Monitoring unrealized revenue and loss is a cornerstone of market evaluation. Whereas realized revenue and loss supply a snapshot of the market’s previous habits, unrealized revenue, and loss present a window into the market’s potential trajectory. This distinction turns into much more pronounced once we zero in on short-term holders.

Brief-term holders, outlined as entities holding Bitcoin (BTC) for lower than 155 days, play a pivotal function in shaping the market dynamics. Their habits, pushed by current market traits and short-term objectives, profoundly influences Bitcoin’s value. Conversely, value actions also can sway their choices, making a suggestions loop that stabilizes or destabilizes the market.

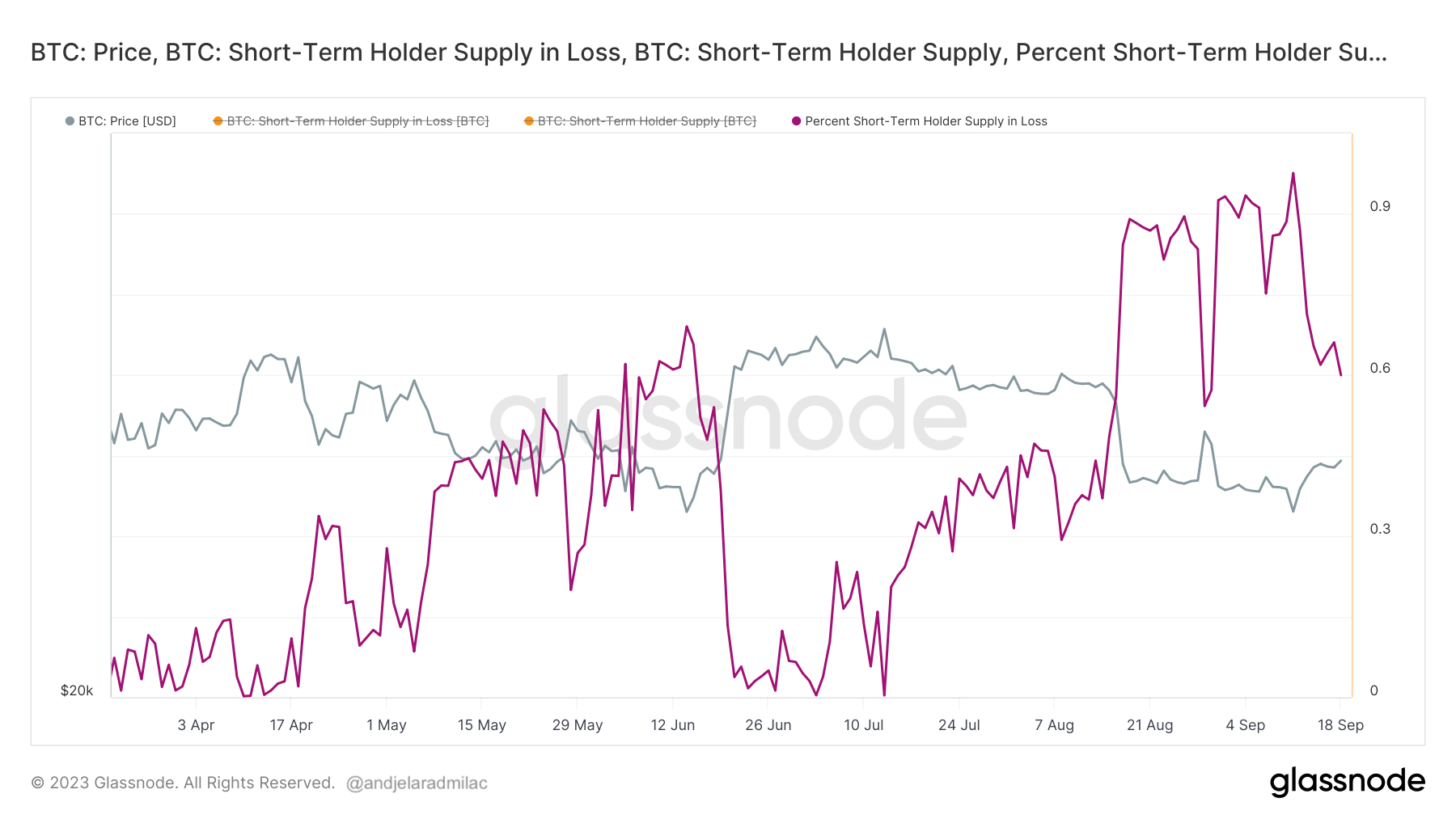

Current knowledge from Glassnode sheds gentle on the state of short-term holders. Following Bitcoin’s transient dip to $25,000 on Sep. 11, the share of short-term holder provide in loss rose to 97.61%. Bitcoin’s restoration to $27,000 diminished the availability loss to 59%. On Sep. 19.

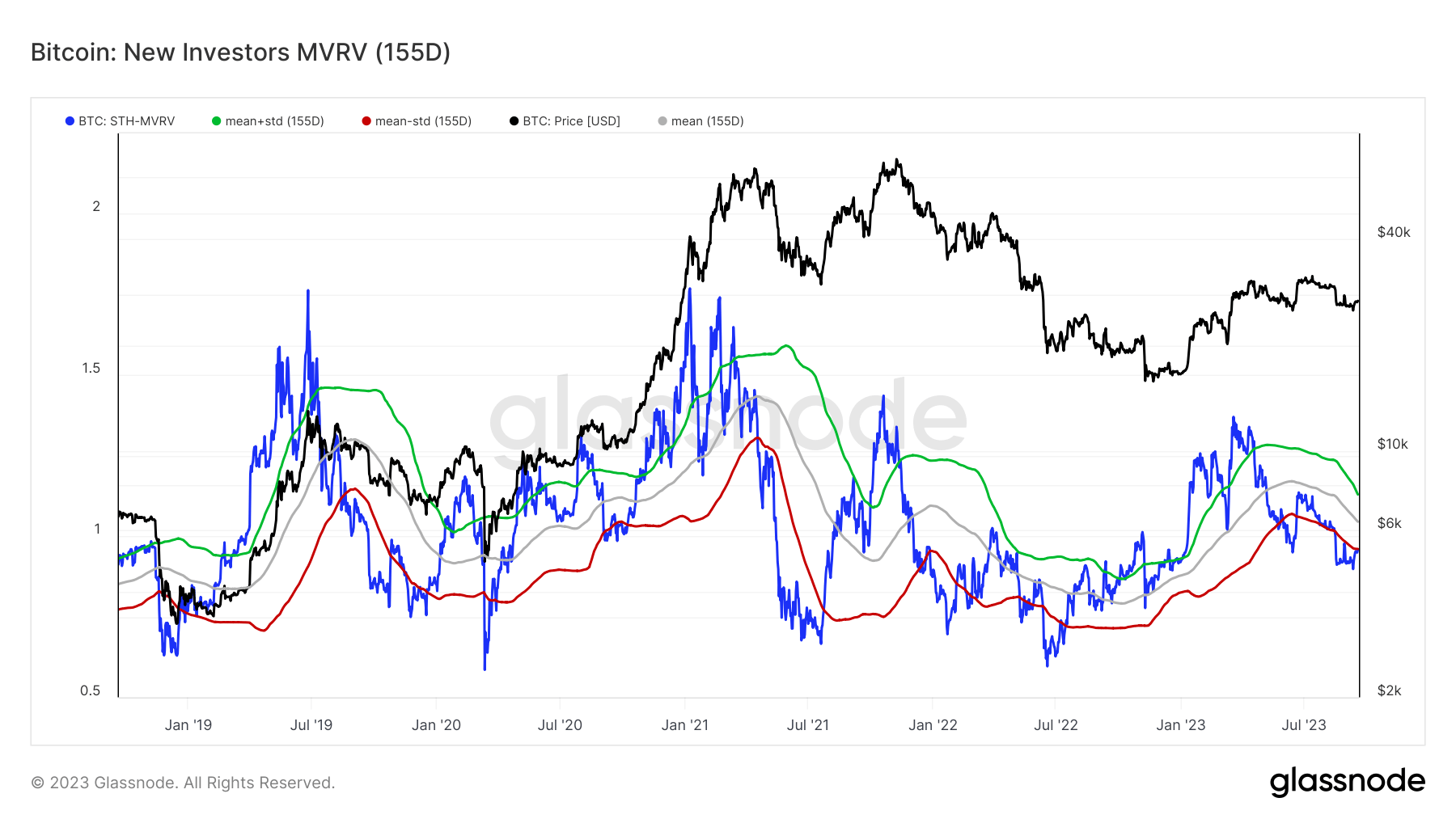

The MVRV ratio exhibits short-term holders’ unrealized revenue or loss relative to the asset’s market worth.

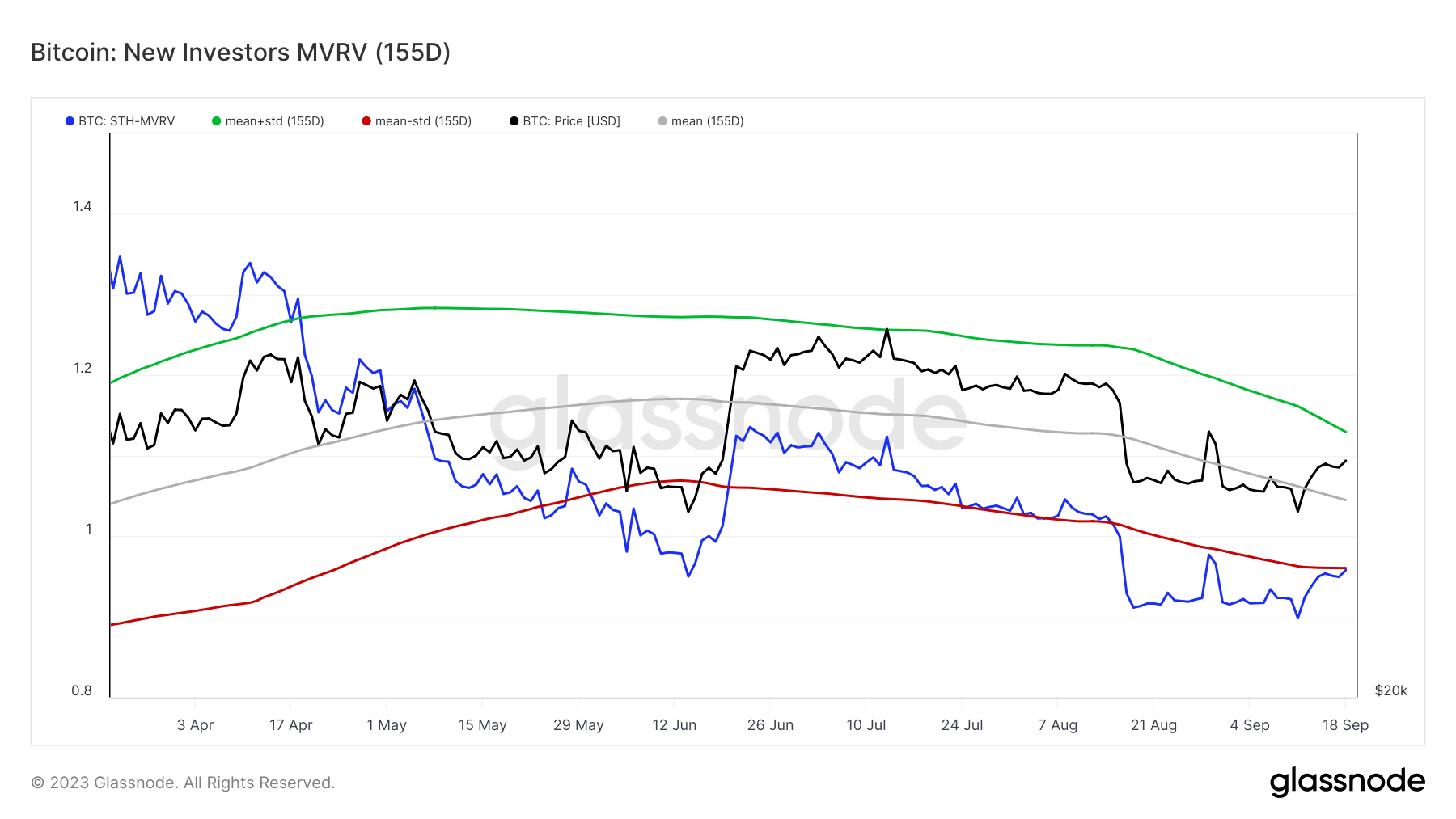

By juxtaposing the extremes in STH-MVRV towards its 155-day common, we are able to create higher and decrease bands for the indicator. The higher band represents the imply plus one customary deviation, whereas the decrease band is the imply minus one customary deviation.

These bands present that lots of the market’s highs and lows correlated with important deviations outdoors these boundaries. This means that current buyers have been both reaping substantial earnings or nursing important losses throughout these durations.

As of Sep. 11, the STH-MVRV ratio hovers at 0.95, brushing towards the decrease band. It’s price noting that the STH-MVRV dipped under this decrease threshold on Aug. 15, coinciding with Bitcoin’s value slide from $29,000 to $26,000. The ratio has remained under this band since then.

The present place of the STH-MVRV ratio, coupled with the share of short-term holder provide in loss, suggests a heightened state of vendor exhaustion. Within the context of Bitcoin’s value, vendor exhaustion implies that the promoting stress begins to wane as most short-term holders who wish to promote have already achieved so. Traditionally, such situations have usually paved the way in which for value recoveries as promoting pressures diminish.

The submit Brief-term holders present indicators of vendor exhaustion appeared first on StarCrypto.