Bitcoin’s current value struggles offered buyers with “shopping for alternatives,” ensuing within the influx of $441 million into crypto-related funding merchandise, in response to CoinShares‘ newest report.

James Butterfill, the top of analysis at CoinShares, defined that digital belongings skilled heavy volatility final week because of promoting pressures from the German authorities and information of defunct Mt. Gox’s repayments.

These elements prompted Bitcoin’s value to drop considerably, hitting a five-month low beneath $55,000. It additionally recorded some of the vital market liquidations for the reason that FTX collapse in 2022.

Butterfill identified that the “value weak spot” offered a “shopping for alternative” for buyers seeking to acquire publicity to the rising business.

This influx marks a turnaround after three consecutive weeks of outflows. Nonetheless, Change-Traded Product (ETP) volumes remained low at $7.9 billion.

Butterfill added:

“Volumes in Change Traded Merchandise (ETPs) remained comparatively low at $7.9 billion for the week, reflecting the standard seasonal sample of decrease volumes in the summertime months. This represents a 17% decrease participation fee in comparison with the full marketplace for trusted exchanges.”

Buyers unfold tentacles

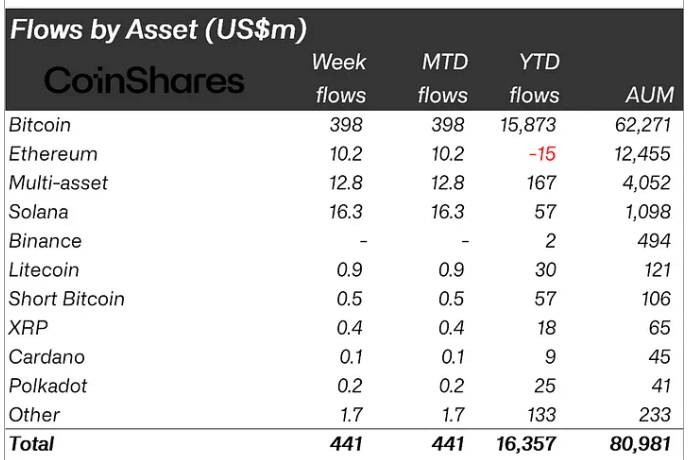

CoinShares famous that buyers have been prepared to unfold their funds throughout completely different digital belongings, which diminished Bitcoin’s traditional dominance to 90% of the full inflows. In line with the agency, the flagship digital asset noticed inflows totaling $398 million, bringing its year-to-date circulate to $15.8 billion.

In the meantime, prime altcoins like Solana additionally noticed vital inflows, reflecting buyers’ diversification methods. Final week, funding merchandise associated to Solana obtained $16 million in inflows, bringing their year-to-date flows to $57 million.

Equally, Ethereum noticed a constructive shift with $10 million in inflows. Nonetheless, it stays the one ETP with a internet outflow of $15 million year-to-date.

Different altcoins, resembling Polkadot, XRP, Litecoin, and Cardano, noticed cumulative inflows of greater than $1 million.