The NFT market skilled a big shock previously three days, with over 1,200 NFTs being liquidated attributable to a record-low plunge within the flooring value of a number of distinguished or ‘blue-chip’ NFTs

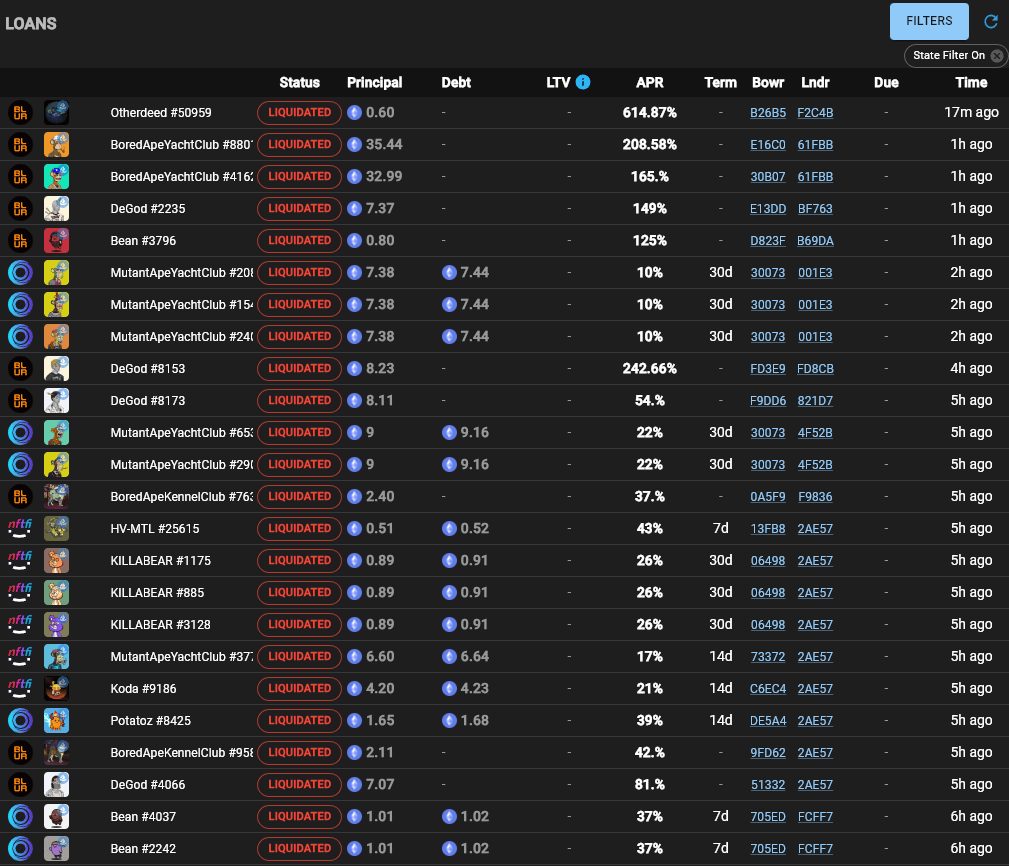

Knowledge from the NFT evaluation web site, Snow Genesis, exhibits that a whole bunch of NFTs used as collateral for loans are vulnerable to being liquidated. Whereas a few of these money owed have been repaid, a number of NFTs have already been listed for public sale. The desk under exhibits the latest NFT liquidations from Snow Genesis as of press time.

CirrusNFT, Wumbo Labs, famous that a number of traders who took loans on their blue chips NFT, together with Azuki, CloneX, MAYC, and BAYC, have been impacted in the course of the interval. Beanz NFT assortment noticed probably the most liquidation as 636 of its NFTs—3% of its complete provide— have been affected.

Cirrus mentioned the tempo of those liquidations was alarming, highlighting the each day common for final 12 months to be between 10-15 NFTs. Nonetheless, He added:

“Excellent news is that the speed of liquidations has slowed drastically over the previous couple of hours and there aren’t a loopy quantity of underwater loans left.”

NFTs flooring value tank

Over the previous week, the ground value of a number of NFT collections massively plunged regardless of the upward value motion throughout the broader crypto market.

Bored Ape NFTs flooring value crashed under 30 ETH on July 2, its lowest worth since October 2021, earlier than recovering to its present value of 31.5 ETH, based on Coingecko knowledge.

At its peak, Bored Ape NFTs offered for over 500 ETH, with a number of A-list celebrities, together with Justin Bieber spending over $1 million on one of many collections.

Azuki additionally recorded substantial losses for its holders following the shoddy launch of its Elementals assortment. The ground value of the gathering fell by greater than 20%, with its group members proposing to sue its founder Zagabond for 20,000 ETH.

In the meantime, different blue-chip NFT collections like DeGods, Pudgy Pegions, Azuki Elementals, and BAKC, Moonbirds additionally took vital hits to their worth in the course of the reporting interval.

The put up Blue-chip NFTs hit laborious as over 1,200 liquidations rock market appeared first on starcrypto.