The crypto market affords a singular perspective on asset valuation by means of the idea of realized capitalization. For Bitcoin, the realized cap gives invaluable perception into its financial footprint and investor sentiment.

Historically, market capitalization is calculated by multiplying the present market worth of an asset by its complete circulating provide. Whereas this technique affords a fast overview of Bitcoin’s market worth, it doesn’t all the time current an correct image. Many cash could also be inactive or misplaced, and a major quantity may very well be held by long-term buyers, all contributing to a disparity between the theoretical market cap and the precise financial worth in circulation.

The realized cap addresses this discrepancy. It values every unit of Bitcoin based mostly on the worth at which it was final transacted reasonably than the present market worth. This method affords a extra granular and lifelike view of the market’s financial well being.

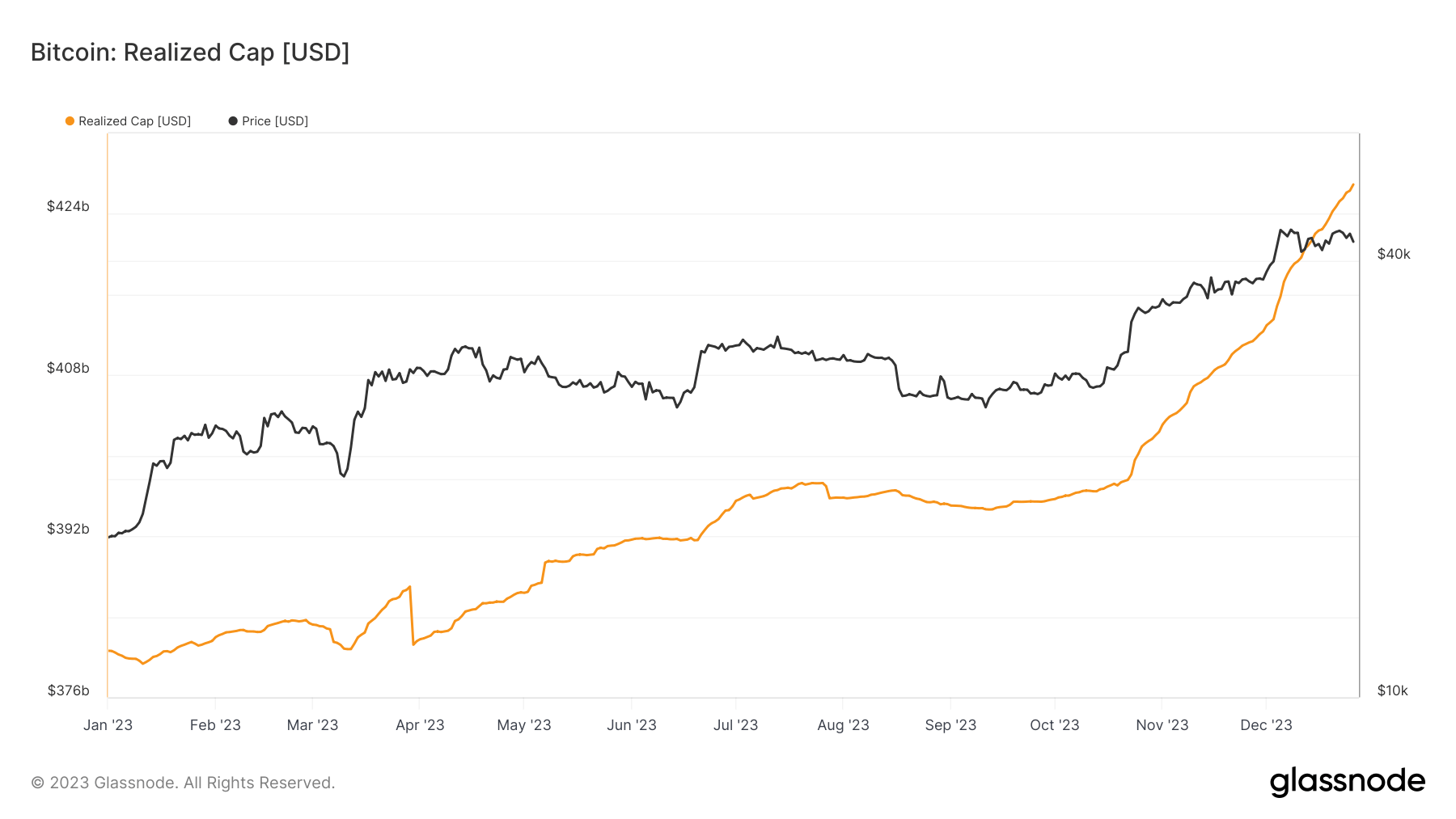

In 2023, Bitcoin’s realized cap elevated from $380.62 billion at first of the yr to $426.93 billion on Dec. 26, marking a major 12.15% improve.

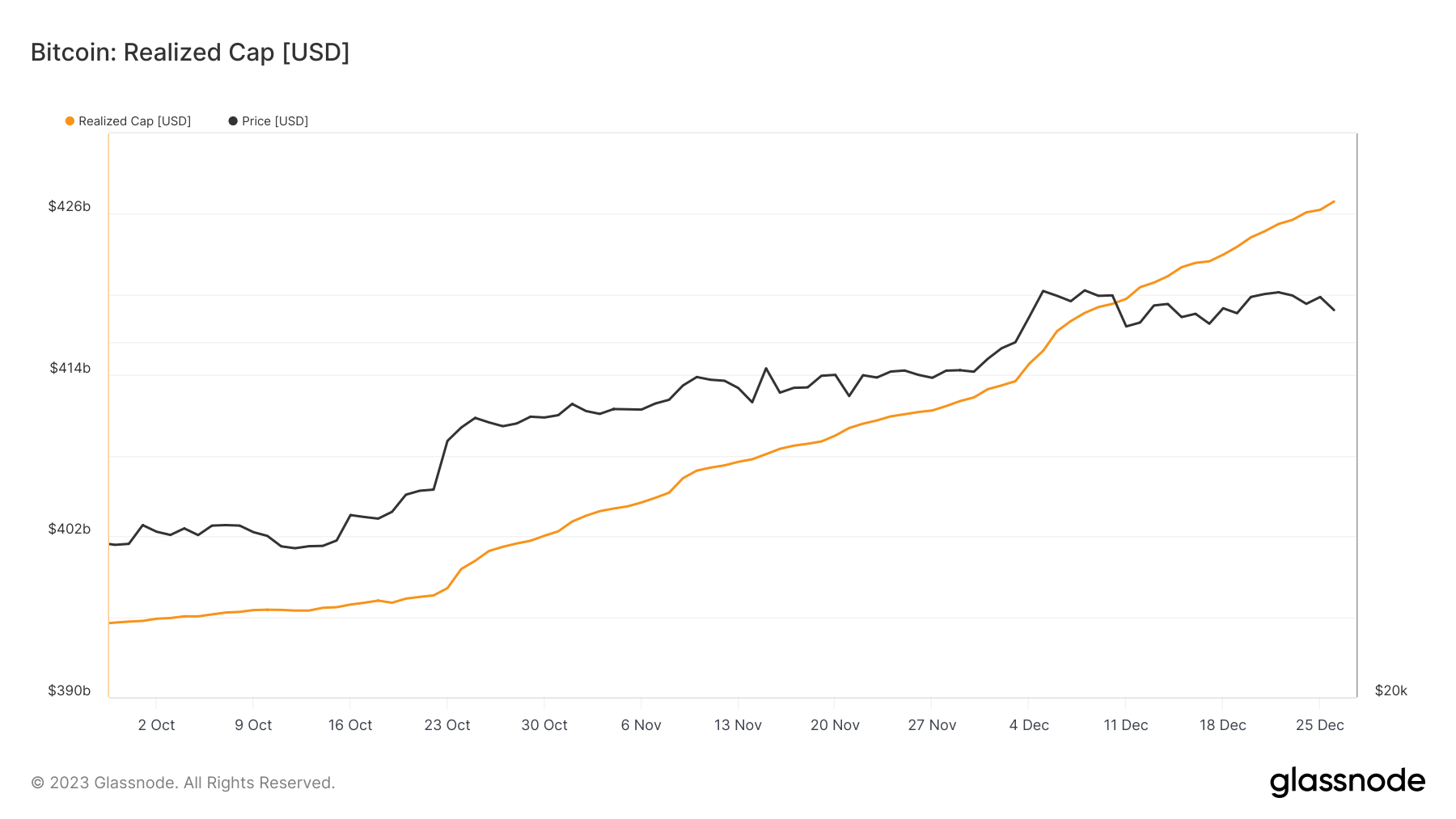

This upward trajectory was significantly evident within the latter a part of the yr. Between Oct. 22, when the realized cap was $397.59 billion, and Dec. 26, the realized cap rose by 7.37%. This improve aligns with a rally in Bitcoin’s worth, surpassing $30,000 and reaching yearly highs of round $42,500.

The numerous improve in Bitcoin’s worth has spurred heightened buying and selling exercise, mirrored in elevated capital inflows and dynamic shifts out there.

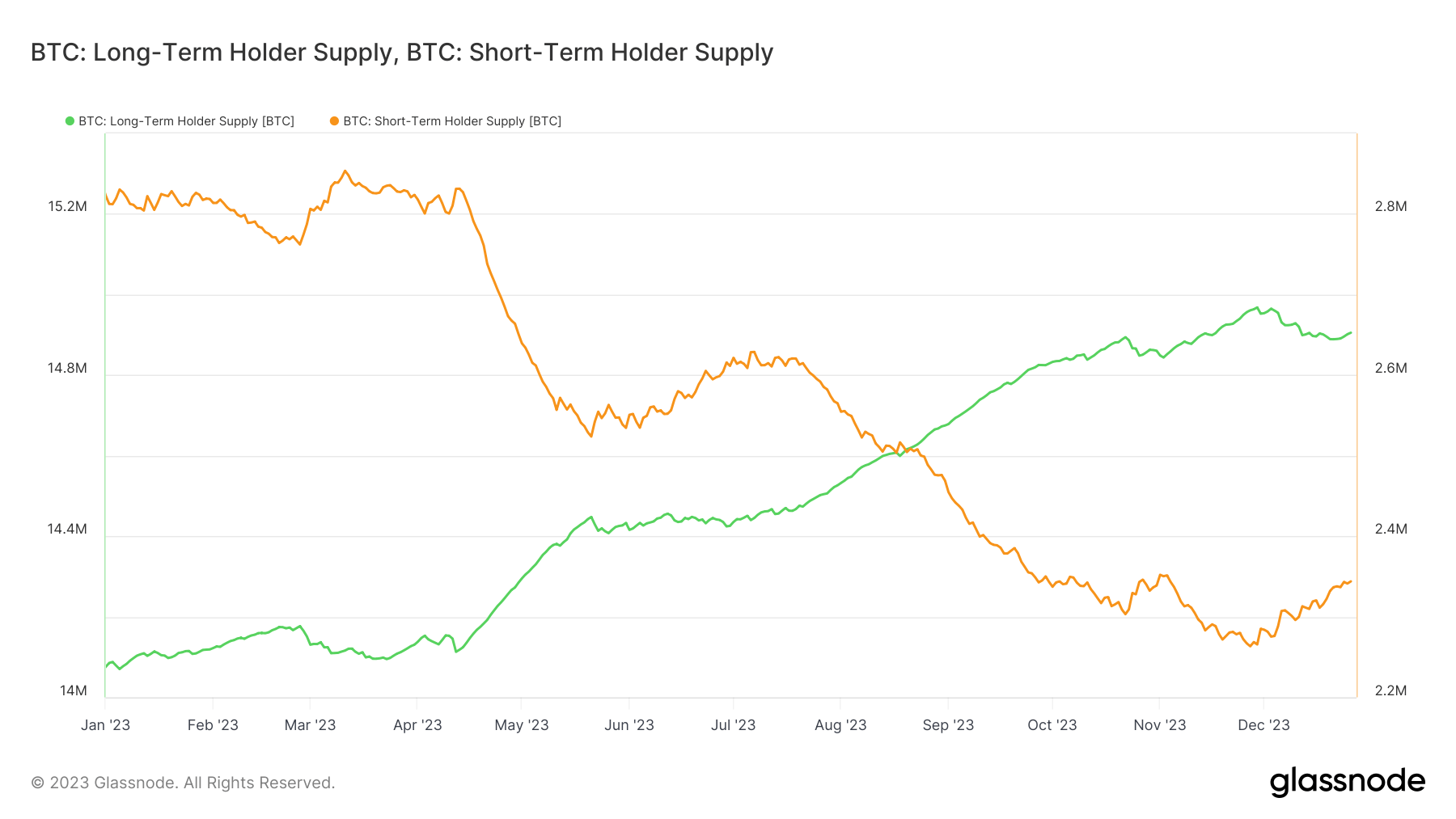

The distribution of Bitcoin holdings amongst short-term and long-term holders gives further context. A lower within the provide held by short-term holders suggests a transition in direction of a market dominated by long-term buyers. These people have held Bitcoin for over 155 days and are more and more contributing to the asset’s capital inflow.

The rise in Bitcoin’s realized cap and the altering holder composition have a number of implications for the market. Primarily, the rise in realized cap suggests a rising financial relevance of Bitcoin, with a extra substantial quantity of capital being invested over time. This shift signifies a maturation of Bitcoin as an funding automobile, reflecting broader acceptance and stabilization out there.

Moreover, the predominance of long-term holders signifies a bullish sentiment amongst buyers, signaling a perception in Bitcoin’s long-term worth proposition. This pattern might doubtlessly result in diminished market volatility, as long-term holders are much less more likely to promote in response to short-term worth fluctuations.

The publish Bitcoin’s realized cap reveals rising financial footprint appeared first on StarCrypto.