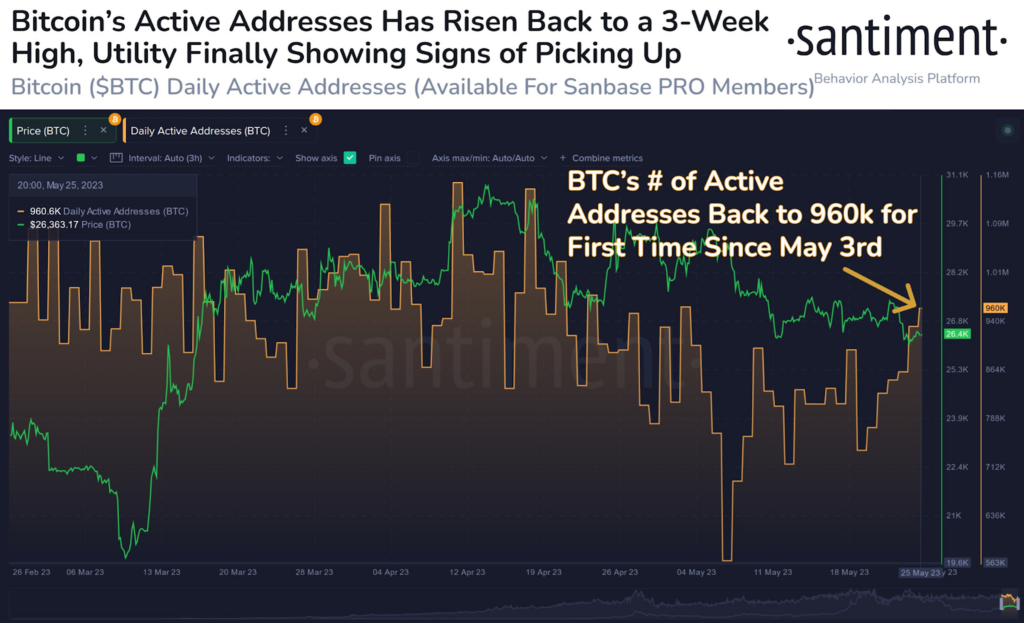

- Santiment just lately tweeted that the variety of energetic addresses for BTC has climbed again to 960K.

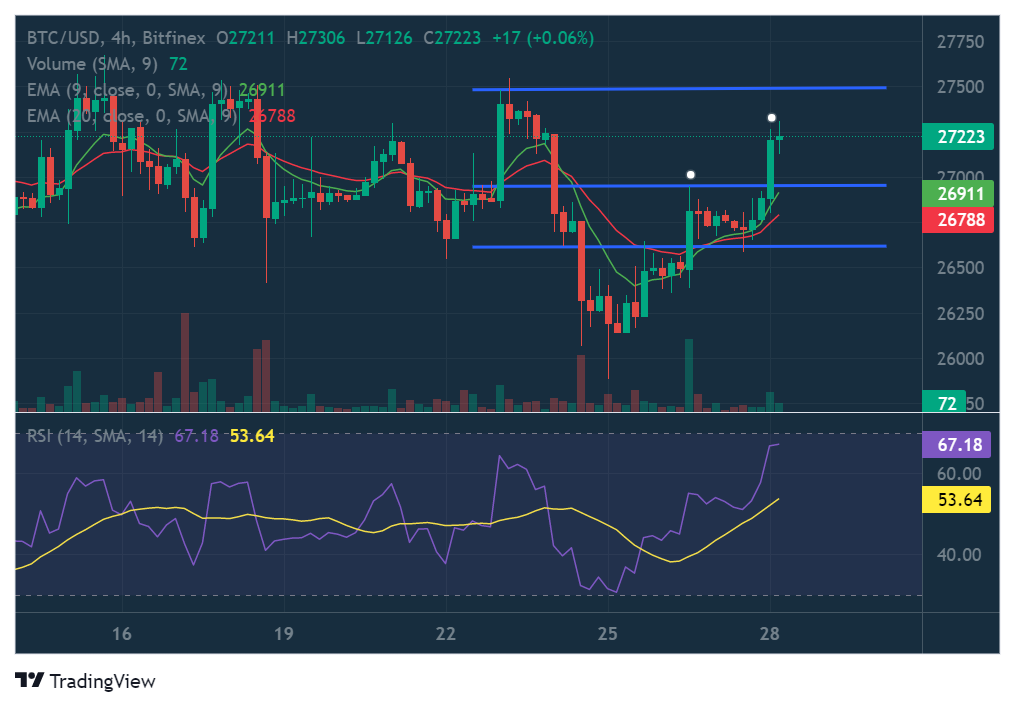

- BTC was in a position to flip the important thing resistance stage at $26,960 into help over the previous 24 hours.

- Technical indicators instructed that BTC’s worth would break above $27,480 within the subsequent 24-48 hours.

Deal with exercise for Bitcoin (BTC) has began to select up once more after concerningly low ranges in Could. In a tweet printed earlier in the present day, the blockchain intelligence agency Santiment famous that the variety of energetic addresses for BTC climbed again to 960K for the primary time since 3 Could 2023.

The latest restoration within the on-chain metric marks a 3-week excessive as BTC’s utility reveals indicators of selecting up. In line with Santiment, rising utility is critical for crypto belongings to take pleasure in sustained rallies.

At press time, the market chief was altering arms at $27,218.63 in keeping with CoinMarketCap. This was after the crypto’s worth printed a 1.84% achieve over the previous 24 hours. The latest enhance in BTC’s worth flipped its weekly efficiency into the inexperienced. In consequence, BTC’s weekly worth efficiency stood at +0.44%.

BTC’s worth had flipped the $26,960 resistance stage into help over the previous 24 hours, and continued to commerce above this mark at press time. Technical indicators on BTC’s 4-hour chart instructed that the crypto’s worth would try and do the identical with the following resistance stage at $27,480 within the subsequent 24-48 hours..

The 9 EMA line on the 4-hour chart had just lately crossed bullishly above the 20 EMA line – signalling that BTC’s worth had entered right into a short-term bullish cycle. Along with this, the shorter EMA line was bullishly breaking away from the longer EMA line.

The RSI indicator on the 4-hour chart was additionally flagging bullish at press time, with the RSI line buying and selling above the RSI SMA line. Moreover, the RSI line was sloped positively in direction of overbought territory, which was one other bullish signal.

Disclaimer: The views and opinions, in addition to all the data shared on this worth evaluation, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held accountable for any direct or oblique injury or loss.