Bitcoin dropping under $60,000 firstly of Might spooked the market and led to important volatility throughout buying and selling merchandise. Nonetheless, regardless of the huge volatility in derivatives, the spot market appears to have led most of this restoration, with volumes and inflows serving to stabilize BTC at round $66,000 in mid-Might. After a uneven few days the place BTC struggled to interrupt by means of $66,000, we noticed a pointy spike on Might 20 that despatched it above $70,000, injecting much-needed optimism into the market. Whereas BTC settled at round $70,100 on Might 21, the essential psychological degree remained breached.

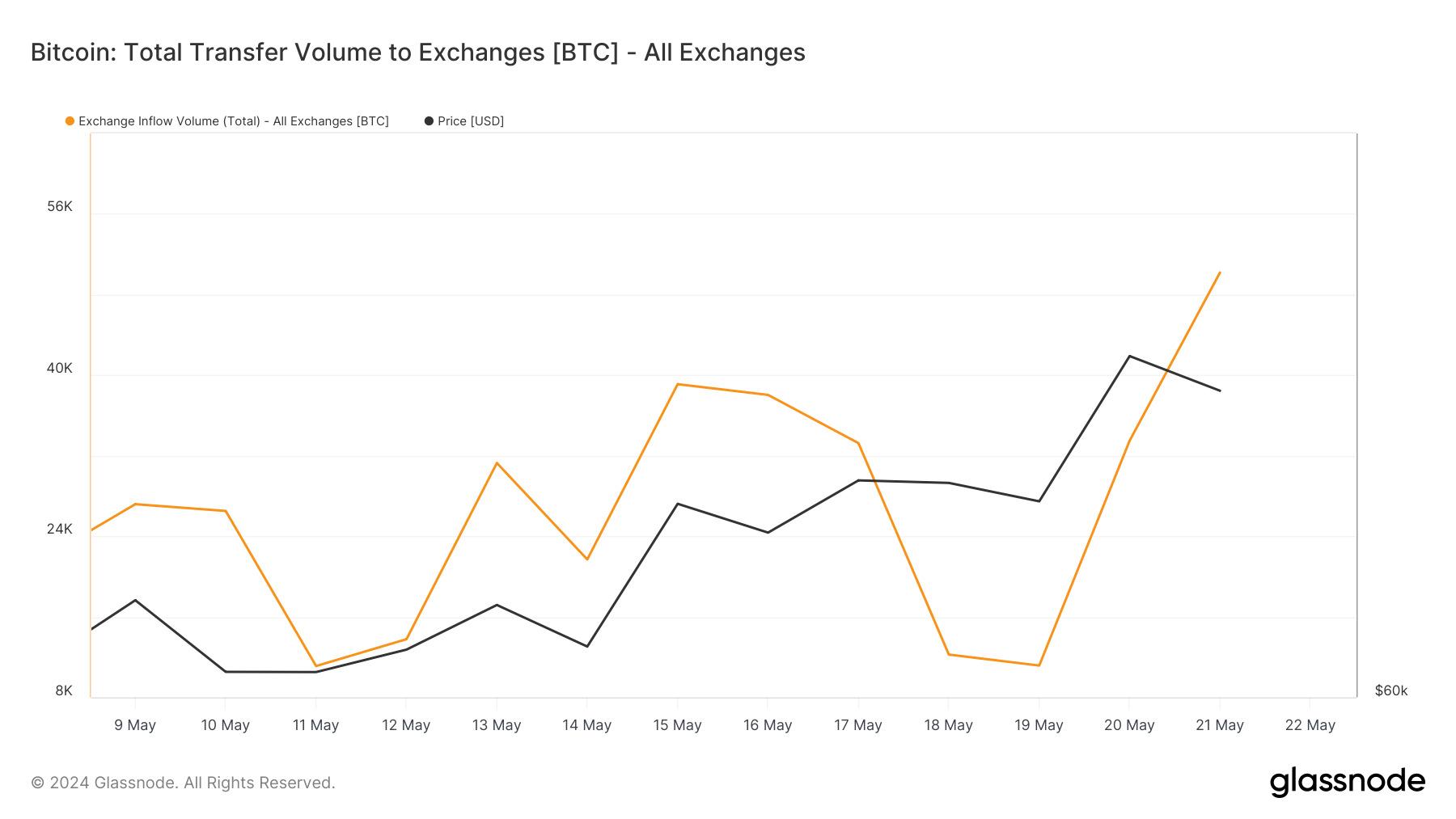

This optimism led to a notable enhance in change exercise, evident within the fast rise in inflows and quantity.

Between Might 15 and Might 21, we noticed fairly a little bit of volatility in switch volumes into exchanges. On Might 15, 39,095 BTC was transferred to exchanges, barely reducing to 38,031 BTC on Might 16. The quantity additional dropped to 33,242 BTC on Might 17, indicating a development of declining switch volumes. A dramatic drop occurred on Might 18, with solely 12,243 BTC transferred to exchanges, adopted by a fair decrease 11,156 BTC on Might 19. Nonetheless, this development reversed on Might 20, with a considerable enhance to 33,484 BTC, culminating in a peak of fifty,186 BTC on Might 2. These fluctuations present how small worth modifications result in important investor exercise and sentiment fluctuations.

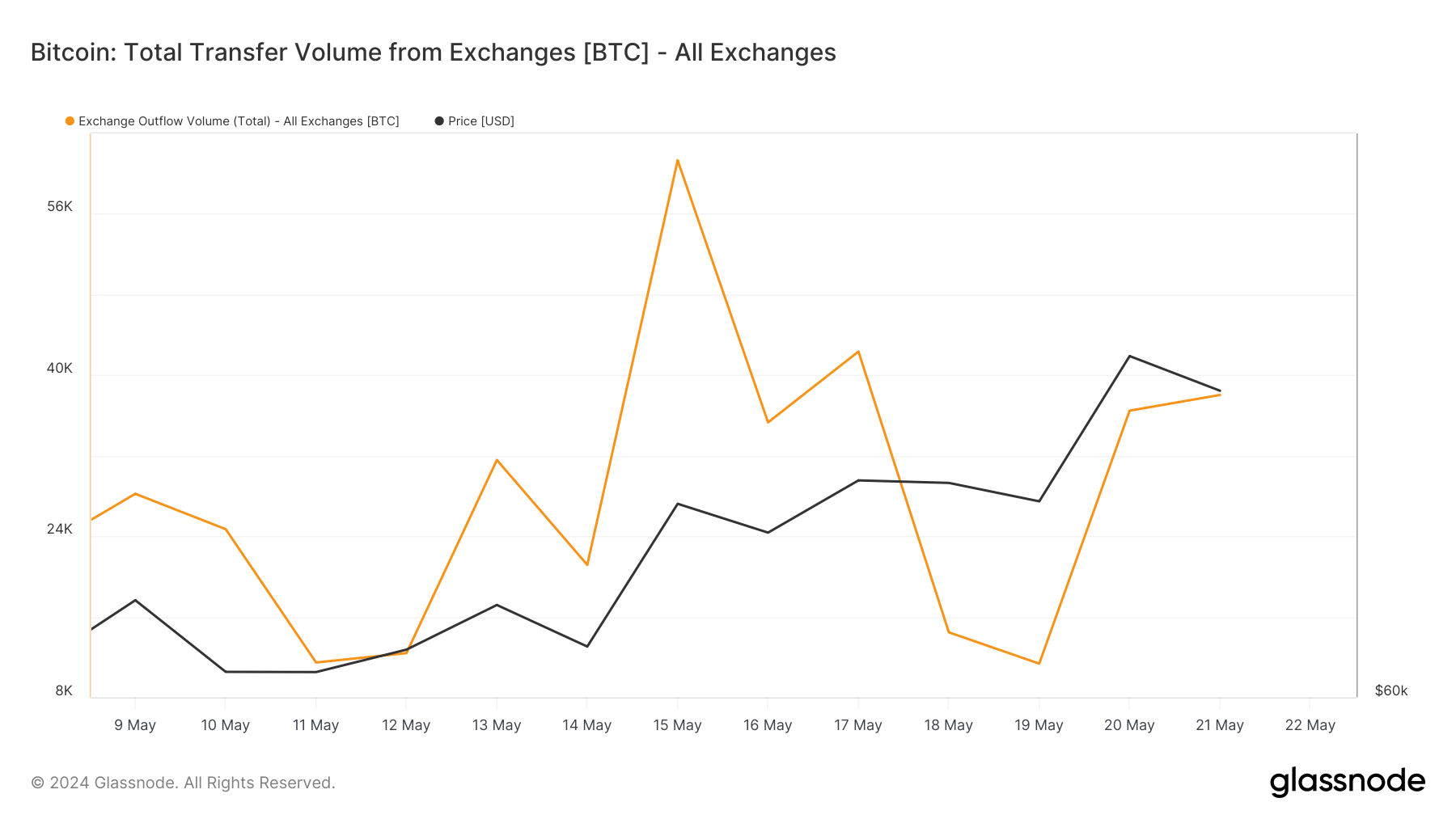

Switch volumes from exchanges confirmed related variations. Between Might 15 and Might 18, switch quantity out of exchanges dropped from 61,232 BTC to 14,454 BTC, adopted by an extra drop to 11,347 BTC on Might 19. Much like the influx development, the outflow volumes elevated on Might 20 to 36,468 BTC and barely decreased to 38,027 BTC on Might 21.

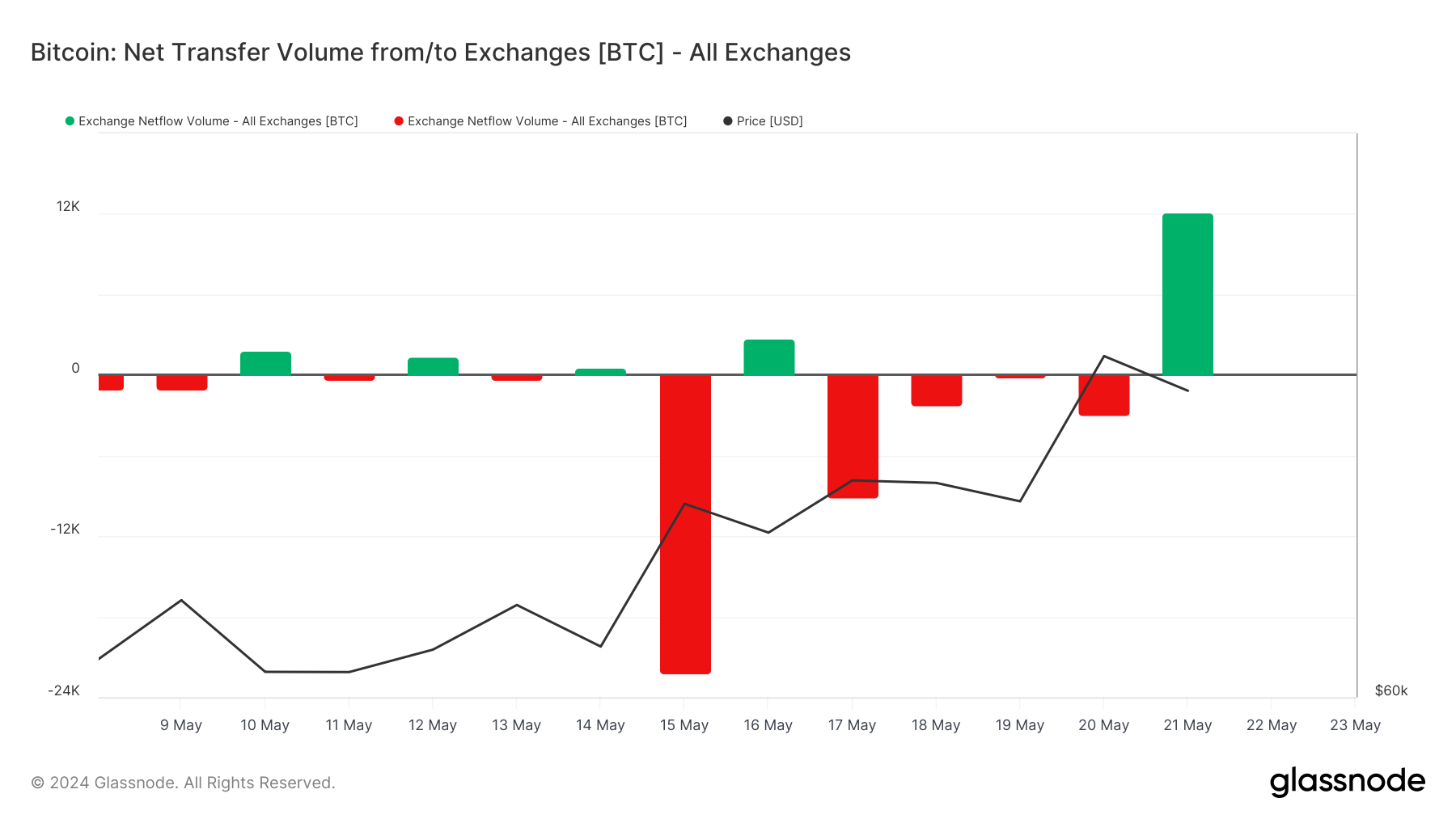

Earlier than the worth surge, from Might 15 to Might 19, Bitcoin’s worth remained comparatively steady with minor fluctuations. Throughout this era, the online switch quantity usually leaned in direction of outflows, indicating holders’ reluctance to maneuver belongings into exchanges, probably anticipating a worth rise. The worth surge and its aftermath on Might 20 and 21 led to a notable change in investor habits.

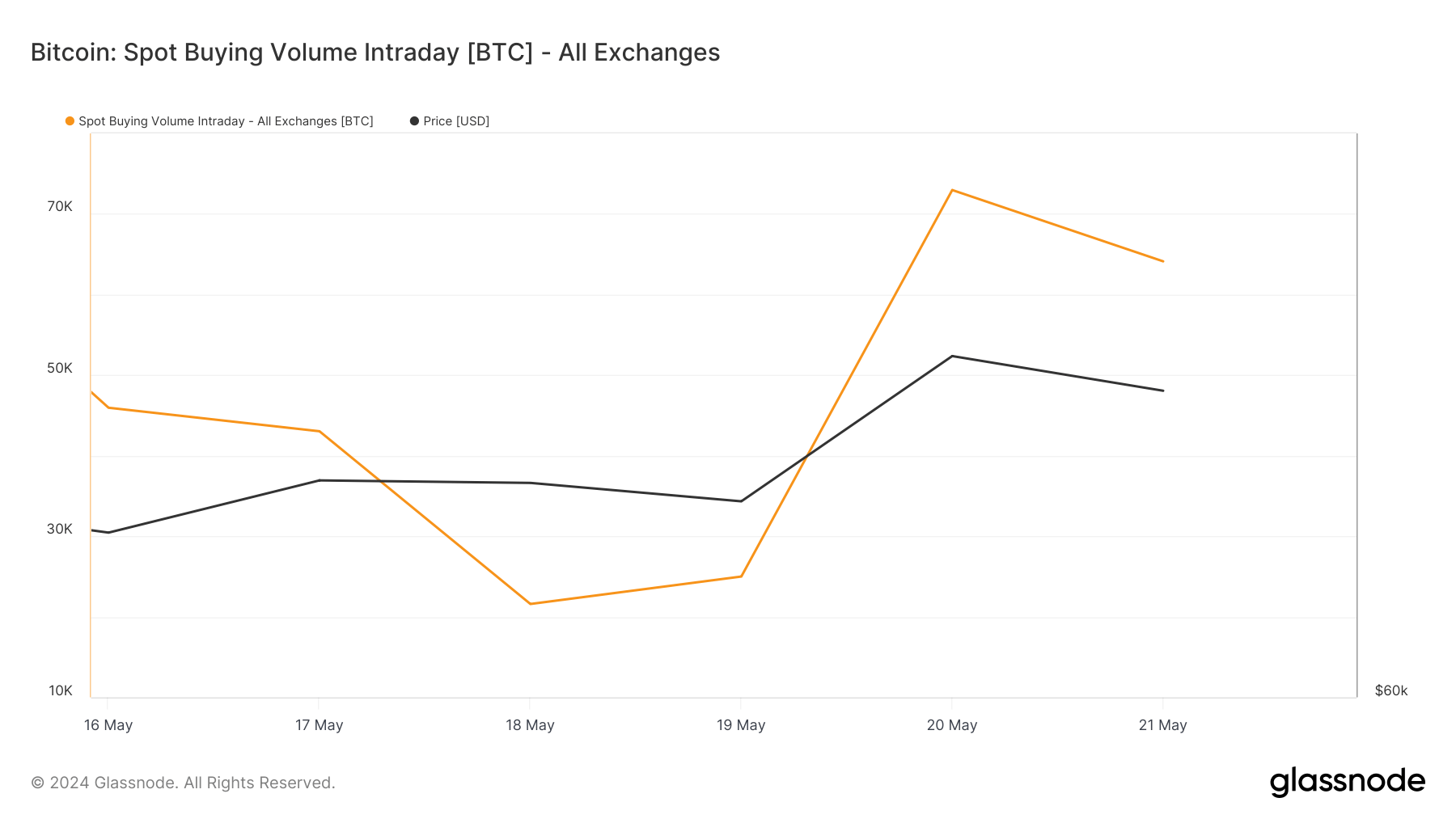

On Might 20, Bitcoin’s worth surged to $71,409, resulting in the elevated switch quantity to exchanges (33,484 BTC) and a excessive spot shopping for quantity (72,971 BTC). Nonetheless, there was additionally important outflow from exchanges (36,468 BTC), exhibiting that whereas some traders capitalized on the worth surge by promoting, others continued shopping for, pushed by bullish sentiment. On Might 21, the development reversed with a web influx of 12,159 BTC.

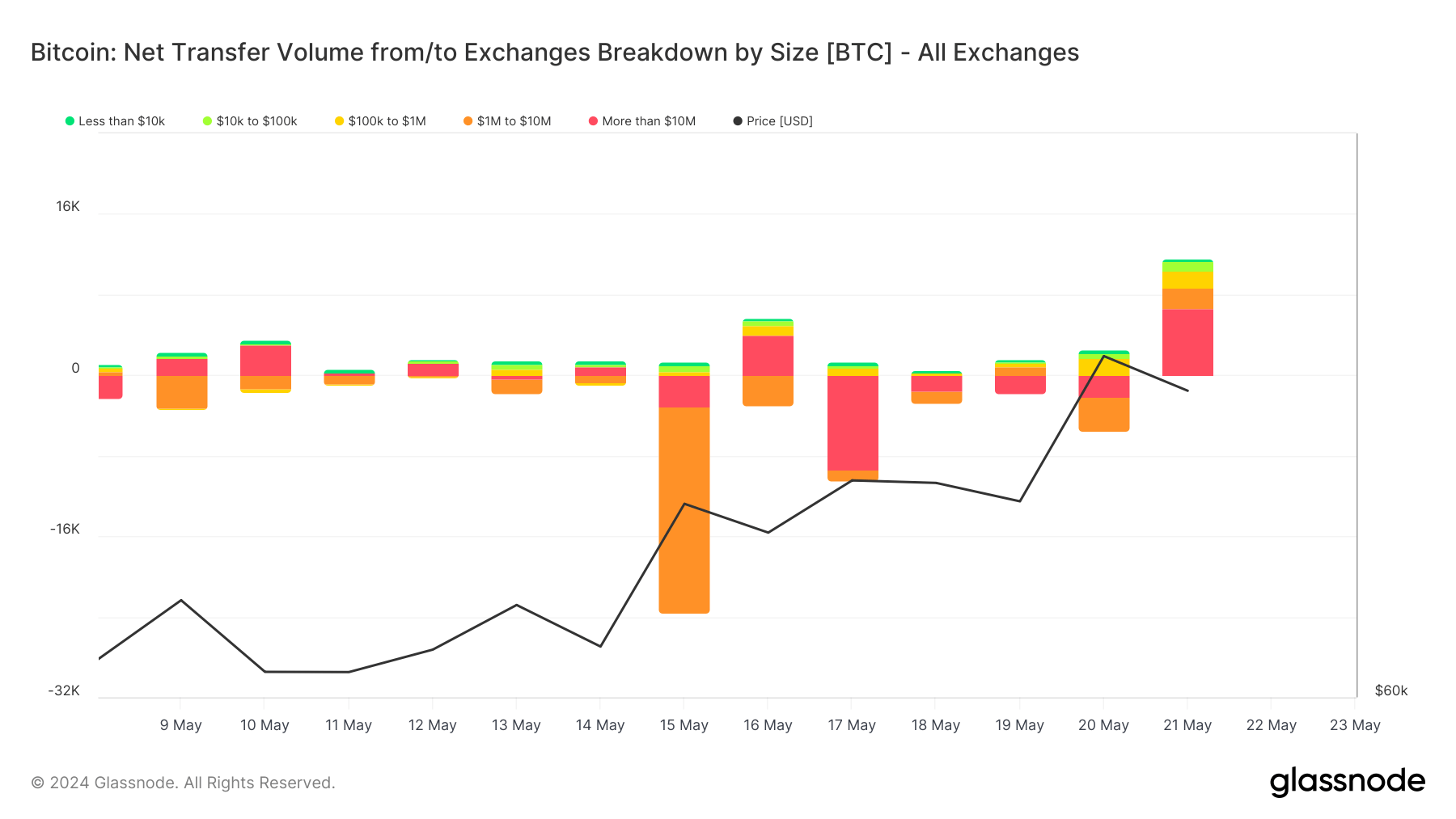

The dimensions breakdown of change switch volumes helps us higher perceive what sort of merchants are shifting the spot market. The comparatively small web inflows in transfers of lower than $100,000 counsel that retail traders have been cautious however regularly elevated their holdings, reflecting rising confidence within the worth stability or potential for future positive factors. Constant inflows within the $100,000 to $1 million class on each Might 20 and Might 21 present energetic participation from bigger retail and smaller institutional traders, who doubtless perceived the surge as a shopping for alternative.

The web outflow of -3,336 BTC within the $1 million to $10 million class on Might 20 implies that some massive holders took benefit of the worth peak to liquidate parts of their holdings. Nonetheless, the reversal to a web influx of two,109 BTC on Might 21 means that different massive traders or the identical entities reinvested, probably indicating a quick profit-taking interval adopted by renewed accumulation. The numerous web outflow of -2,183 BTC within the transfers above $10 million on Might 20 contrasts sharply with the substantial influx of 6,604 BTC on Might 21. This dramatic shift highlights strategic repositioning by very massive traders, who initially bought into the worth peak however shortly moved again into the market, probably signaling long-term bullish sentiment or using subtle buying and selling methods to maximise income.

The market’s reactions to those flows are evident within the intraday spot shopping for and promoting volumes. On Might 15, the spot shopping for quantity was 69,519 BTC, reducing to 21,585 BTC on Might 18. A major enhance occurred on Might 20, with the spot shopping for quantity peaking at 72,971 BTC earlier than barely reducing to 61,119 BTC on Might 21.

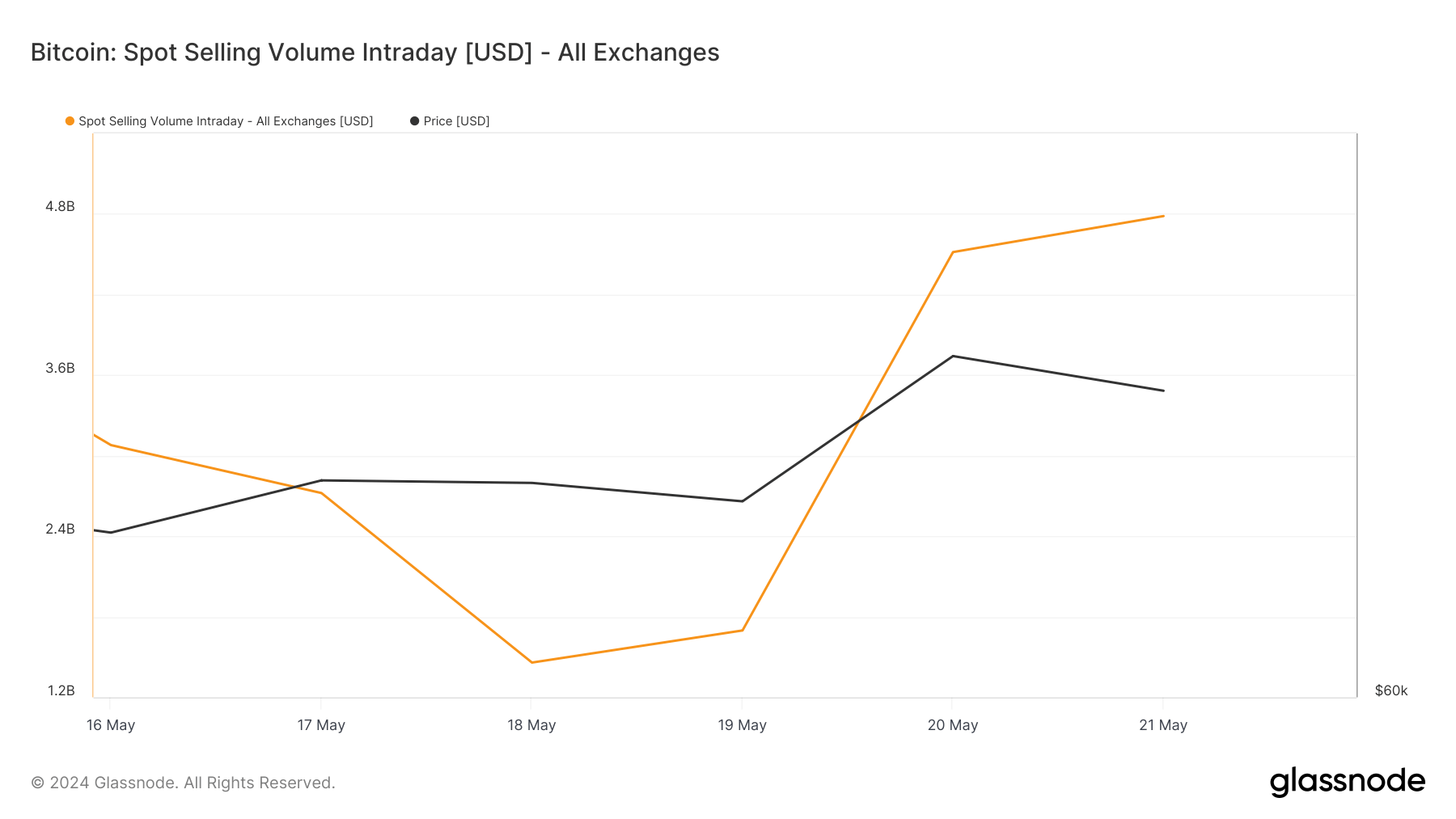

Spot promoting volumes decreased from simply over $4 billion on Might 15 to $1.458 billion on Might 18. By Might 20, the spot promoting quantity elevated considerably to $4.516 billion and additional to $4.784 billion on Might 21. Whereas the elevated spot shopping for quantity displays an increase in bullish sentiment, the corresponding excessive promoting volumes present {that a} appreciable a part of the market capitalized on the worth enhance.

Glassnode’s information exhibits the market is tense and able to react shortly to minor modifications in Bitcoin’s worth. Whereas this response is typical for the derivatives market, we’ve additionally begun seeing a equally aggressive response within the spot market. The swift reentrance to the market from massive holders exhibits it solely takes a bit of upward volatility to reignite the assumption in Bitcoin’s potential. Retail traders’ cautious accumulation factors to a gradual build-up of confidence, doubtlessly setting the stage for extra sustained worth actions sooner or later.

The put up Bitcoin’s surge above $70k sparked change inflows appeared first on StarCrypto.