- CEO of XOR Technique tweeted that the bear market lasted just for one yr, adopted by three years of bull run.

- BTC may hit 350K within the subsequent halving scheduled for Might 2024, states Ohayon.

- The bears are in on BTC. The bulls may have one thing further particular to cease the bears.

Chief Govt Officer (CEO) of XOR Technique, Aurelien Ohayon, tweeted that bear markets final just one yr with every halving that occurs as soon as in 4 years. The remainder of the three years had been adopted by bull runs sped by halving, acknowledged the CEO within the tweet.

When taking a more in-depth take a look at the picture shared on the above tweet, it might be seen that the gradient of BTC rose with the start of each halving course of as proven within the second rectangle throughout the three years.

In the meantime, the tweet factors out that, at current, BTC is to start with part of the primary rectangle. With its halving course of scheduled for Might 2024, as per studies, Ohayon predicts BTC to hit $350K after the approaching halving.

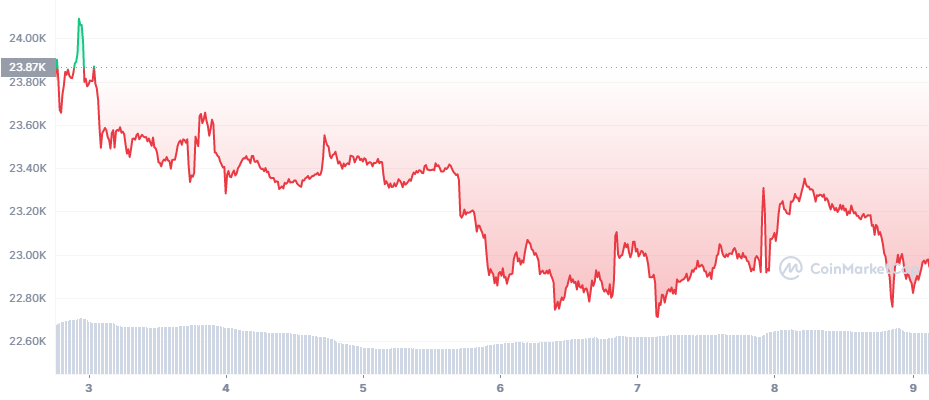

When having a look on the chart under, BTC simply had a peep into the inexperienced zone on the primary day of the week. After opening the market with its value at $23.87K, the coin rose to $24.10K inside a couple of hours. Nonetheless, after its transient keep within the inexperienced zone, BTC bulls couldn’t cope with the bears who pulled the costs into the pink zone.

Whereas BTC was fluctuating within the pink zone, the bulls tried their stage finest, however they had been solely capable of consolidate the costs for 3 days. On the fourth day, the value fell from $23,370 to $22,760. However it’s price noting that the quantity of the BTC had little or no fluctuation all through the week.

As proven within the chart under with blue candlesticks, BTC traded, taking comparable patterns within the second half of January. BTC mimicked its habits from January 14 to twenty and once more throughout January 20-27. Nonetheless, the latter fluctuation occurred close to help 1, whereas the sooner fluctuation occurred close to help 2.

At current, BTC is transferring sideways between Help 1 and Help 2. It has been rebounding on Help 1, however the bear bull energy data -379 and is titled downwards, indicating that the bears are gaining energy.

If that’s the case, will Help 1 be robust sufficient to carry BTC? If that’s the case, for a way lengthy will it help BTC? From one other perspective, if BTC breaks help 1, the 200-day MA might interject it from tanking to help 2. Contrastingly, if the bulls pull one thing particular, BTC will attain resistance 1. Can the bulls negate the growing bear strain?

Disclaimer: The views and opinions, in addition to all the data shared on this value evaluation, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat, Coin Version and its associates won’t be held answerable for any direct or oblique injury or loss.