- Rekt Capital tweeted that BTC closed beneath the $26,200 stage, unable to reclaim the $27,600 as assist.

- BTC is at present priced at $26,082.69 after witnessing a spike of 0.95% in 24 hours.

- Indicators spotlight that BTC might expertise an uptrend sooner or later.

Analyzing BTC’s efficiency over the week, a crypto analyst below the pseudonym of ‘Rekt Capital’ tweeted that Bitcoin closed beneath the $26,200 stage, unable to reclaim the $27,600 as assist. Furthermore, the crypto analyst talked about that the ‘blue stage’ ($26,638.3) might turn out to be the brand new resistance for BTC sooner or later.

At the moment, BTC skilled a 1.19% surge in seven days which led it into the inexperienced zone. BTC is priced at $26,082.69 after witnessing a spike of 0.95% in 24 hours, based mostly on CoinMarketCap. Despite the fact that BTC fell beneath the $26,200 stage, the cryptocurrency chief nonetheless has a buying and selling quantity of $11,583,591,020, on the time of writing.

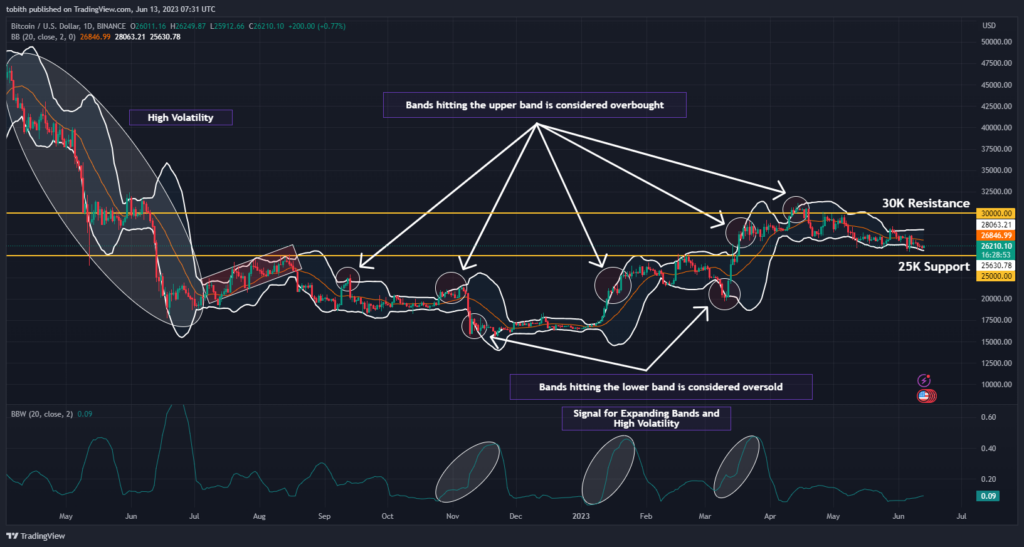

Wanting on the 1-day chart of BTC/USD, the candlesticks are at present within the decrease half of the Bollinger Bands, which may very well be thought-about that there’s a downtrend out there. Furthermore, the hole between the higher band and the decrease band stays slender, indicating that market volatility is low for BTC. Since BTC didn’t commerce above the $26K assist stage, $25,000 may very well be thought-about because the assist stage.

BTC’s volatility might stay low for a while because the Bollinger Band Width (BBW) is shifting horizontally in comparison with its earlier conduct. Moreover, BTC’s candlesticks retraced again contained in the Bollinger Band after it was pushed to the oversold area. Nevertheless, BTC’s retracement missed the chance to succeed in the highest half of the Bollinger Bands.

BTC’s present worth momentum is forming a descending triangle sample as new greater lows appear to type. The descending triangle might create two entry factors: bullish and bearish. Through the bearish entry level, BTC might fall by 3.81% to the touch the Help stage.

In the meantime, the BTC must rise by 15.52% with the intention to make $30K within the new Help stage. If BTC experiences an identical development power throughout its gradual downtrend, then, the crypto chief might attain $30K over 11 weeks.

Moreover, the RSI is valued at 43.70 and stays beneath the SMA, which is taken into account a bearish sign. Nevertheless, the RSI might cross above the SMA because the hole between them is sort of slender. This crossover would verify the beginning of BTC’s uptrend. After the bullish crossover, RSI might reside inside the robust development neighborhood for a while, driving the worth upwards towards BTC’s $30K purpose.

The RVGI’s bullish crossover additionally confirms that the RSI would cross above the SMA. One other attainable sign concerning BTC’s uptrend can be by way of the formation of a medium bullish divergence noticed within the RSI. If the RSI varieties greater lows, then, BTC might proceed to stand up avoiding the $26K stage.

Disclaimer: The views and opinions, in addition to all the data shared on this worth evaluation, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger, Coin Version and its associates is not going to be held answerable for any direct or oblique harm or loss.