The approval of the primary spot Bitcoin ETFs by the U.S. Securities and Alternate Fee (SEC) on Jan. 10 was a big milestone within the crypto market. Nevertheless, the milestone led to much more important volatility in Bitcoin’s value and on-chain exercise.

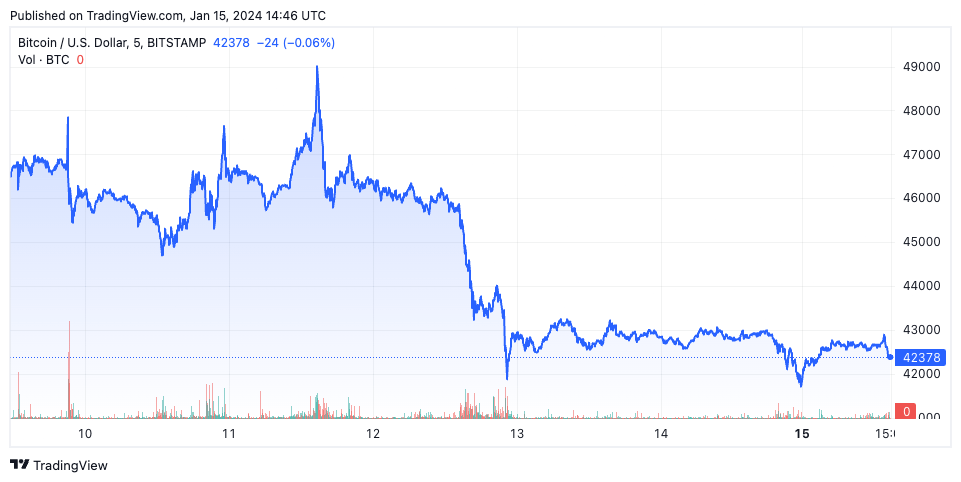

Initially, Bitcoin’s value confirmed a optimistic response to the information of the ETF approval, climbing to $46,608 on Jan. 10. By Jan. 11, the value declined to $46,393, and a extra pronounced drop occurred on Jan. 12, when the value fell to $42,897. This downward pattern continued over the next days, culminating in a value of $41,769 on Jan. 14.

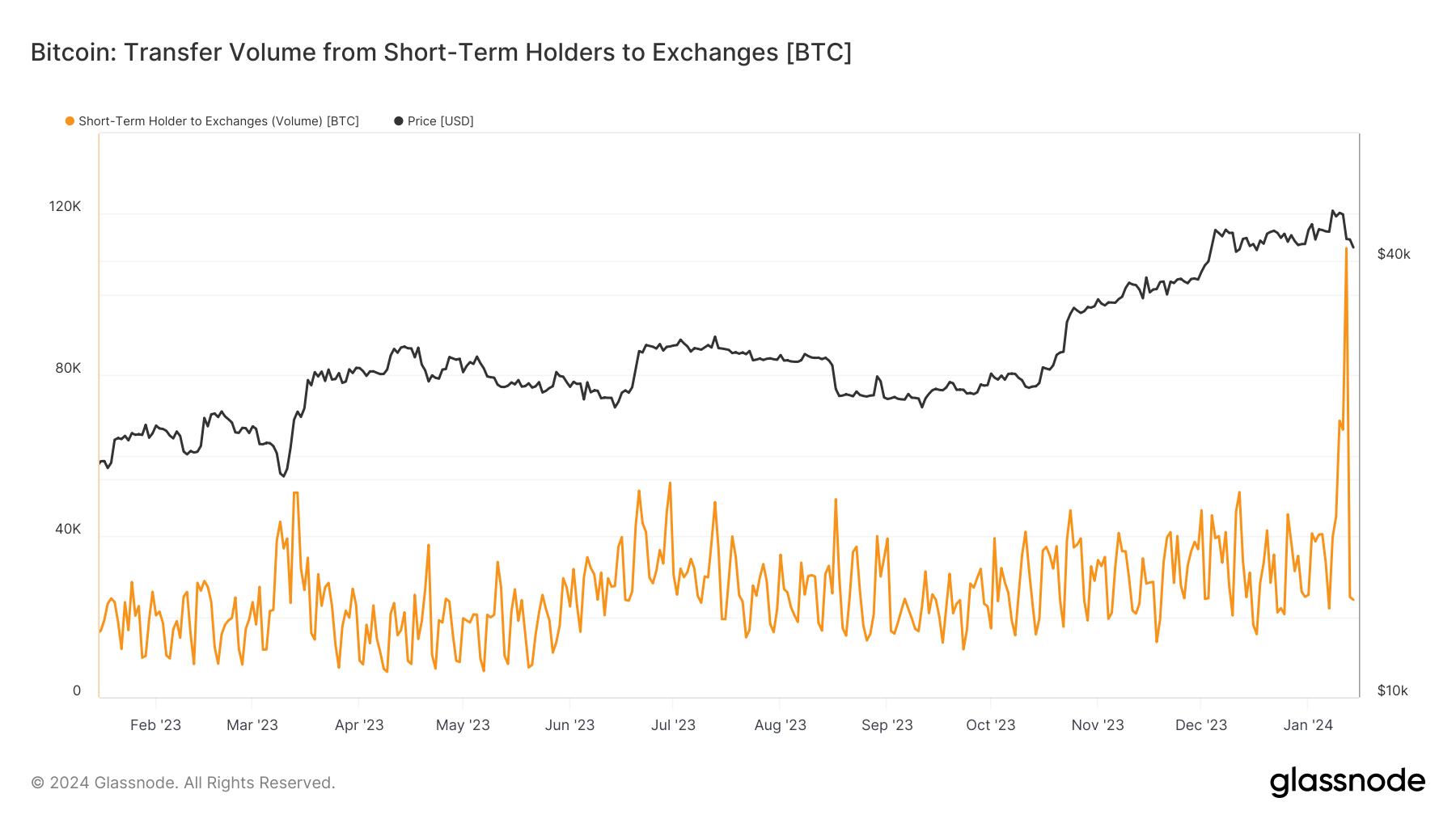

The actions of short-term holders, notably their transactions to exchanges, present the place a lot of the volatility got here from. A big improve within the quantity of Bitcoin despatched to exchanges was noticed, notably on Jan. 12, when short-term holders transferred 111,476 BTC to exchanges, marking the very best degree since Could 19, 2021. This spike signifies a substantial sell-off by addresses which have held their BTC for lower than 155 days.

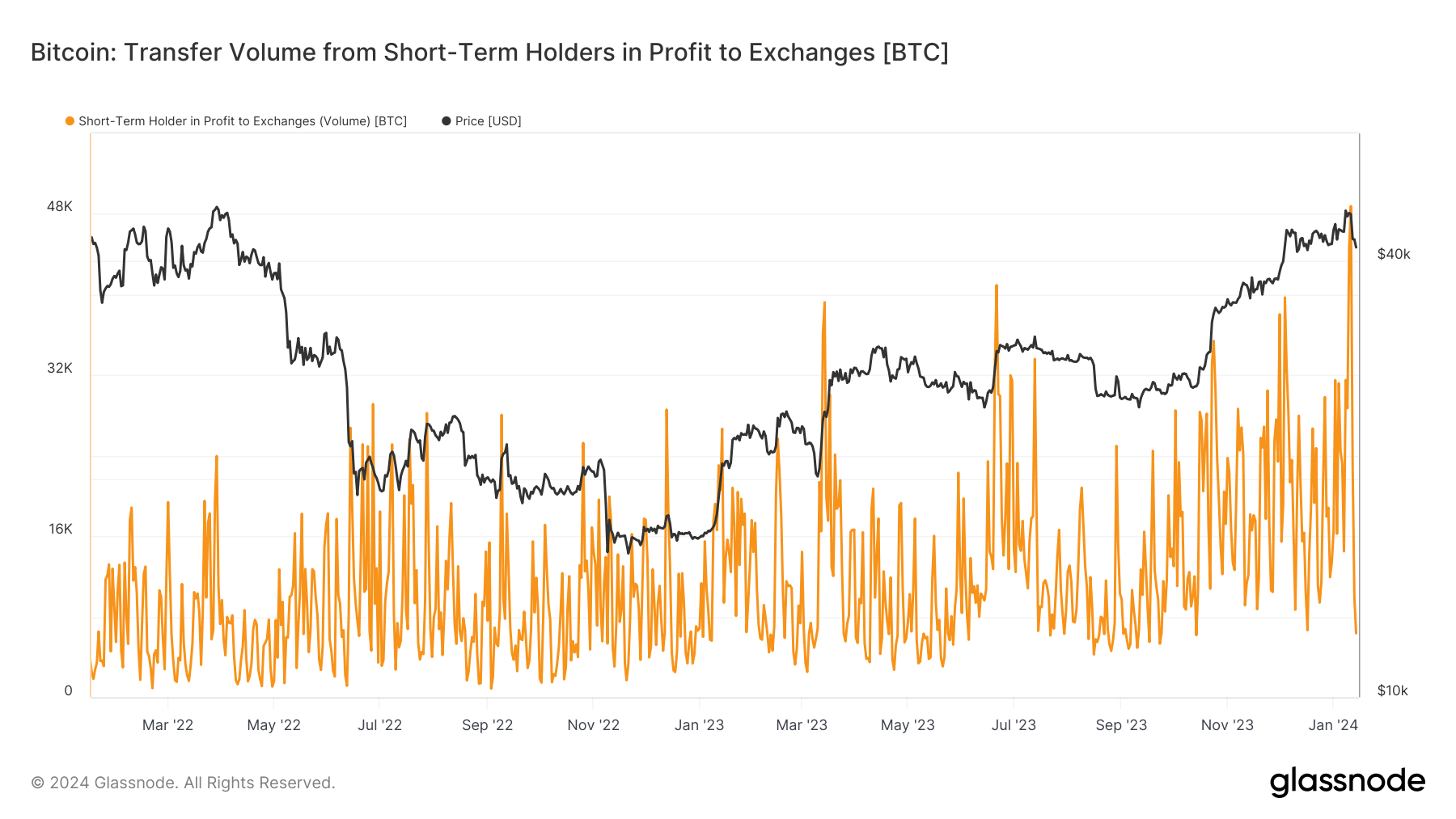

Additional evaluation of short-term holders’ positions in revenue and loss reveals the extent of profit-taking through the volatility. On Jan. 11, the amount of Bitcoin held by short-term holders in revenue despatched to exchanges reached its peak.

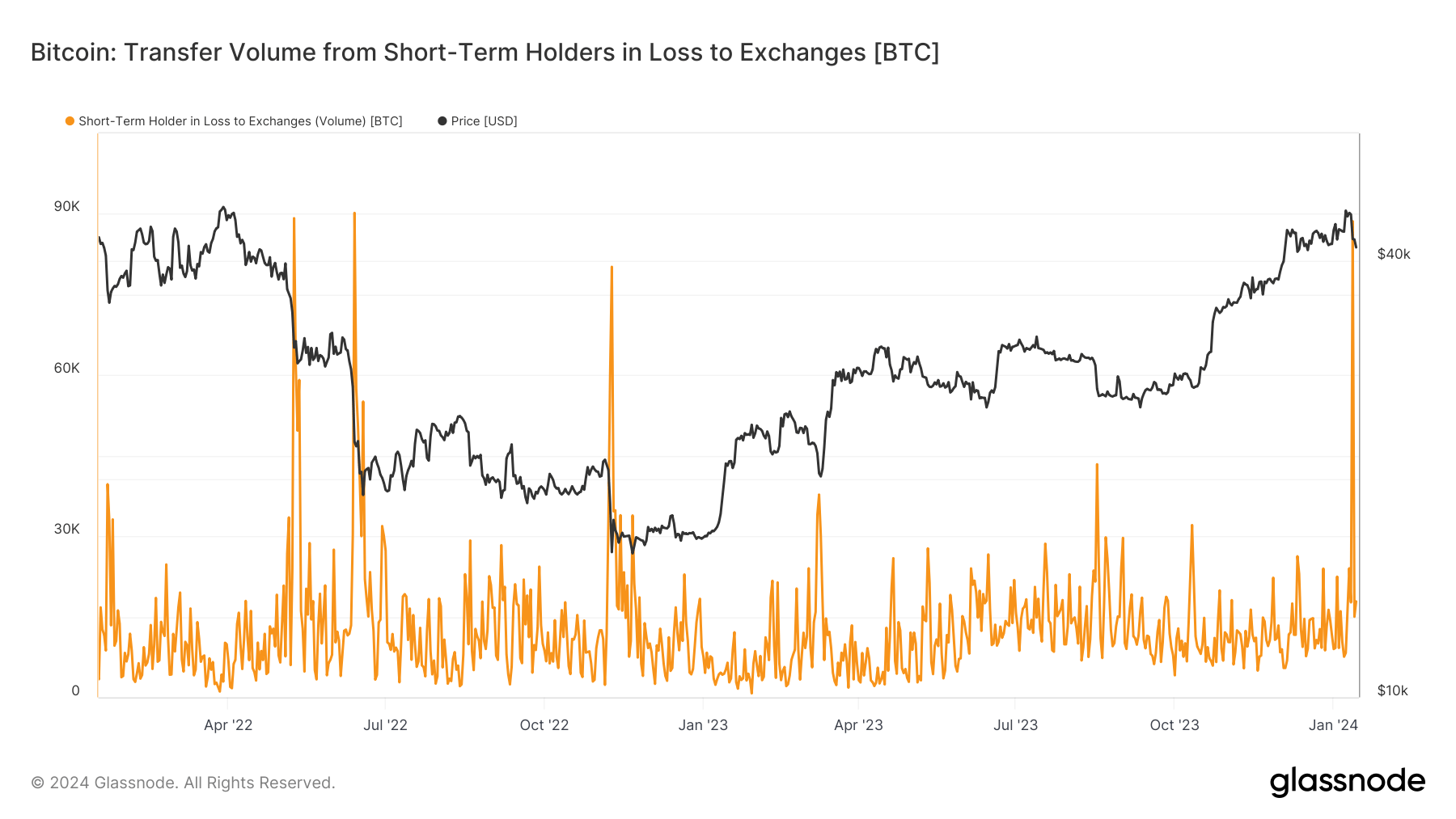

Conversely, the next day noticed a peak in Bitcoin held by short-term holders in loss being transferred to exchanges. These actions counsel a fast shift in market sentiment — from taking income to slicing losses — as the value began to fall.

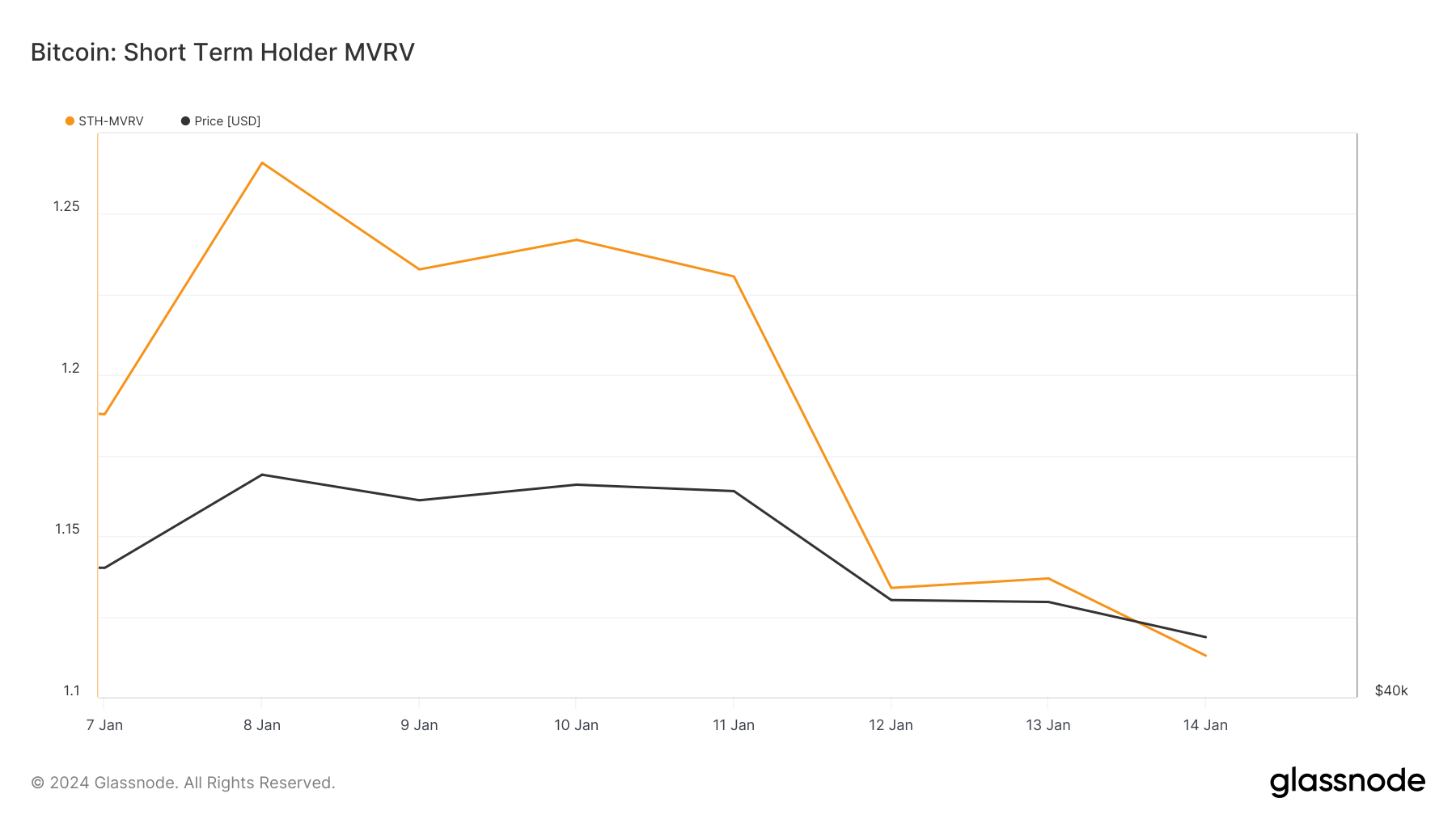

The Market Worth to Realized Worth (MVRV) ratio helps us perceive the profitability of those short-term holdings. MVRV compares the market worth (the value at which BTC final moved) with the realized worth (when BTC was final purchased).

Usually, a excessive MVRV ratio means that holders are in revenue and could also be inclined to promote, whereas a decrease MVRV signifies minimal revenue or losses. Throughout this era, the MVRV ratio noticed a downward pattern, reflecting a lower within the profitability of short-term holdings, probably contributing to the promoting strain noticed available in the market.

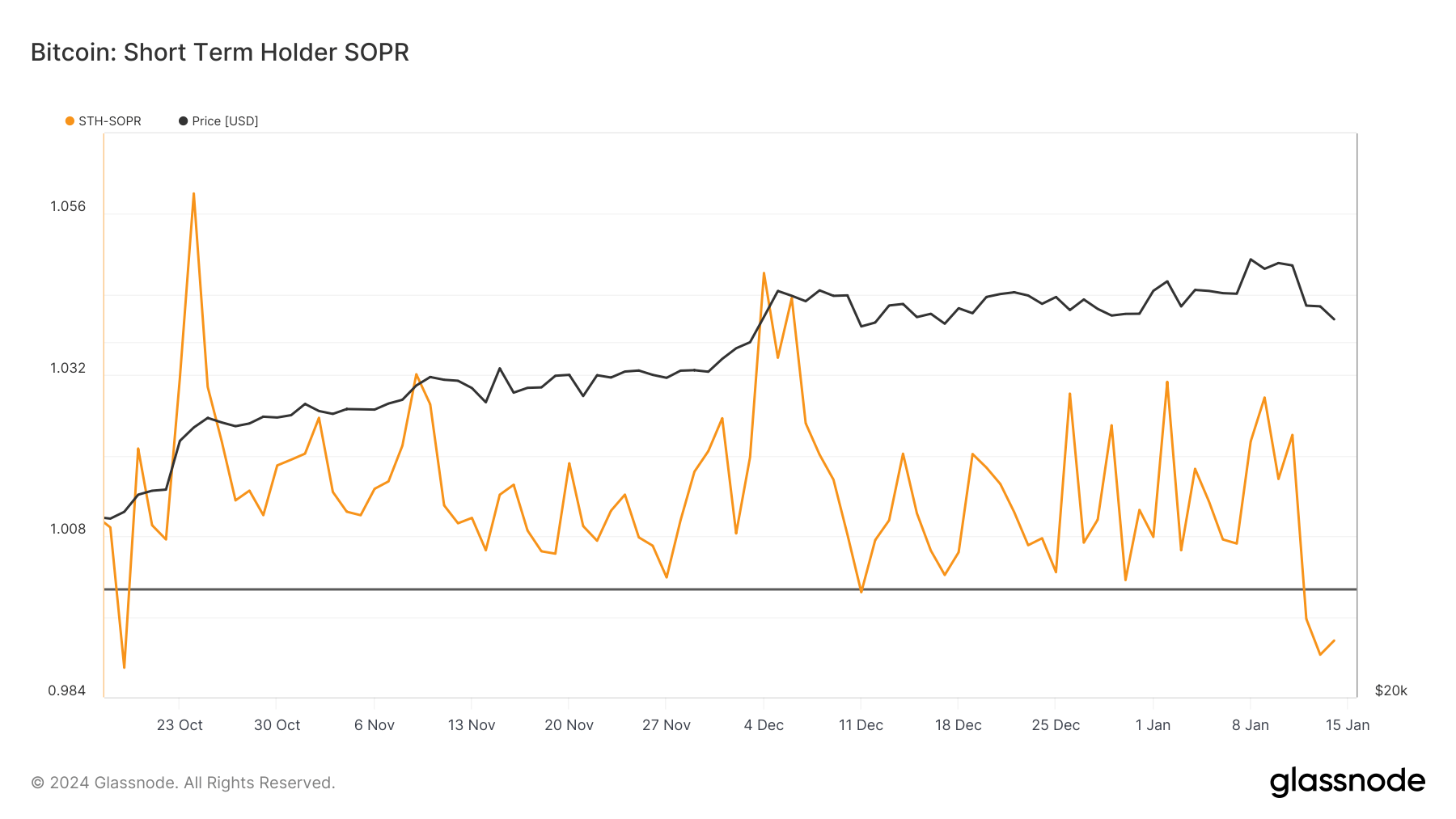

One other pivotal on-chain metric is the Spent Output Revenue Ratio (SOPR), which assesses the revenue ratio of spent outputs. When the SOPR is above 1, it implies that cash are being offered at a revenue. In distinction, a SOPR beneath 1 signifies that cash are offered at a loss.

Notably, the short-term holders’ SOPR fell beneath 1 on Jan. 12 and 13. That is important because it alerts a change in market sentiment, with holders possible promoting Bitcoin at a loss in response to the declining costs.

The short-term knowledge surrounding the SEC’s approval of the primary spot Bitcoin ETFs reveals a Bitcoin market that’s extremely reactive to regulatory developments. The preliminary optimistic anticipation of the approval shortly shifted to panic, characterised by the substantial sell-off from short-term holders.

This conduct is mirrored within the important quantity of Bitcoin moved to exchanges, particularly on Jan. 12, and the declining MVRV ratio. The drop within the SOPR beneath 1 reveals how shortly and aggressively short-term holders react to market volatility.

The submit Brief-term holders drive Bitcoin’s post-ETF volatility appeared first on StarCrypto.