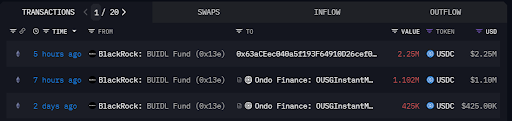

- BlackRock’s BUIDL Fund moved $3.35 million in USDC to a number of addresses.

- Ondo Finance obtained a notable 1.102M USDC switch.

- Injective launched a tokenized index for the BUIDL Fund, providing on-chain entry to U.S. Treasuries with leverage.

BlackRock’s BUIDL Fund continued its rising involvement within the cryptocurrency area, most lately transferring $3.35 million USDC to a number of addresses, together with Ondo Finance, as reported by Arkham information. This transfer builds on BlackRock’s rising exercise in decentralized finance (DeFi), notably its push into real-world asset (RWA) tokenization earlier this yr.

The BUIDL Fund’s latest transactions embody a $1.102 million USDC switch to Ondo Finance, a platform specializing in tokenized monetary companies. Quickly after, one other $2.25 million USDC went to a newly recognized deal with.

These transfers are the newest in a collection of great fund actions over the previous few weeks, indicating BlackRock’s rising dedication to DeFi.

Strategic Positioning and Tokenized Finance

Whereas the precise function of those transfers isn’t but public, they level to BlackRock’s strategic positioning inside the decentralized finance ecosystem. Ondo Finance has turn out to be a notable recipient of the fund’s transfers, highlighting its rising significance within the tokenized finance sector.

Including to those developments, Injective has rolled out a tokenized index for the BUIDL Fund, furthering BlackRock’s DeFi ambitions. This new product permits customers to entry U.S. Treasuries with leverage instantly on-chain and strengthens BlackRock’s position in connecting conventional finance and DeFi.

Past its USDC transfers, BlackRock’s foray into cryptocurrency continues to attract consideration, significantly with its spot Bitcoin ETF. Studies confirmed that the ETF has obtained a big allocation of BTC from Coinbase Prime.

BlackRock has additionally up to date its custodial settlement with Coinbase, including a 12-hour withdrawal window for its Bitcoin ETF. This transformation goals to streamline transaction processing for cryptocurrency ETFs.

Furthermore, BlackRock runs its personal blockchain node to validate its BTC balances, offering transparency for its purchasers. This permits BlackRock to verify day by day that the Bitcoin held in its ETF is actual and never merely “paper BTC.”

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.