- MANA, GRT, and AAVE accrued important quick positions, probably setting the stage for additional worth features.

- Funding charge information reveals that the majority merchants are betting towards these belongings.

- Aave elevated by 12.5% over the previous week, with a 55% progress over 30 days.

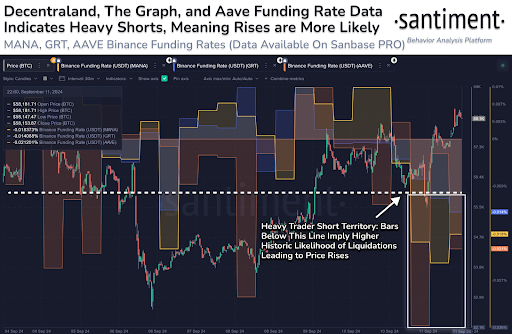

Because the restoration rally within the cryptocurrency markets lingers, consideration is drawn to Decentraland (MANA), The Graph (GRT), and Aave (AAVE). Information from Santiment reveals important quick positions on Binance for these three prime 100 belongings, probably setting the stage for worth spikes pushed by quick liquidations.

Funding charge information reveals that almost all of merchants are betting towards these belongings, pushing them into what Santiment identifies as “Heavy Dealer Brief Territory.”

Why Excessive Brief Positions Might Result in Additional Features

At the moment, MANA, GRT, and AAVE are seeing destructive funding charges of 0.0184%, 0.0141%, and 0.0212%. Damaging funding charges point out that these holding quick positions are paying charges to take care of their stance, suggesting a bearish sentiment.

Nonetheless, this units the scene for a potential quick squeeze—a state of affairs the place rising costs drive quick sellers to purchase again their positions, additional driving costs up.

Traditionally, when belongings accumulate such a big quick ratio, any optimistic worth motion can set off a cascade of purchase orders from liquidations, propelling costs upward. This dynamic may result in important features in MANA, GRT, and AAVE if the market restoration continues or experiences sudden upward momentum.

Over the past 24 hours, MANA’s worth has risen by 3.3%, buying and selling at $0.2714. The asset additionally reveals a optimistic development over the previous week. GRT has skilled related share progress in the identical timeframe.

Then again, AAVE has seen extra explosive efficiency in latest instances. Buying and selling at $149.64, AAVE has expanded by a considerable 12.5% over the previous week. Zooming out to the 30-day timeframe, AAVE has grown by over 55%, whereas many different crypto belongings, together with MANA and GRT, put up destructive progress.

Primarily, merchants betting towards the upward traits of those altcoins appear unconvinced about their sustainability. Nonetheless, historic information suggests their actions may, in truth, be paving the best way for additional worth will increase.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.