- BONK (BONK) faces an 8% drop in 24 hours, testing help at $0.00001103 amid growing promoting stress.

- BONK’s market cap and buying and selling quantity dropped by 7.34% and 14.55%, signalling waning investor confidence.

- Technical indicators like MACD, RSI, and Aroon counsel a bearish development for BONK/USD within the brief time period.

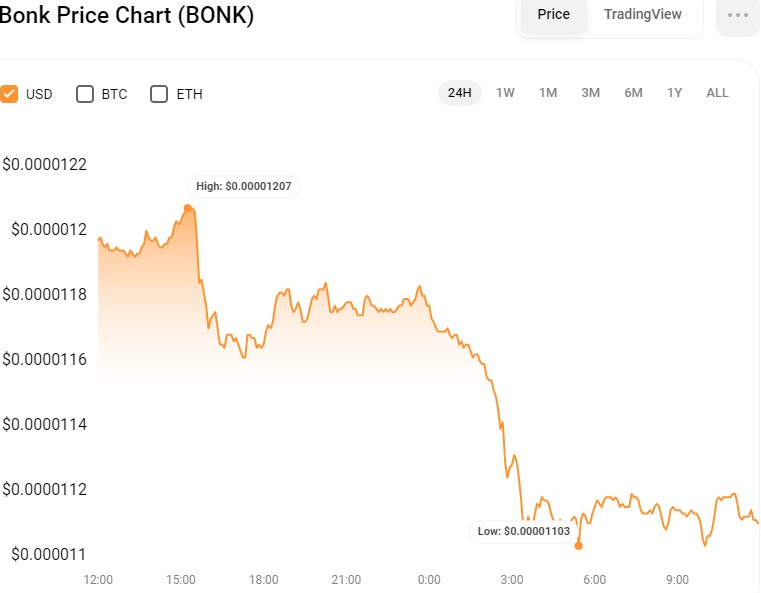

Bonk (BONK) has been in a bearish rally over the past 24 hours, dropping from an intra-day excessive of $0.00001207 to a low of $0.00001103, the place help was reached. This worth drop is probably going attributable to growing promoting stress and profit-taking by merchants.

Regardless of the destructive development, the help stage exhibits there should still be some shopping for exercise at this worth level, given BONK’s 0.83% improve within the earlier week. At press time, BONK was buying and selling at $0.00001109, down 8.23% from its 24-hour excessive.

If this bearish development continues, it might doubtlessly check the subsequent help stage at $0.00001050. Nevertheless, if shopping for stress will increase and the help stage holds, BONK could have an opportunity to get better and retest its earlier excessive.

In the course of the stoop, the BONK market capitalization and 24-hour buying and selling quantity fell by 7.34% and 14.55% to $701,864,960 and $79,045,175, respectively. This decline in market capitalization and buying and selling quantity signifies a decline in investor confidence and exercise within the BONK market.

BONK/USD Technical Evaluation

On the BONKUSD 4-hour worth chart, the Transferring Common Convergence Divergence (MACD) has dropped under its sign line, with a score of -0.000000087. This MACD development depicts a destructive sample for BONKUSD within the brief time period. Moreover, the histogram has turned destructive, confirming the bearish temper and indicating further draw back potential for BONKUSD.

Supporting the bearish rally, the Relative Power Index (RSI) dips under its sign line, with a score of 37.41. This RSI studying implies that BONKUSD is nearing the oversold area, indicating that the value could fall decrease. If the RSI goes under 30, it could verify the destructive development and may result in additional promoting stress.

Moreover, the Aroon up (orange) has shifted under the Aroon down (blue), with the previous and latter touching at 50% and 100%, respectively. This exhibits that momentum has shifted from bullish to bearish, with the Aroon up line representing upward worth motion and the Aroon down line representing downward worth motion. The convergence of those traces signifies that promoting stress is rising, which could ship BONKUSD additional down.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.