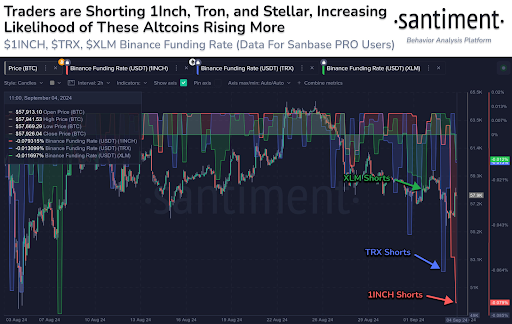

- Traders are massively shorting 1INCH, TRX, and XLM.

- These tokens would possibly skyrocket as soon as the shorts are liquidated.

- Up to now seven days, 1INCH has outperformed TRX and XLM.

Learn additionally: Altcoin Market Primed for September Breakout, Says Analyst

Blockchain evaluation platform Santiment has pointed to traders who’ve shorted towards 1Inch (1INCH), Tron (TRX), and Stellar (XLM), suggesting these altcoins might see a major worth soar as soon as liquidations start, ought to their valuations rise towards these bets.

Via a publish on X (previously Twitter), Santiment defined how, opposite to the traders’ quick positions, their costs will rise as soon as liquidations begin. The blockchain analytics agency added:

“After we see heavy bets towards an asset, liquidations can happen which act as “rocket gasoline” for the asset’s worth to rise increased. Going towards the gang of doubters might pay dividends.”

A liquidation occasion is triggered as soon as the worth of an asset begins to maneuver, not within the favor of the traders who’ve longed or shorted their belongings. In such a situation, the quantity liquidated boosts the worth of the asset additional which could possibly be bullish, in case shorts get liquidated, or bearish, in case longs get liquidated.

Value Evaluation of XLM, 1INCH, and TRX

Learn additionally: 4 Altcoins Shaking Off the Hunch: Bullish Reversals in Sight?

XLM, 1INCH, and TRX are anticipated to turn out to be risky as soon as the liquidation of shorts begins. In response to the info from CoinMarketCap, Tron (TRX), the ninth-largest altcoin by market capitalization, has dropped 0.5% previously 24 hours, and is buying and selling at $0.1497. TRX is down 5.94% previously 7 seven days however has jumped a whopping 24.58% within the final 30 days.

Additional, XLM is up 1,38% and is buying and selling at $0.09142 with a market cap of $2.6 billion. The altcoin’s worth is down 2.23% previously week however up 11.90% previously month. Nevertheless, since September 2023, XLM is down 27.11%, performing poorly.

Lastly, 1INCH is up 7.17% previously 24 hours and has risen 3.96% previously seven days. In the meantime, previously 30 days, the altcoin rose 7.33%. Since September 2023, the cryptocurrency is up 9.06% and at present has a market cap of $326 million.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.