The crypto market witnessed a tumultuous 24 hours between Oct. 1 and a couple of, seeing an enormous liquidation spike. Round 85% of those liquidations had been quick positions, translating to $97.73 million in shorts liquidated in only a day. This speedy motion affected 29,510 merchants, bringing the whole liquidation worth to $114.92 million. Essentially the most important single liquidation order was noticed on Huobi with the BTC-USDT pair, valued at $8.39 million.

Main exchanges like OKX, Binance, and Huobi had been on the epicenter of those liquidations. They recorded liquidation values of $36.21M, $33.20M, and $27.79M, respectively. CoinEx, primarily, skilled a notable 97.94% of its liquidations briefly positions. In distinction, different exchanges oscillated between 72% and 96% briefly liquidations.

| Exchanges | Liquidations | Lengthy | Brief | Fee (General) | Fee (Brief) |

|---|---|---|---|---|---|

| All | $114.56M | $17.05M | $97.51M | 100% | 85.12% |

| OKX | $36.21M | $6.52M | $29.68M | 31.61% | 81.99% |

| Binance | $33.20M | $6.10M | $27.11M | 28.98% | 81.64% |

| Huobi | $27.79M | $1.04M | $26.75M | 24.26% | 96.26% |

| Bybit | $10.94M | $2.98M | $7.96M | 9.55% | 72.79% |

| CoinEx | $4.88M | $100.37K | $4.78M | 4.26% | 97.94% |

| Bitmex | $593.91K | $100.82K | $493.10K | 0.52% | 83.02% |

| Bitfinex | $581.34K | $146.79K | $434.56K | 0.51% | 74.75% |

| Deribit | $367.16K | $68.72K | $298.43K | 0.32% | 81.28% |

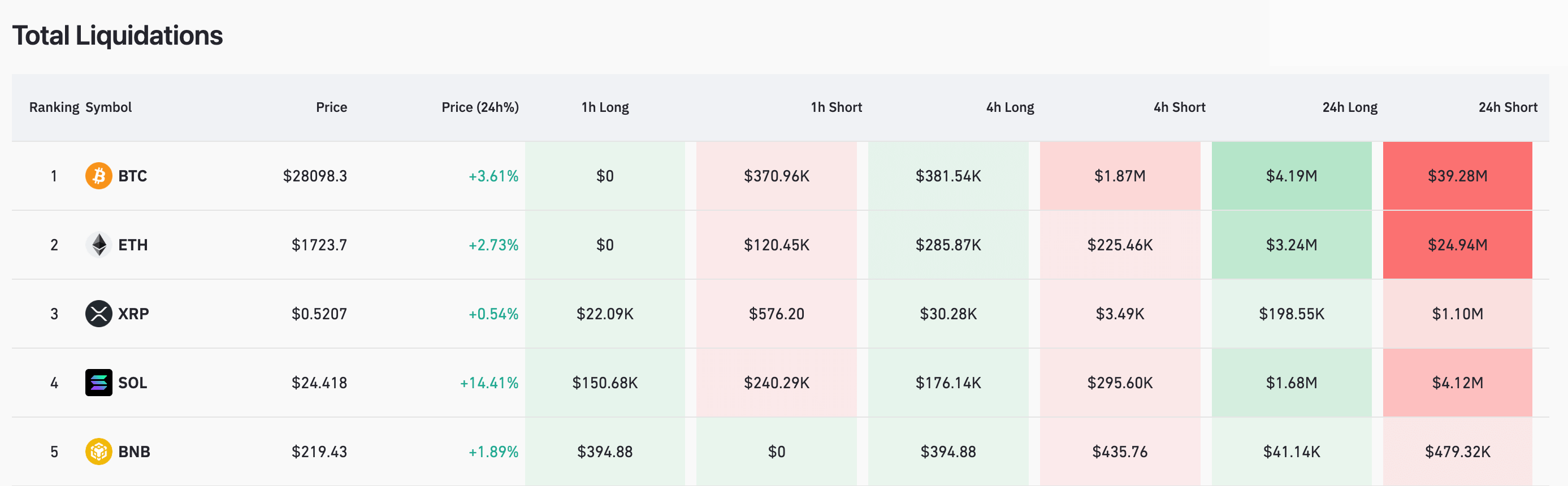

Zooming into particular person cryptocurrencies, Bitcoin was on the forefront of the liquidation charts. Inside a mere 4-hour window, Bitcoin noticed lengthy liquidations amounting to $381.54K and quick liquidations reaching a major $1.87M. Ethereum wasn’t far behind, with its 24-hour shorts touching a excessive of $4.12M.

Liquidations discuss with the obligatory closure of a dealer’s place when market situations transfer towards their hypothesis, eroding the collateral they’ve posted. When buying and selling any asset, together with cryptocurrencies, merchants can undertake two main stances: ‘lengthy’ or ‘quick.’ In a protracted place, merchants are primarily betting on an upward trajectory of an asset’s worth. Conversely, a brief place is taken with the expectation that the asset’s worth will decline.

The mechanics of liquidation come into play when the market’s precise motion contradicts a dealer’s place. For example, if the market worth rises when a dealer has a brief place or drops once they’re lengthy, the place is liquidated to forestall additional losses. This ensures the dealer’s losses don’t exceed their preliminary margin or collateral. The dominance of quick liquidations prior to now 24 hours signifies that many merchants had guess on Bitcoin’s worth descending, solely to be stunned by its climb to $28,000.

The surge in Bitcoin’s worth could be attributed to a number of elements. After consolidating beneath $27,000 for over a month, Bitcoin broke the interim resistance, aiming for the $28,000 mark. The elevated volatility and historic information suggesting bullish traits for Bitcoin in October and November have fueled optimism. The continuing volatility is predicted to stay elevated, doubtlessly growing the value.

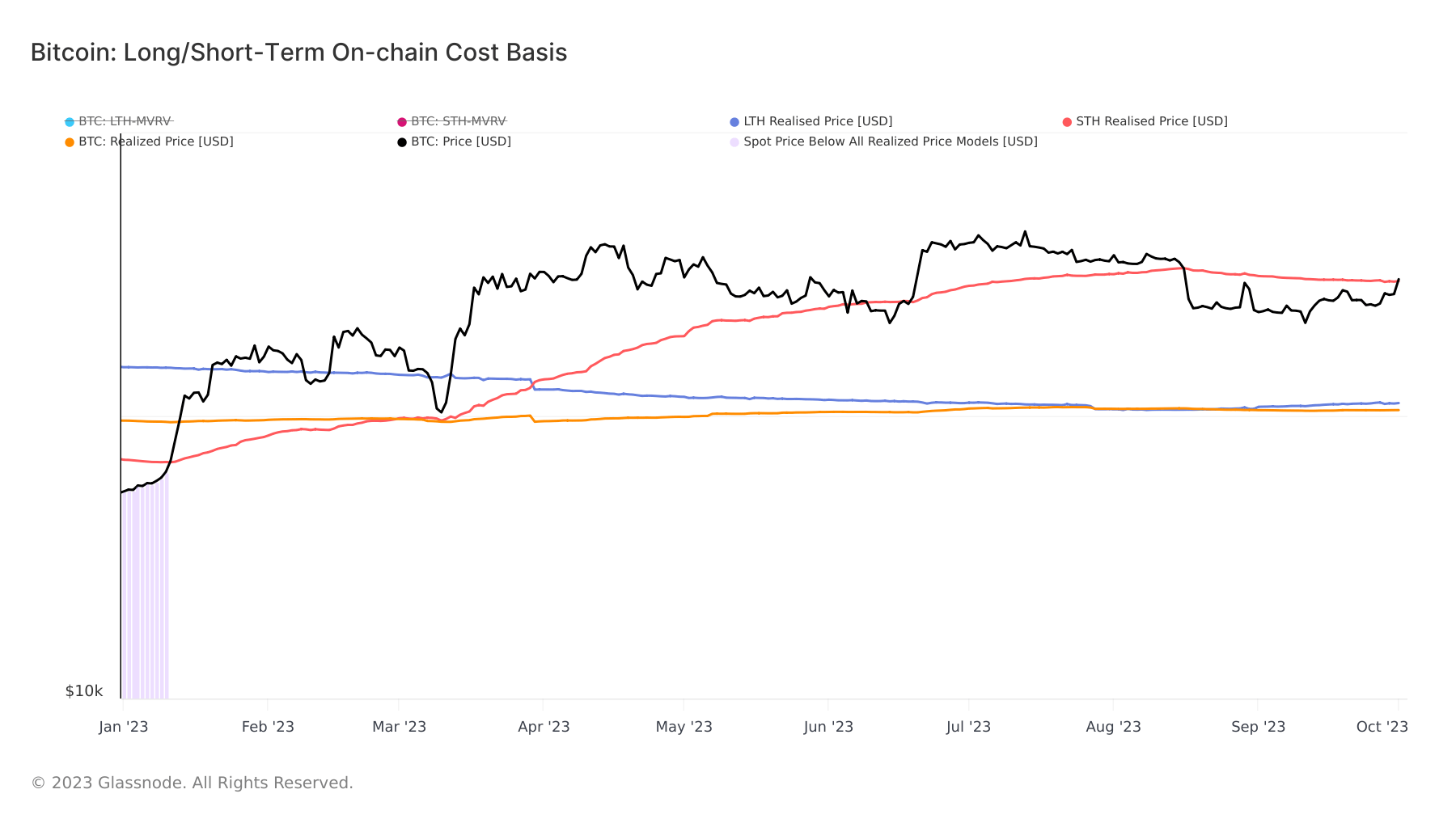

One other essential metric on this narrative is the realized worth. Bitcoin has now surpassed the realized worth for short-term holders, which was pegged at $27,850 on Oct. 1. When Bitcoin’s worth exceeds the short-term holder value foundation, the chance of those holders promoting their property to understand earnings escalates.

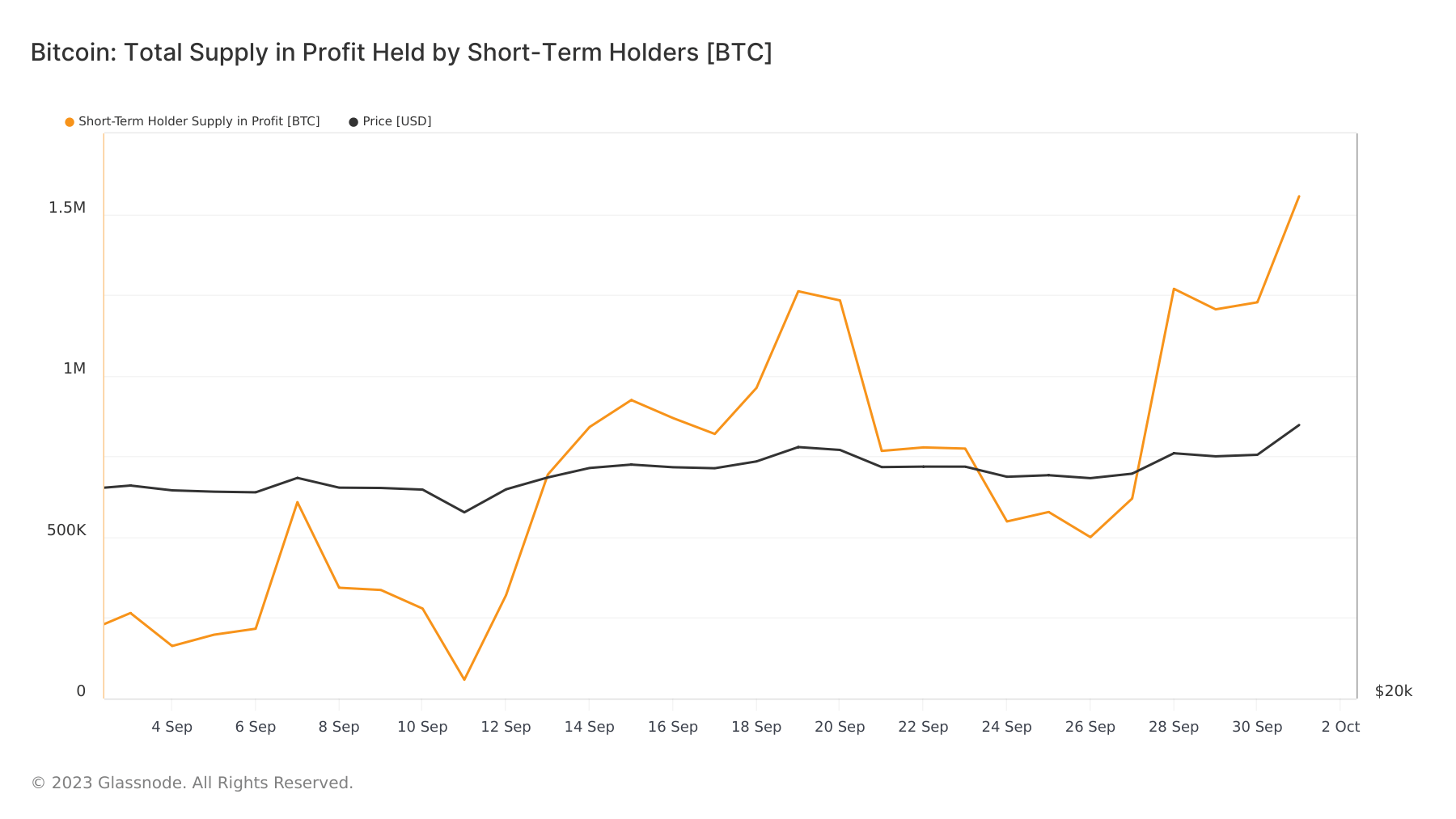

Knowledge from Glassnode reinforces this, displaying that the short-term holder provide in revenue surged between Oct. 30 and Oct. 1, with roughly 331,450 BTC held by long-term holders at present in revenue.

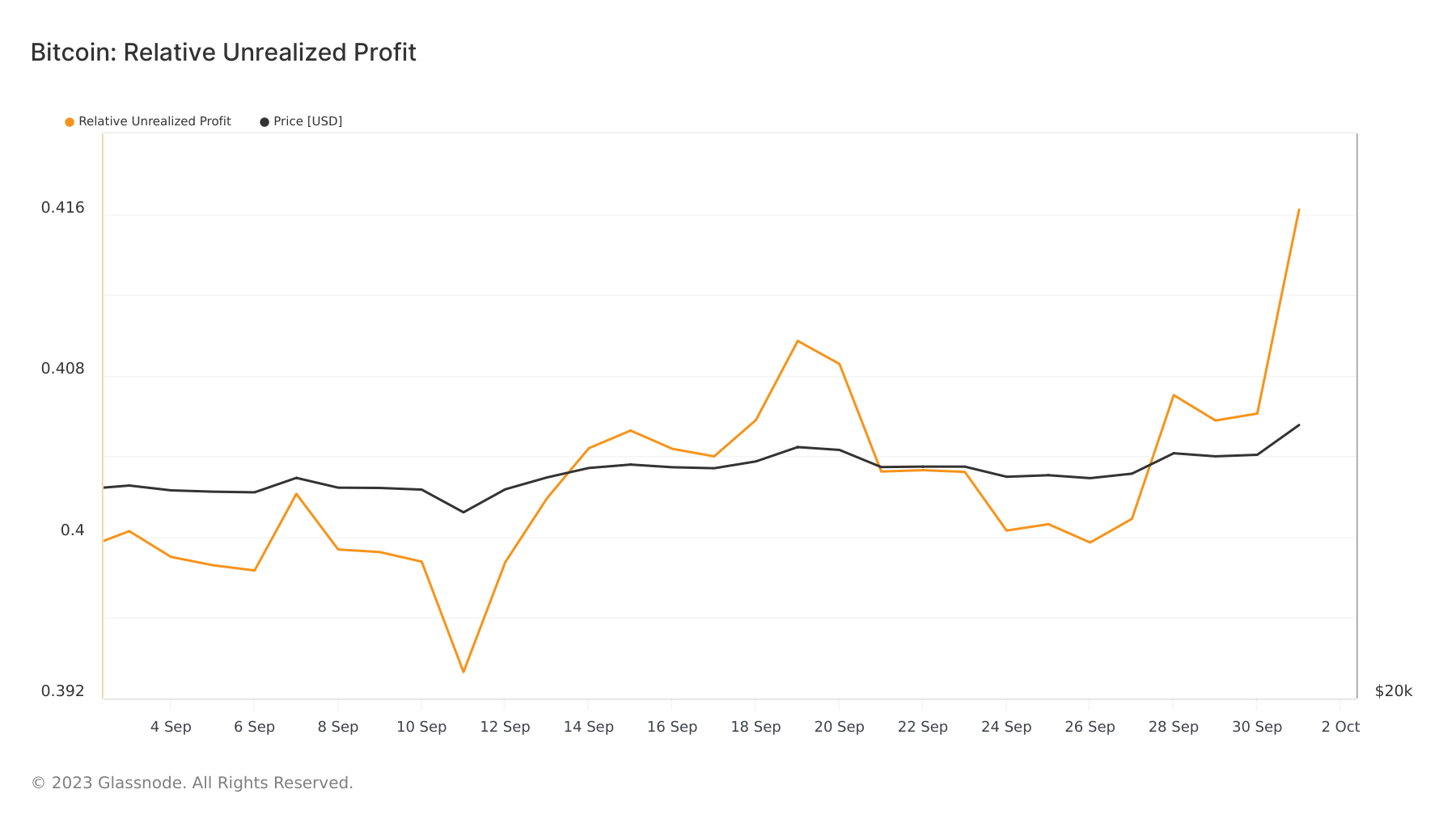

The current liquidations and Bitcoin’s worth motion recommend a bullish momentum. The market is witnessing a shift in sentiment, with merchants turning into more and more optimistic. Nonetheless, it’s necessary to notice {that a} rise in unrealized earnings seen available in the market creates a barrier to Bitcoin’s additional progress. With an growing variety of market individuals now sitting on unrealized features, expectations of additional volatility might push them to promote their positions, pushing costs down.

The put up Bitcoin’s surge to $28k results in $114M in liquidations in 24 hours appeared first on StarCrypto.