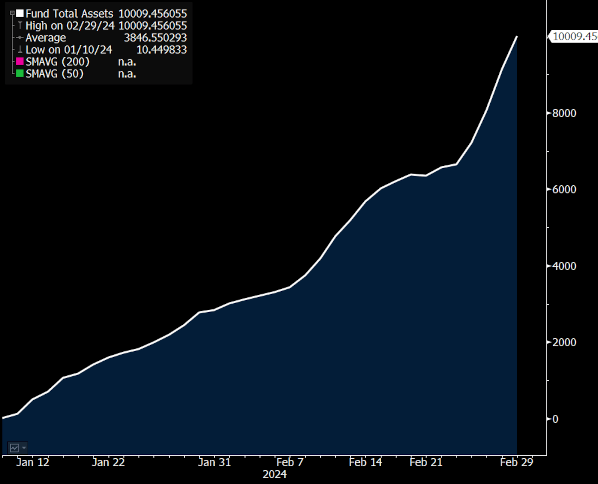

BlackRock’s iShares Bitcoin Belief (IBIT) now has greater than $10 billion in property underneath administration (AUM), based on knowledge from CoinGlass.

Bloomberg ETF analyst Eric Balchunas famous that IBIT is one in every of simply 152 exchange-traded funds (ETFs) which have reached the $10 billion mark. At the moment, roughly 3,400 ETFs exist in complete.

He noticed that IBIT is the quickest to achieve $10 billion in AUM. The fund started buying and selling lower than two months in the past on Jan. 11, that means that it reached its present stage in lower than two months. ETF.com individually famous that the primary gold ETF didn’t attain $10 billion in AUM for 2 years.

The competing Grayscale Bitcoin Belief (GBTC) experiences a bigger AUM, with $27 billion in property underneath administration. Nevertheless, GBTC originated as an funding fund in 2013 earlier than it was transformed to an ETF this yr, and in contrast to BlackRock’s IBIT, it didn’t begin with zero property.

The third largest spot Bitcoin ETF, the Constancy Sensible Origin Bitcoin Fund (FBTC), now holds $6.5 billion in property underneath administration. All ten current spot Bitcoin ETFs have $48.2 billion in AUM mixed.

Causes for IBIT’s progress

Balchunas implied that IBIT’s rising AUM is because of inflows. He recommended that ETFs sometimes wrestle to realize the primary $10 billion in AUM as a result of that worth should originate from inflows, whereas the second $10 billion is simpler to realize due to market appreciation.

IBIT surpassed the $10 billion mark on March 1. Round that point, the ETF reported $7.7 billion in inflows since launch, together with $603 million in inflows on Feb. 29. In accordance with Balchunas, this makes IBIT the ETF with the third-longest run of inflows.

Rising Bitcoin costs could also be an extra contributor to IBIT’s progress. As of March 4, Bitcoin is value $67,200. Its value is up 25.3% over the previous week and up 51.0% over two months.

Moreover, sure monetary establishments, together with Financial institution of America’s Merrill Lynch and Wells Fargo, have reportedly begun to supply entry to BlackRock’s Bitcoin ETF and competing exchange-traded funds. This growth might have contributed to current progress.