The anticipation of the primary spot Bitcoin ETFs within the U.S. fueled Bitcoin to a 21-month excessive of $49,000. Nevertheless, the excessive it reached on Jan. 10 was short-lived, as the value dropped swiftly and sharply to a low of $39,450 on Jan. 21. This sharp decline, which many deemed a traditional case of “purchase the rumor, promote the information,” was important however not as catastrophic because it may have been. By Jan. 24, Bitcoin had bounced again, regaining the crucial $40,000 stage.

StarCrypto’s earlier evaluation shed mild in the marketplace’s robustness within the face of this volatility. The market demonstrated a formidable capability to soak up appreciable promoting pressures, successfully curbing further liquidations and offering a buffer in opposition to additional value decline.

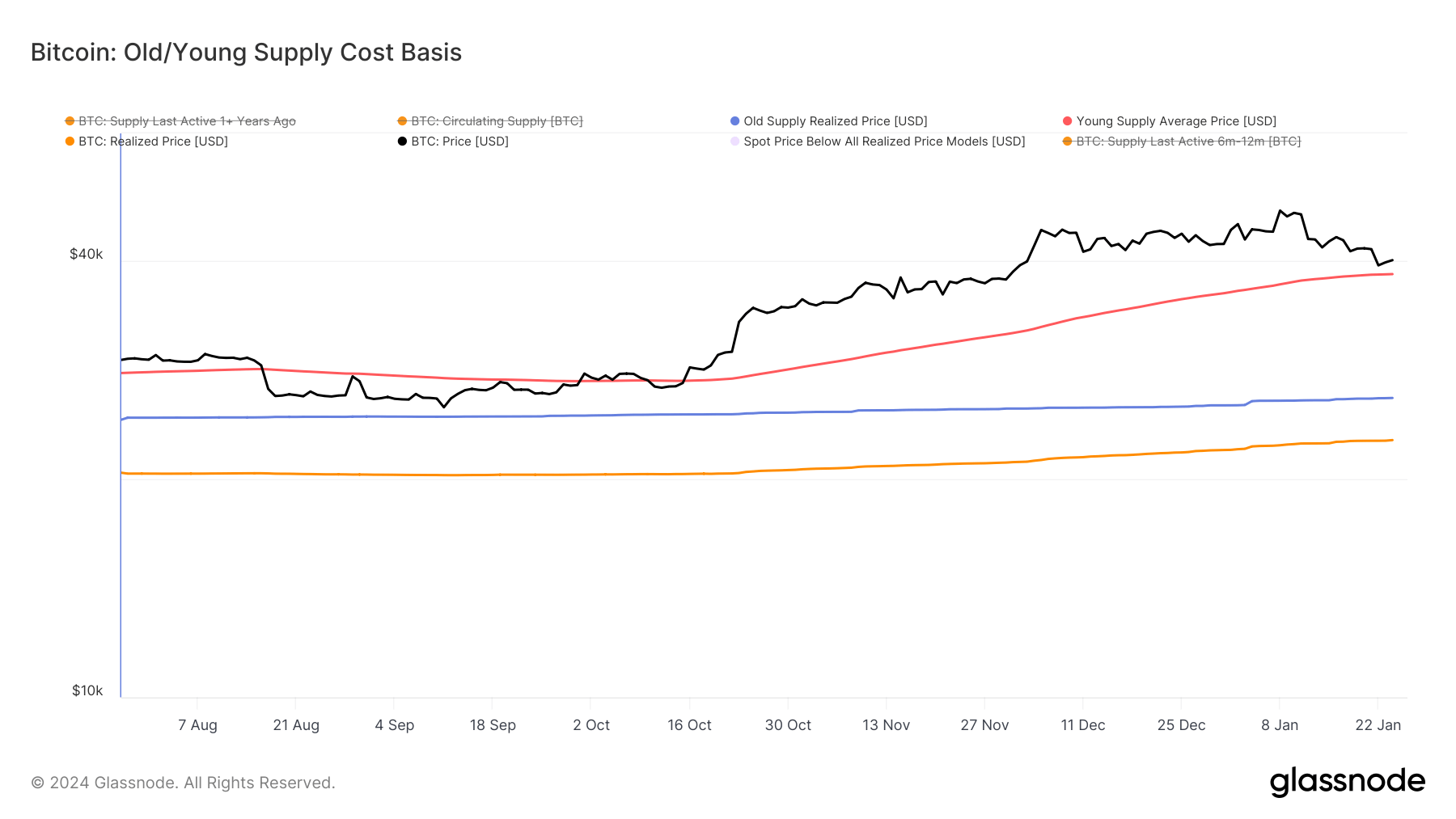

One other pivotal ingredient that helped preserve Bitcoin’s value above $39,000 has been the realized value. The realized value signifies the combination value at which every coin was final moved on-chain. This metric is essential in on-chain evaluation, because it exhibits the typical acquisition value of Bitcoin throughout totally different investor cohorts. By analyzing this, we are able to see the typical value foundation of Bitcoin holders and estimate potential assist and resistance ranges.

Nevertheless, a basic evaluation of Bitcoin’s value foundation presents restricted insights. The realized value of the younger provide – cash which have moved throughout the final six months – gives a extra correct reflection of the market sentiment. The younger provide realized value, using a 120-day exponential transferring common, is a significantly better indicator of short-term holder habits.

Knowledge from Glassnode places the realized provide of younger provide at $38,370, considerably larger than the outdated provide’s realized value of $25,886. The realized value for younger provide noticed a comparatively small improve between Jan. 10 and Jan. 25, whereas the realized value for outdated provide remained steady.

The shortage of great motion within the realized value for younger provide created sturdy assist for Bitcoin’s value at $39,000. Younger provide, additionally known as short-term holders, react shortly and aggressively to cost swings, and durations, the place Bitcoin’s spot value fell under its value foundation, have usually triggered a chronic downward development. The truth that Bitcoin’s value drop stopped at 16% may very well be attributed to the assist created by the younger provide’s realized value.

It serves as a really tough estimate of the value stage current traders are more likely to defend and a stage under which they may start to capitulate.

The publish Bitcoin’s realized value by ‘younger provide’ underpins current value assist appeared first on StarCrypto.