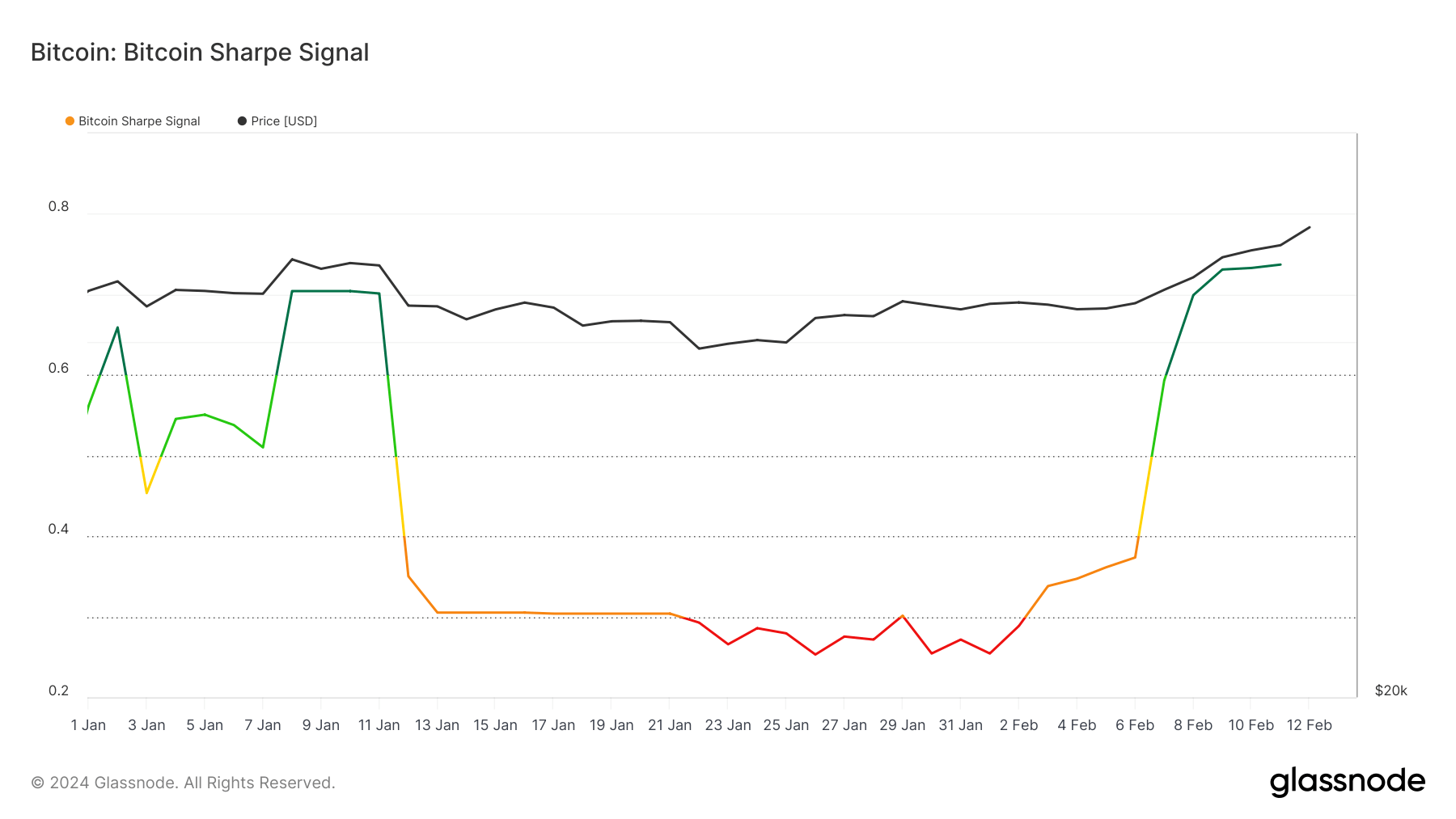

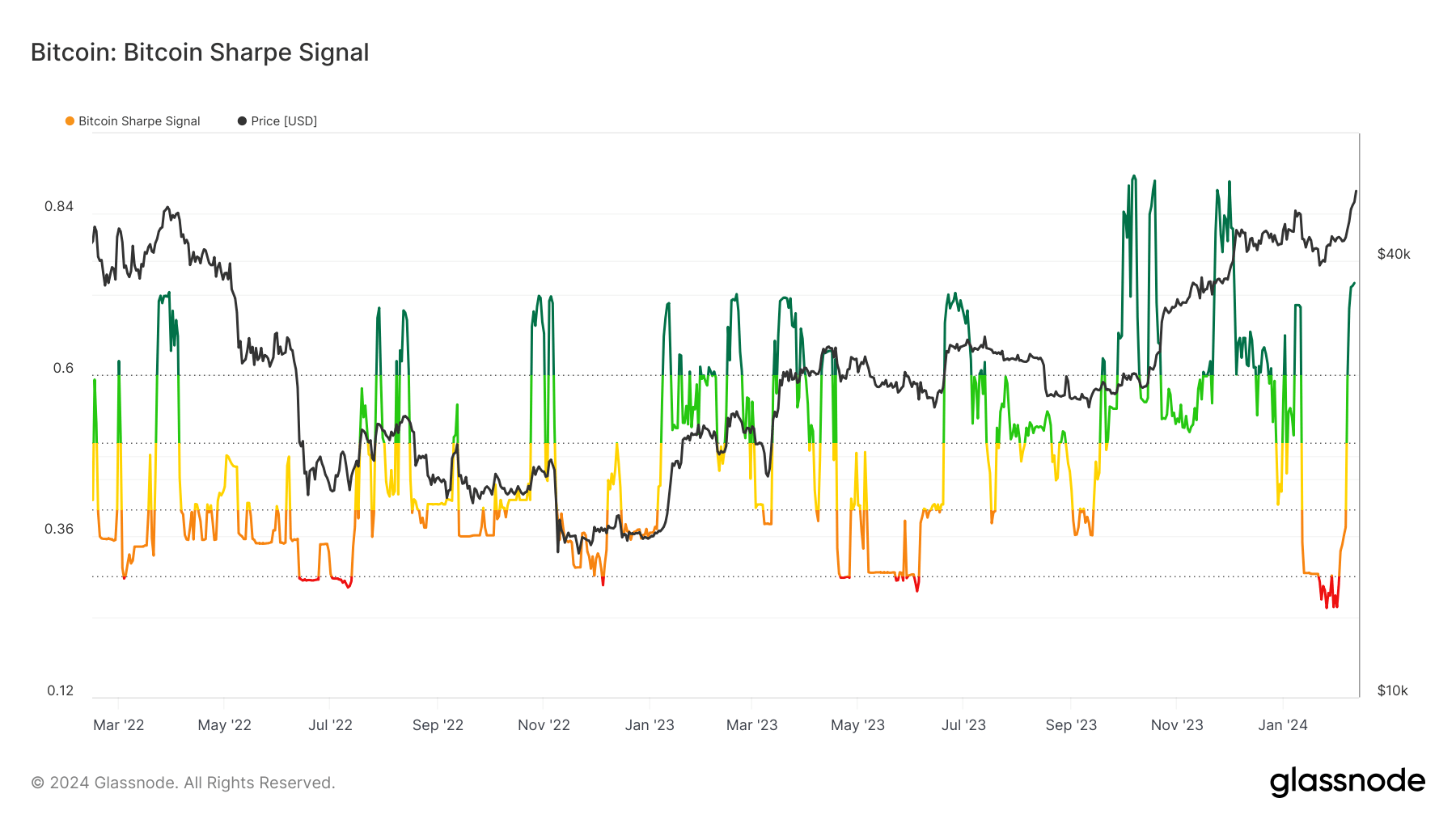

On Jan. 26, Glassnode’s Sharpe Sign hit its lowest stage since March 2020. It dropped to 0.2531 from a excessive of 0.7042 on Jan. 10. Nevertheless, by Feb. 11, as Bitcoin’s value crossed $48,000, the Sharpe Sign elevated to 0.7371.

This sharp spike within the Sharpe Sign has profound implications for the crypto market, indicating a probably profitable section for traders attuned to risk-adjusted metrics.

To completely grasp the importance of the sign’s fluctuations, it’s important to know the Sharpe ratio.

This metric, created by Nobel Laureate William F. Sharpe, measures the efficiency of an funding relative to its danger. The Sharpe ratio compares the anticipated returns of an funding to the risk-free price of return, adjusting for the funding’s volatility. By doing this, the ratio gives a standardized measure of extra returns per unit of danger. Put merely, it measures how rather more cash you would make on an asset riskier than authorities bonds.

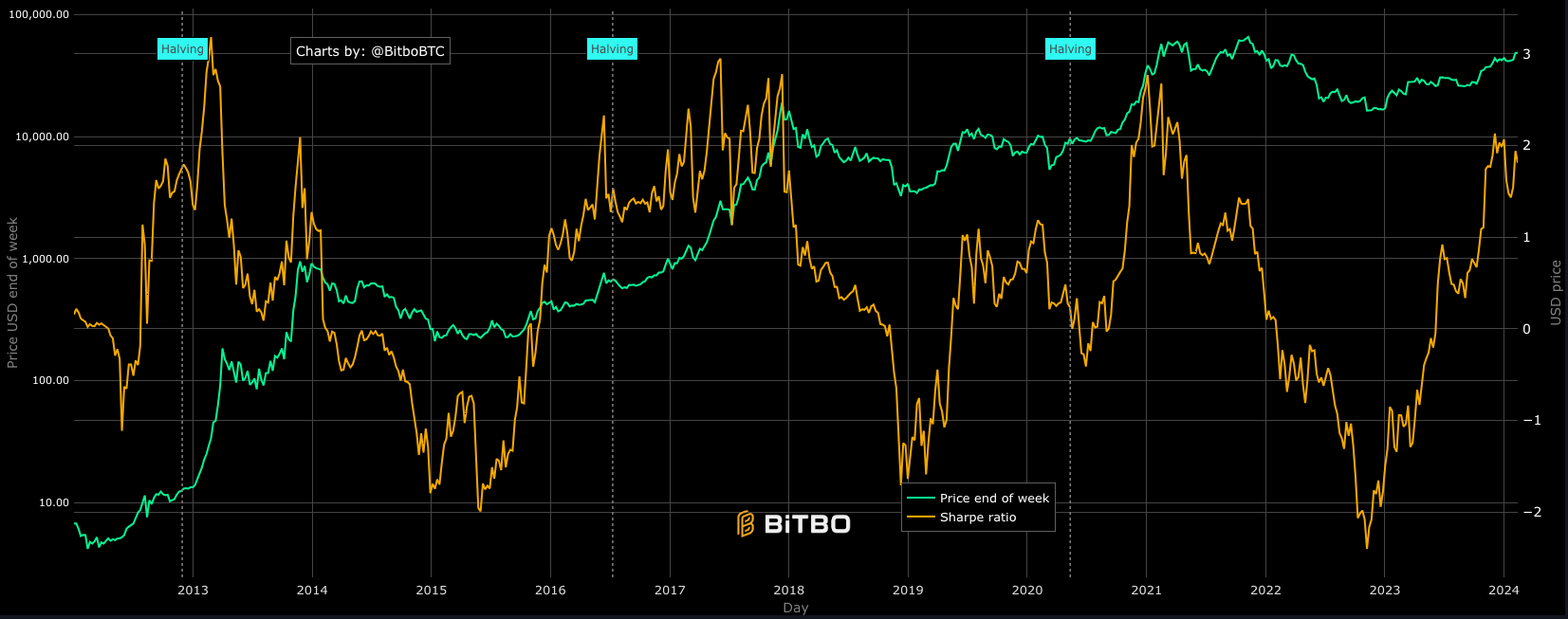

The Sharpe ratio skilled its personal volatility, dropping to 1.43 on Jan. 22 earlier than surging to 1.94 on Feb. 5 and settling at 1.74 as of Feb. 11. These actions supply insights into the altering risk-reward profile of Bitcoin, with greater ratios indicating a extra favorable risk-adjusted return.

The Sharpe Sign, derived from Glassnode’s proprietary mannequin, builds on this idea by incorporating machine studying and on-chain information to foretell Bitcoin’s risk-adjusted return potential. This sign is calculated by analyzing historic information, market traits, and on-chain exercise to gauge the present risk-reward stability. A rise within the Sharpe Sign suggests enhancing risk-adjusted returns, making it a bullish indicator for Bitcoin. Conversely, a lower alerts rising draw back danger or diminishing returns relative to danger, urging warning amongst traders.

The latest actions within the Sharpe Sign, significantly the rebound from 0.2531 to 0.7371, alongside Bitcoin’s value improve, present a major turnaround in market sentiment and Bitcoin’s risk-adjusted return outlook.

The decline in late January, attributable to the market downturn following the US launch of spot Bitcoin ETFs, indicated traders had been seeing heightened danger. Nevertheless, the next restoration reveals a powerful resurgence in confidence, fueled by a lower in draw back danger and anticipation of upward value traits.

This improve within the Sharpe Sign reveals that traders are seeing a comparatively low danger with regards to investing in Bitcoin. The rise within the ratio, alongside the rise in value, additionally reveals that the market is gearing up for an additional improve in value.

Because the sign rebounds from its January lows, it brings a few section of considerably improved risk-adjusted returns, which might make a compelling case for merchants guided by these metrics for strategic funding in Bitcoin.

The submit Bitcoin’s risk-adjusted return potential skyrockets as Sharpe Sign surges appeared first on StarCrypto.