- Bitfinex market report factors to bullish metrics for BTC

- Provide in Revenue, Bitcoin Realised HODL (RHODL) A number of and Reserve Threat ratio are all flashing inexperienced.

- Bitcoin has traded to above $23k once more after slipping on Monday following broader market response to financial information.

Bitcoin is buying and selling round $23,360 on the time of writing, about 2.4% up prior to now 24 hours as cryptocurrencies flash inexperienced on Tuesday amid an bettering market sentiment.

For the world’s main cryptocurrency by market cap, it seems on-chain metrics are ticking additional north to recommend a strengthening bullish case.

Provide in Revenue up 20%, factors to purchase sign

In accordance with analysts at Bitfinex, certainly one of Bitcoin’s on-chain metrics suggesting recent upside momentum is probably going the Provide in Revenue indicator. Information reveals bulls look to have efficiently absorbed promoting stress as short-term and a few long-term HODLers flip worthwhile.

An commentary of the metric on the 90-day time-frame highlights a 20% leap for the “provide in revenue” chart in January 2023, the analysts wrote within the report launched on Monday.

“This suggests that bigger and longer-term traders presently maintain worthwhile on-paper spot positions. That is wholesome for the latter half of a bear market as a sustained 30-day uptrend after an in depth downtrend on this indicator has traditionally offered a superb purchase sign for the next two years,” the Bitfinex crew famous.

So far as markets are involved, the above state of affairs doesn’t imply that the crypto market is ready for an “up-only” transfer. Nevertheless, the outlook does recommend bulls have an higher hand within the spot markets, a state of affairs that’s traditionally reflective of “late bear and early bull markets.”

The Bitcoin Realised HODL (RHODL) A number of, traditionally additionally bullish, has additionally been in an uptrend. In accordance with information, the RHODL A number of has remained constructive over a 90-day window, to additionally recommend profitability for HODLers.

#Bitcoin stability statistics now favour the HODLers! 🙌

On-chain metrics are flipping bullish as we see worthwhile promoting by each short-term & long-term HODLers.

Dive into the small print in our newest Bitfinex Alpha:https://t.co/aBJ2teTpVM pic.twitter.com/lBvlb4o43A— Bitfinex (@bitfinex) February 6, 2023

Key metrics recommend a 10x leap for BTC value

Aside from the 90-day EMA, different technical indicators flipping inexperienced embrace the online adjusted Spent Output Revenue Ratio. Per on-chain information, the indicator is presently above one, which means that internet gross sales throughout the Bitcoin market are worthwhile.

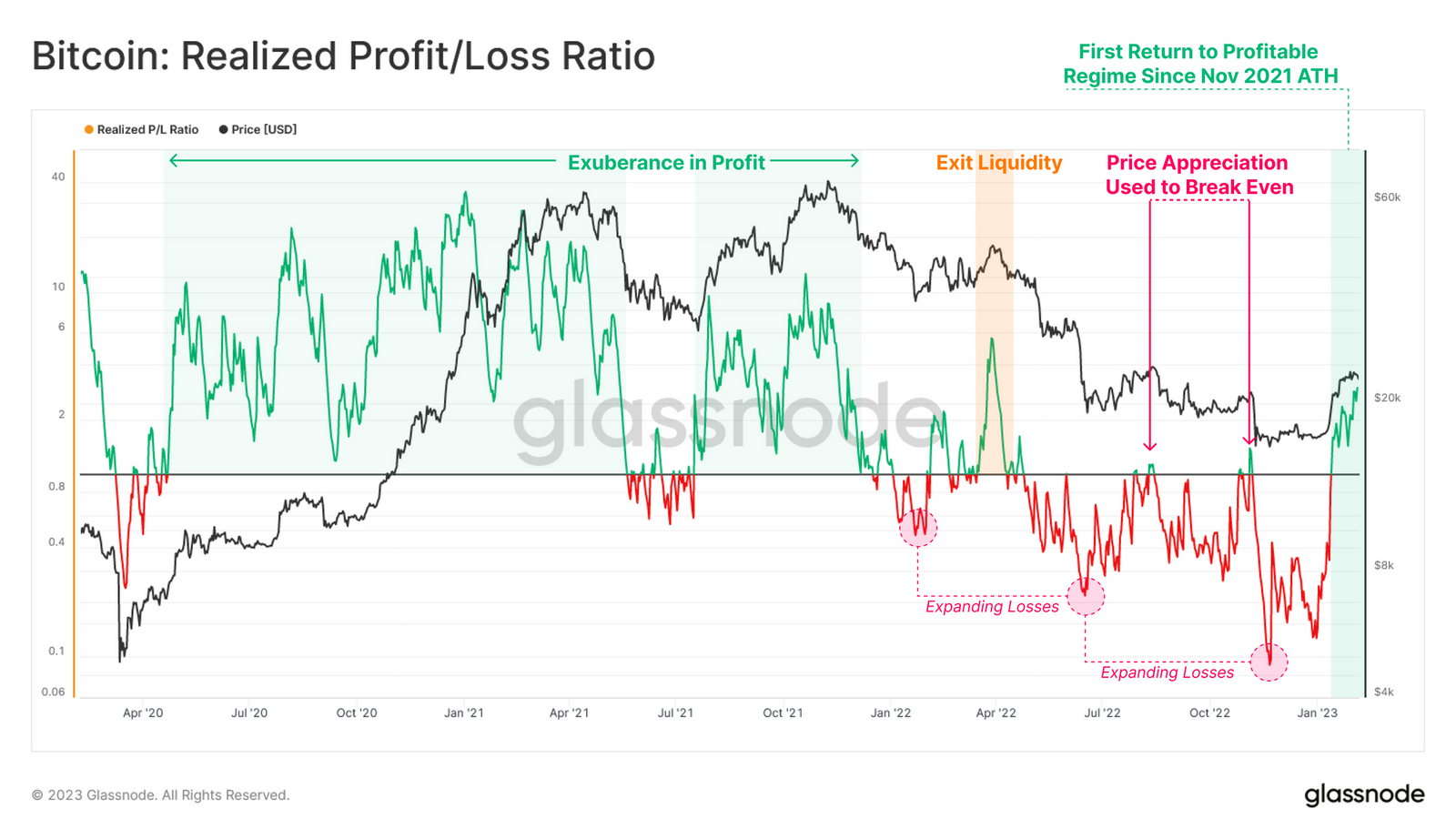

Additionally, the Realised Revenue to Losses (RPLR) ratio is above zero, which additionally confirms the worthwhile promoting noticed in previous few weeks. The metric is presently transferring in the direction of 0.2, a studying akin to the RPLR measure when Bitcoin value fell to lows of $3,600 in 2019. After the RPLR hit 0.2, BTC value flipped inexperienced and rallied 19x, hitting its all-time excessive in November 2021.

Bitcoin Realized Revenue Loss Ratio chart by Glassnode

Bitcoin Realized Revenue Loss Ratio chart by Glassnode

With the metric approaching this ratio when Bitcoin fell to lows of $16,000, the opportunity of one other 10x rally may see BTC goal highs of $160,000 over the following two-three years.

Bitcoin’s reserve threat ratio suggests HODLer conviction is excessive

Taking a look at an extended time-frame, Bitcoin’s on-chain metrics are additionally pointing to a bullish outlook. One odf these technical indicators is the Reserve Threat ratio.

In accordance with on-chain analytics platform Glassnode, Bitcoin’s reserve threat ratio has fallen to its all-time low. This places the metric decrease than when markets bottomed in 2019 or 2020, Bitfinex analysts identified.

Because the ratio is a cyclical oscillator that highlights value vs. HODLer conviction, with incentive to promote factored in opposition to alternative price, a really low ratio interprets to a better conviction amongst traders.

A constructive outlook for Bitcoin can also be seen within the Market Worth Realised Worth (MVRV) ratio, which has recovered and has typically coincided with traditionally bullish returns.