- CEXs skilled a surge in spot and futures buying and selling quantity in October.

- Main the pack in spot quantity progress had been Crypto.com (201%), Upbit (75%), and Bybit (73%).

- This elevated exercise got here following the Bitcoin-led bull rally that commenced in October.

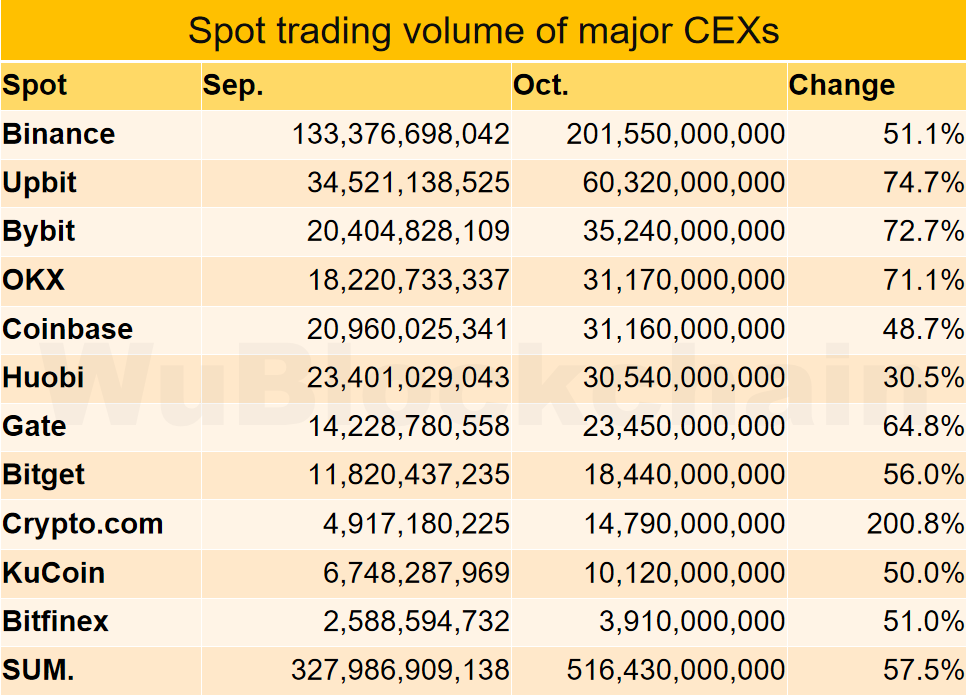

In October, the spot buying and selling panorama witnessed a considerable curiosity surge, with main centralized exchanges (CEXs) collectively experiencing a outstanding 57.5% month-on-month enhance in quantity. In line with the well-known crypto-focused Chinese language reporter Colin Wu, these figures recorded for October had been final seen six months in the past.

Moreover, Wu famous that the frontrunner exchanges in spot buying and selling quantity progress had been Crypto.com, Upbit, and Bybit. Particularly, he disclosed that Crypto.com recorded roughly $5 billion spot quantity in September, solely to surge 201% to almost $15 billion in October.

Upbit adopted with a 75% uptick from $34.52 billion to $60.32 billion. Likewise, Bybit improved 73%. Then again, the exchanges with the bottom progress change had been Huobi, registering a extra modest 31%, Coinbase at 49%, and Kucoin at 50%.

Notably, the most important buying and selling platform, Binance, commanded about 40% of the cumulative spot buying and selling quantity of the ranked 11 exchanges. In perspective, Binance managed almost 4 occasions the spot quantity of its closest rival, Upbit.

Delving into the crypto by-product market, the Chinese language reporter revealed that the ranked exchanges exhibited a 44.5% month-on-month progress, scaling heights unseen since June. Deribit spearheaded the pack with a unprecedented 260% surge, trailed by Crypto.com at 199% and Bitmex at 171%.

In the meantime, Huobi trailed behind once more with a mere 14% progress change. Binance adopted, recording a 62% enhance, and OKX at 65%. Whereas Binance’s proportion progress change was solely 61% in comparison with others, the alternate’s by-product quantity grew from $663 billion in September to over $1.07 trillion by October. Curiously, different exchanges, regardless of registering a extra important progress by way of proportion change, failed to achieve the determine Binance recorded in September.

Cumulatively, the crypto by-product market noticed over $2.31 trillion in buying and selling quantity. It’s value mentioning that the elevated exercise within the crypto spot and futures market could also be attributed to the Bitcoin-led bull market rally that commenced in October.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.