Since June 22, Bitcoin has been buying and selling above the essential psychological stage of $30,000. This value rally is a results of elevated demand for the digital asset, a requirement that’s additional exacerbated by the low availability of Bitcoin on exchanges.

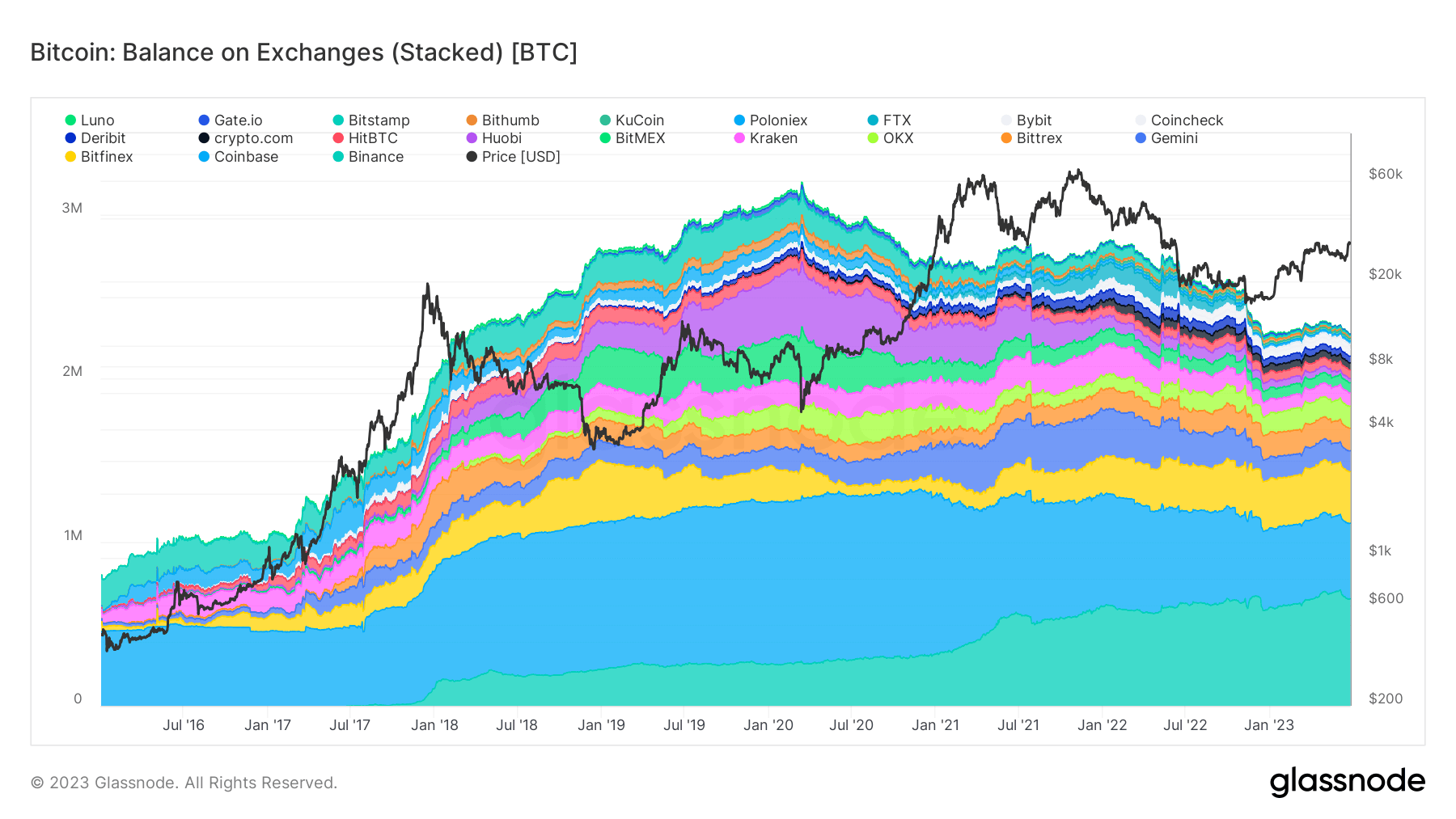

One key metric that underscores this pattern is the proportion of Bitcoin’s provide held on exchanges. Knowledge from Glassnode measures the entire quantity of cash held on trade addresses and calculates the proportion of the provision on exchanges.

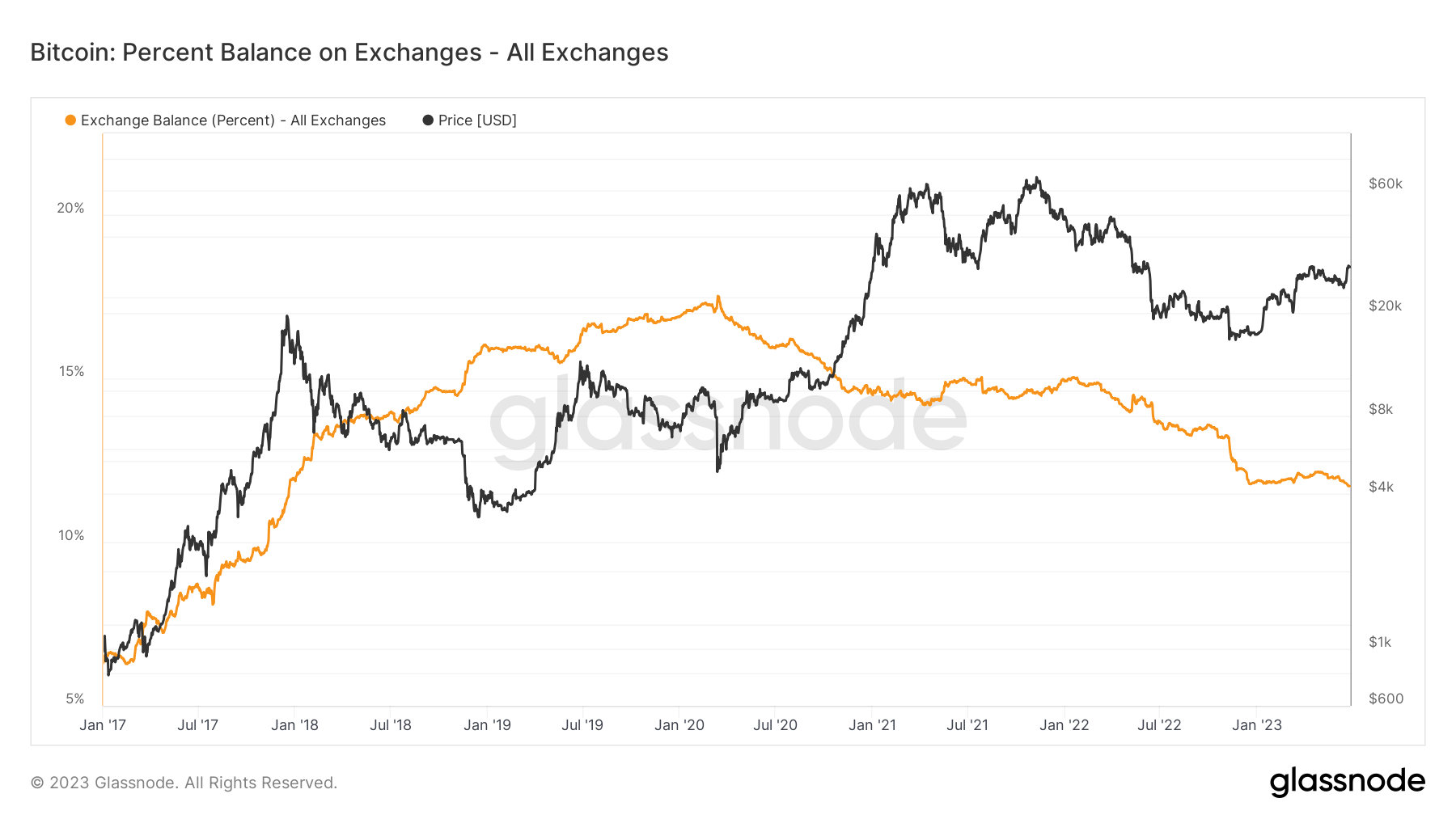

When a considerable amount of Bitcoin is held on exchanges, it typically signifies that traders are able to promote their holdings, suggesting a bearish sentiment. Conversely, a lower within the quantity of Bitcoin on exchanges can indicate that traders are shifting their property to non-public wallets for long-term holding, signaling a bullish sentiment.

Furthermore, the quantity of Bitcoin on exchanges instantly impacts market liquidity. Excessive liquidity signifies that there are numerous market individuals, and patrons will shortly take in any giant promote orders. Nevertheless, if the quantity of Bitcoin on exchanges decreases considerably, it might result in decrease liquidity. Which means giant promote orders might drastically have an effect on the market value, resulting in elevated volatility.

Subsequently, monitoring the quantity of Bitcoin held on exchanges can present worthwhile insights into potential market actions and investor sentiment.

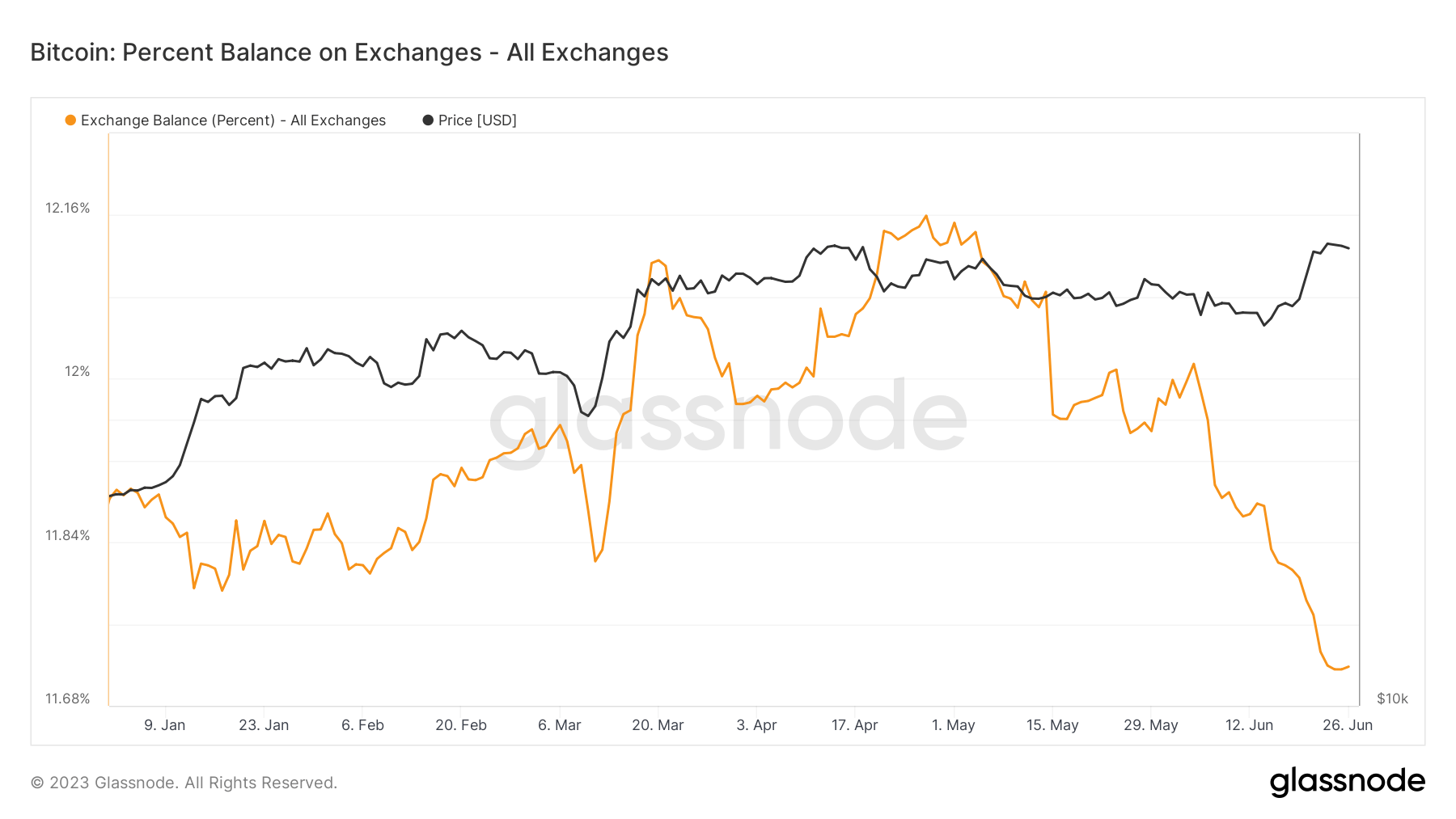

The share of Bitcoin’s provide held on exchanges has been on a downward trajectory for the reason that finish of April when it reached its year-to-date (YTD) excessive of 12.16%.

Nevertheless, a broader perspective reveals that the quantity of Bitcoin held on exchanges has been in decline since March 2020, when it reached an all-time excessive of 17.51%.

The share of Bitcoin’s provide held on exchanges has now dropped to a five-and-a-half-year low of 11.71%, reaching ranges final recorded in December 2017. This pattern signifies a shift in investor conduct, with extra holders opting to retailer their Bitcoin off exchanges, presumably in anticipation of future value appreciation.

The publish Bitcoin’s trade stability drops to 5-year low as value hits $30K appeared first on StarCrypto.