The Bitcoin mining business serves as a crucial barometer for market well being and route. Among the many varied instruments employed to research this very important sector, hash ribbons stand out for his or her nuanced insights into the state of Bitcoin miners.

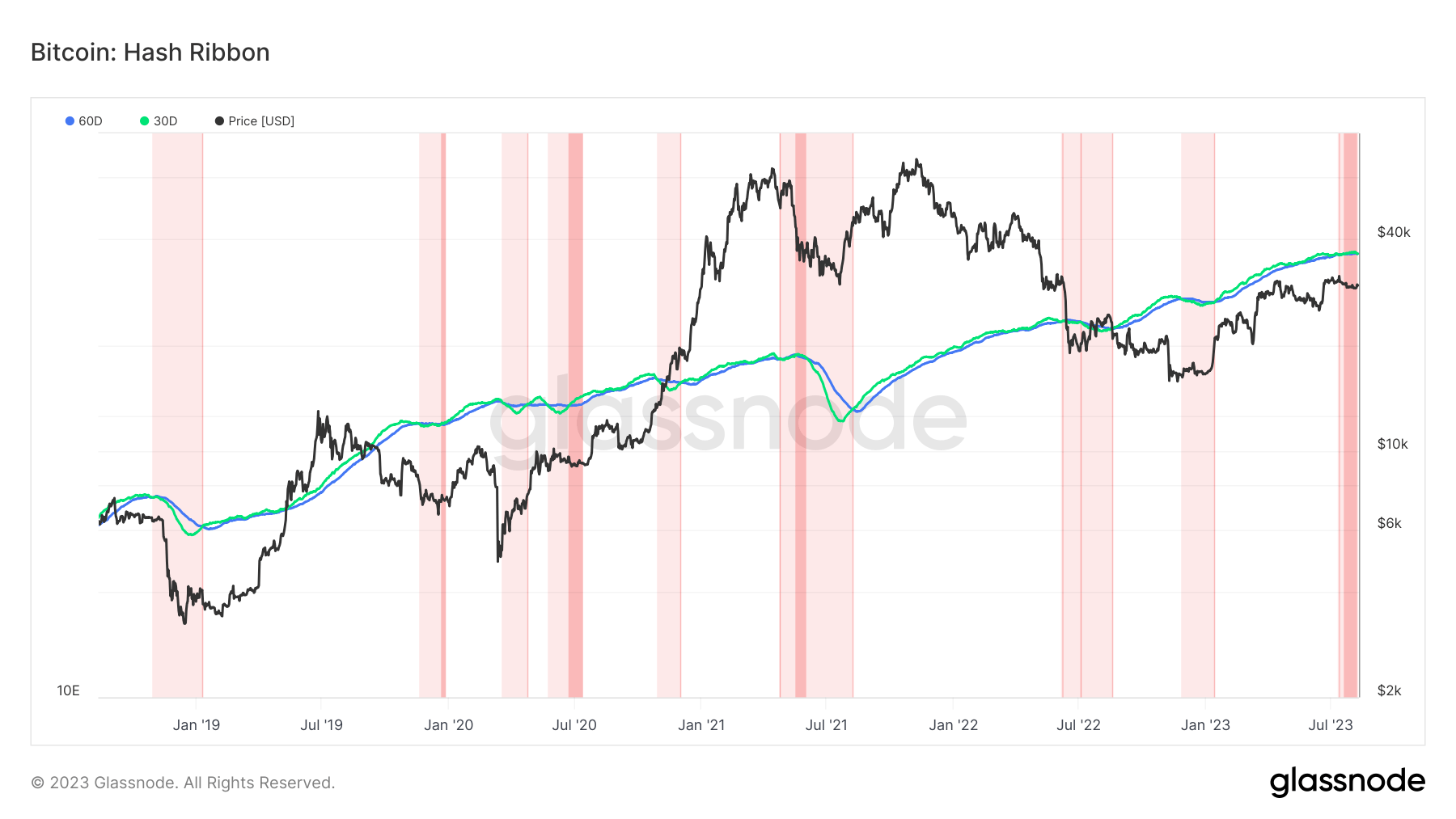

Hash Ribbons are a technical indicator that compares two shifting averages of Bitcoin’s hash price: the 30-day easy shifting common (30D-SMA) and the 60-day double shifting common (60D-DMA).

The hash price represents the overall computational energy used to course of and validate transactions on the Bitcoin community. Measured in hashes per second (H/s), it instantly signifies the community’s safety and the miners’ exercise.

Analyzing Bitcoin hash price

Monitoring the 30-day easy shifting common (30D-SMA) and the 60-day double shifting common (60D-DMA) of the hash price supplies insights into short-term and long-term developments in mining exercise.

The 30D-SMA provides a view of the current mining panorama, reflecting short-term fluctuations, whereas the 60D-DMA smooths out these fluctuations to disclose underlying developments. Collectively, these metrics kind the Hash Ribbons, serving to to establish potential miner capitulation or restoration.

When the 30D-SMA falls under the 60D-DMA, it alerts a interval of acute miner earnings stress, often known as a detrimental inversion. Conversely, a optimistic inversion happens when the 30D-SMA rises above the 60D-DMA, indicating a restoration interval and elevated profitability for miners.

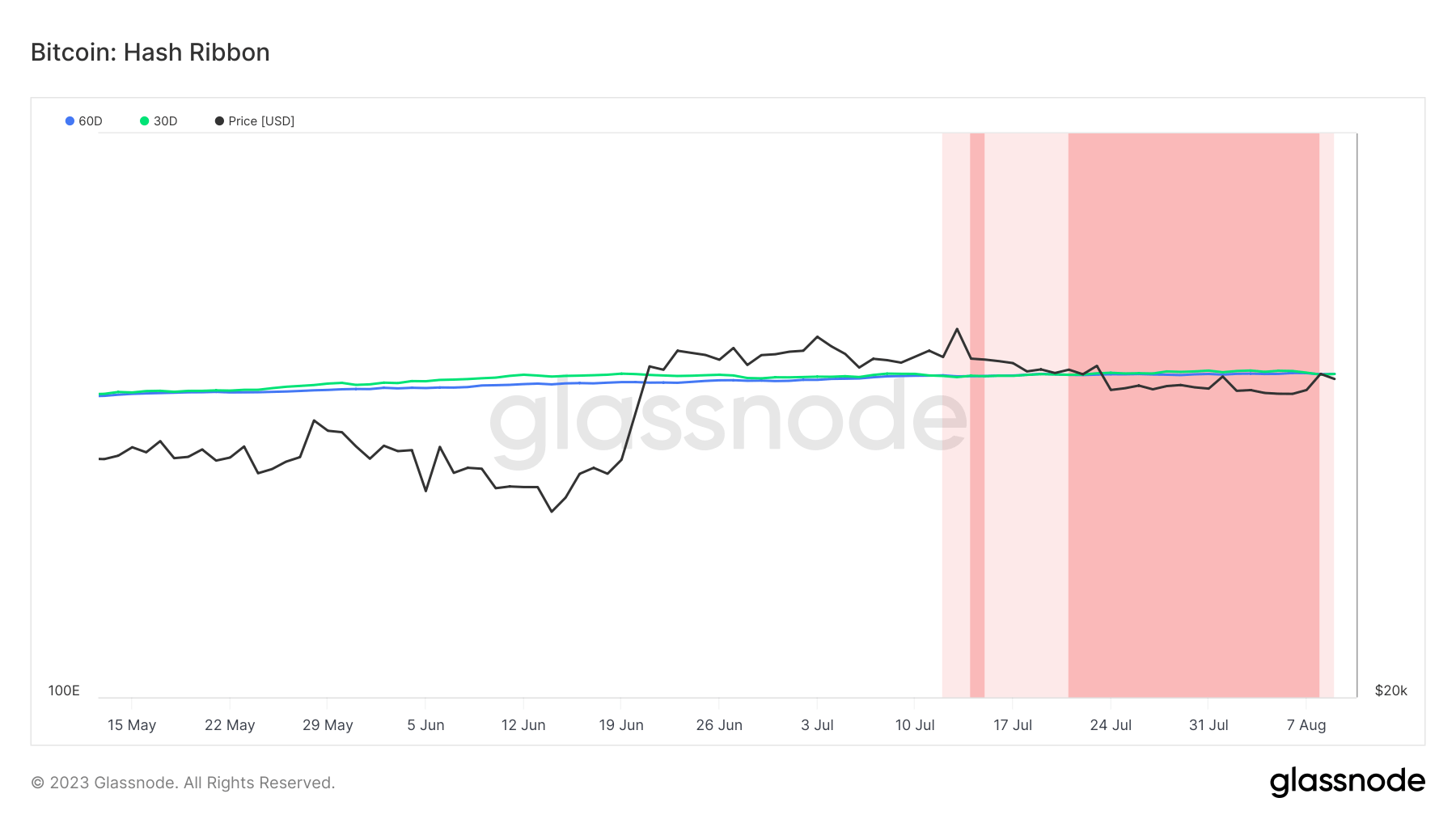

Since July 2023, the hash ribbons have been virtually solely flat, with the 30D-SMA and the 60D-DMA touching and having practically the identical values.

This flat sample signifies a balanced and stagnant section within the Bitcoin mining business. It has mirrored a scarcity of clear route in Bitcoin’s worth, with the cryptocurrency buying and selling between $28,000 and $30,000 in a decent vary.

What it means

The implications of this equilibrium are multifaceted. On the one hand, the steadiness within the mining business suggests a scarcity of serious stress, which might be seen as a optimistic signal for the general well being of the Bitcoin community.

However, the absence of clear momentum in both route displays a market in a state of uncertainty, probably awaiting a catalyst to maneuver.

The present flat sample noticed within the hash ribbons would possibly point out a consolidation section, suggesting that the market is holding. Nevertheless, it’s additionally essential to notice that such patterns could precede a big market breakout or breakdown.

Traditionally, extended intervals of tight buying and selling ranges accompanied by flat hash ribbons typically result in substantial worth actions as soon as a transparent route was established.

The publish Bitcoin’s tight buying and selling vary mirrored by flat hash ribbons alerts impending market motion appeared first on StarCrypto.