- Analysis analyst Tom Wan just lately highlighted that BRC-20 tokens account for 45% of the entire Ordinal buying and selling quantity.

- The analyst’s submit comes after buying and selling quantity for Ordinals surpassed that of Solana-based NFTs.

- In associated information, each BTC and ETH printed good points previously 24 hours.

In a latest tweet, a analysis analyst by the identify of Tom Wan shared some insights referring to BRC-20 tokens and BTC Ordinals. In line with the submit, 45% of the ordinal buying and selling quantity is attributed to BRC-20 tokens, whereas Ordinals (ORDI) account for 22.1%.

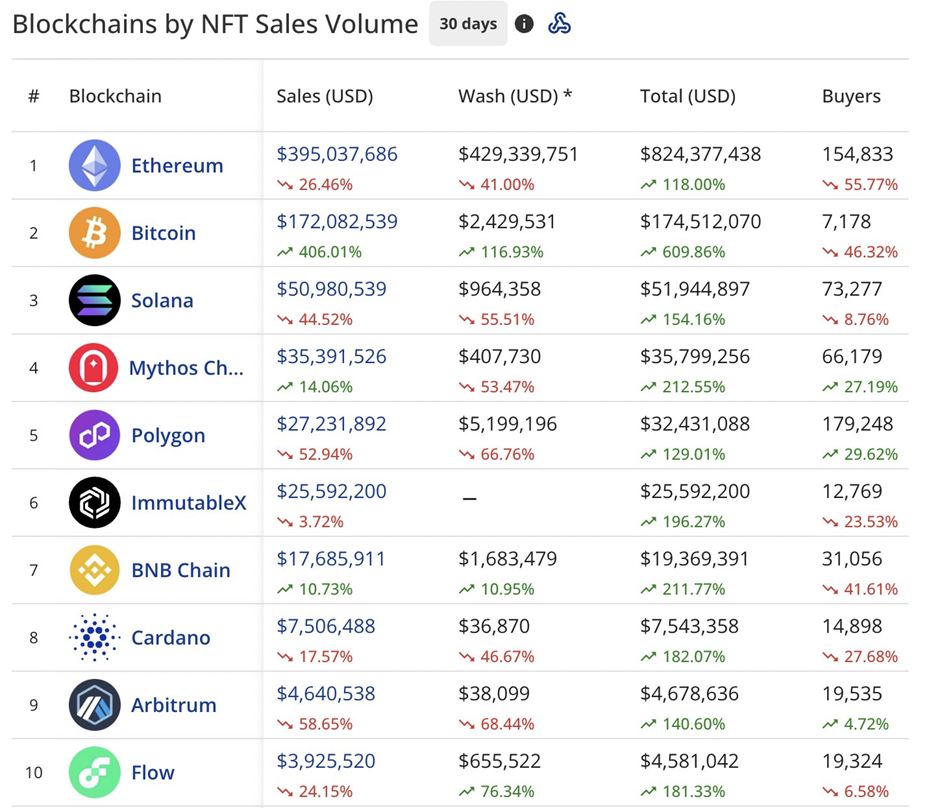

In consequence, the analyst raised a thought-provoking query about whether or not all Ordinals needs to be thought-about as NFT quantity or if it needs to be restricted to the Picture Inscribed Ordinals. This follows the information of the buying and selling quantity for Bitcoin (BTC) Ordinals surpassing that of Solana-based NFTS — rating their buying and selling quantity second beneath Ethereum-hosted NFTs.

Over the previous 30 days, the entire buying and selling quantity for BTC Ordinals reached $172,082,539, which is a 406.01% improve. Throughout this time, the buying and selling quantity for ETH NFTs dropped by 26.46% to $395,037,686.

At press time, CoinMarketCap indicated that each BTC and Ethereum (ETH) skilled worth will increase over the previous 24 hours. BTC was altering palms at $26,418.97 after it printed a 24-hour acquire of 0.52%. In the meantime, ETH’s worth stood at $1,809.58 after it climbed 1.39% within the final day.

The market chief was in a position to attain a every day excessive of $26,591.52, however has since retraced. Its 24-hour low stood at $26,121.83. Much like BTC, ETH has additionally dropped from its every day excessive at $1,815.99, with its 24-hour low sitting at $1,777.93.

Each of the cryptos skilled drops of their every day buying and selling quantity. At press time, ETH’s buying and selling quantity stood at $5,414,599,653, a 22.47% lower. BTC’s buying and selling quantity had dropped 20.71% and stood at $12,676,643,115.

Disclaimer: The views and opinions, in addition to all the data shared on this worth evaluation, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held answerable for any direct or oblique injury or loss.