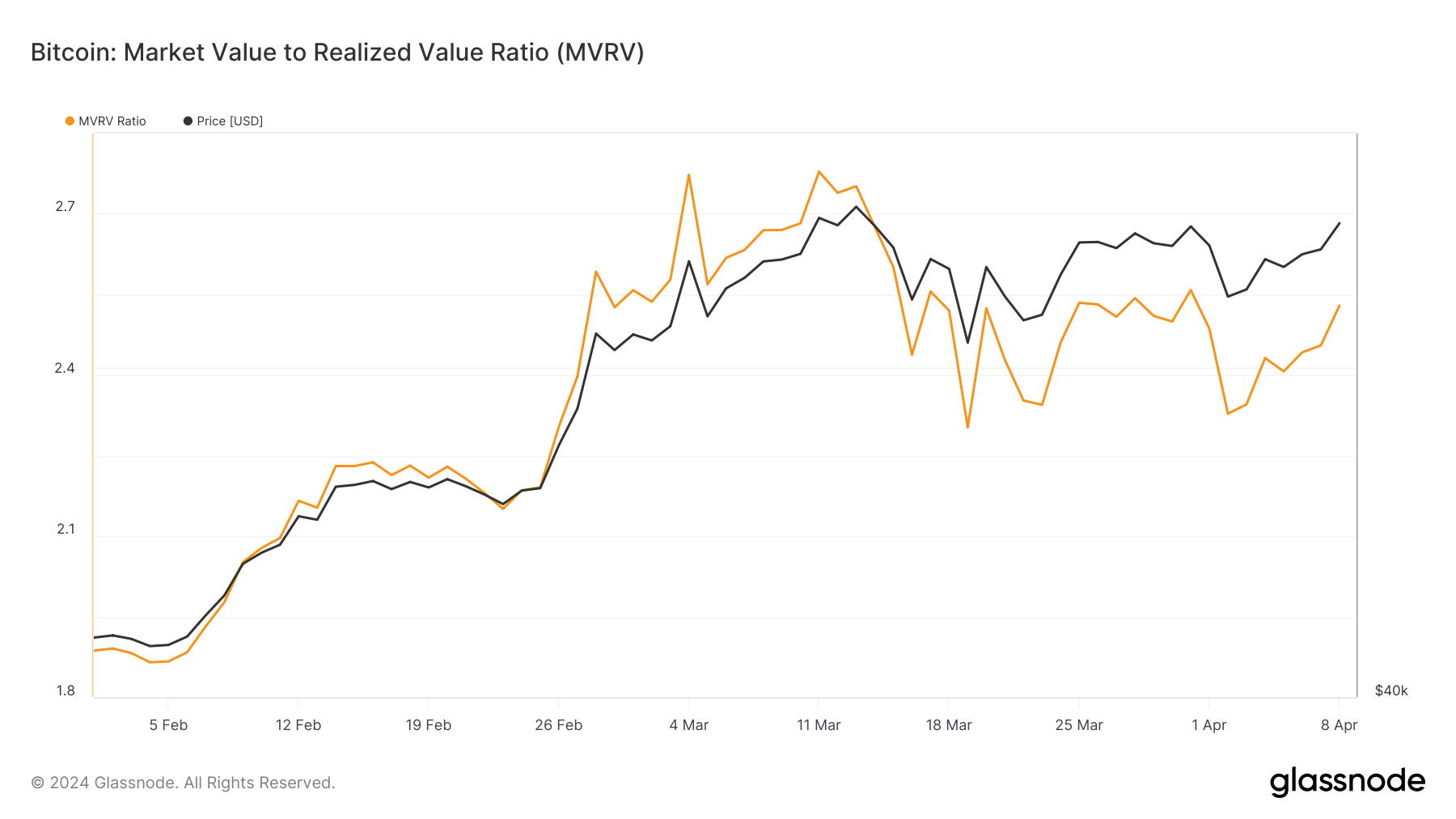

The market worth to realized worth (MVRV) ratio is among the most vital indicators for analyzing the Bitcoin market. It measures the ratio between the market cap (the present worth of Bitcoin multiplied by the overall variety of cash in circulation) and the realized cap (the sum of the worth of all cash in circulation on the worth they have been final moved).

Whereas there are a lot of makes use of for the MVRV ratio relying on which metric they’re analyzed with, it primarily gives perception into whether or not Bitcoin is undervalued or overvalued at a given time.

The next MVRV ratio means that Bitcoin’s worth is probably overvalued, because it signifies the realized worth is increased than the market worth, which implies traders are holding onto unrealized earnings. A rise in unrealized earnings results in elevated promote stress as a good portion of these traders are certain to capitalize on their beneficial properties.

Conversely, a decrease MVRV ratio can point out an undervalued market with minimal promote stress, as traders aren’t holding unrealized beneficial properties. This ratio turns into much more vital when utilized to long-term holders (LTHs) and short-term holders (STHs), because the distinction between their MVRV ratios can provide invaluable insights into market sentiment and future worth actions.

StarCrypto’s evaluation of Glassnode knowledge confirmed that adjustments within the MVRV ratio mirrored Bitcoin’s worth volatility previously six weeks. The ratio fluctuated alongside Bitcoin’s worth, which peaked at $73,104 on Mar. 18 and was adopted by volatility that noticed it modify all the way down to $61,000 earlier than discovering footing at above $71,600 on April 8. The MVRV ratio peaked at 2.751 on March 13 as effectively.

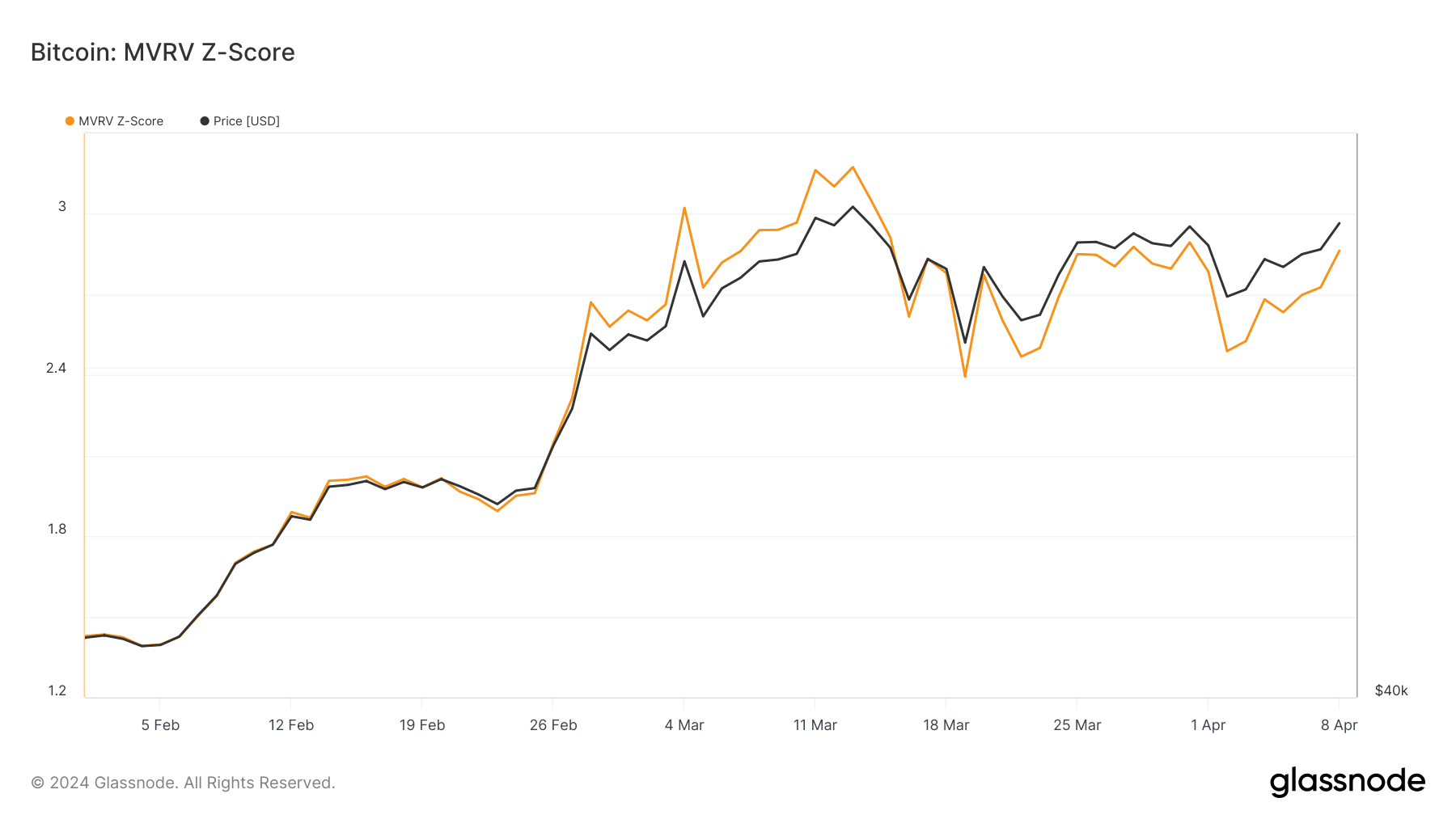

The MVRV ratio Z-score, which standardizes the MVRV ratio to establish extremes of market worth in comparison with realized worth, gives a clearer image of the connection between Bitcoin’s market cap and realized cap. With values peaking alongside each the MVRV ratio and Bitcoin’s worth, it reinforces the notion of potential overvaluation at these factors.

As each the overall ratio and the Z-score decreased notably since their peak on March 13, it suggests the interval noticed elevated speculative exercise and profit-taking.

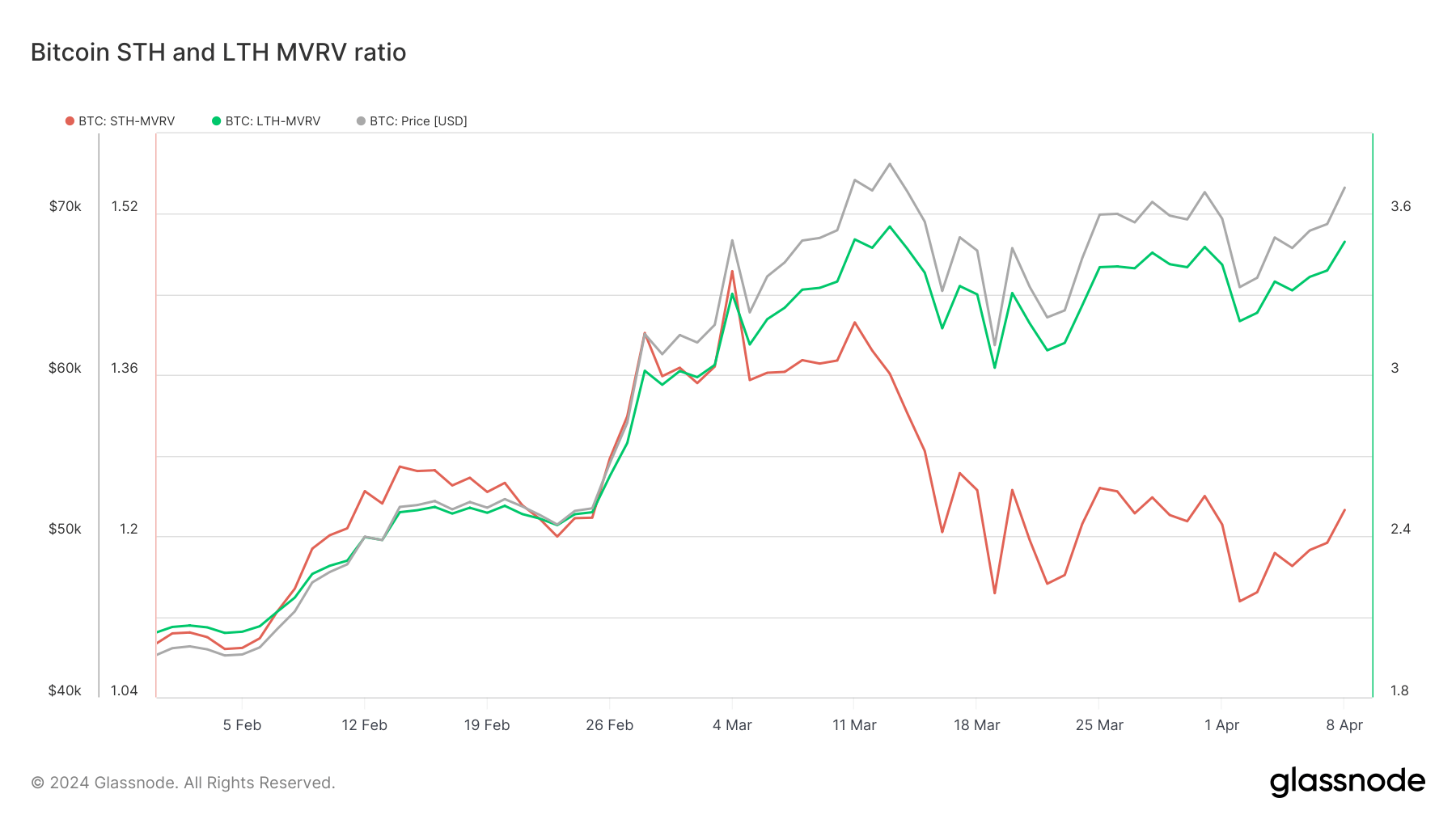

Diving deeper into the conduct of LTHs and STHs helps us perceive which phase of the market noticed probably the most unrealized revenue.

The LTH MVRV ratio was constantly increased than the overall MVRV ratio, indicating that long-term holders have been seeing considerably extra unrealized revenue in comparison with the market common. That is significantly noteworthy round March 13, when the LTH MVRV ratio reached 3.553, considerably increased than the overall MVRV ratio of two.751.

The disparity means that long-term holders might have been in a powerful place to promote and notice earnings, probably contributing to subsequent worth corrections. As of April 8, this disparity continues to be important, exhibiting the cohort’s realized worth is considerably decrease than the market worth.

Conversely, the STH MVRV ratio remained notably decrease than the overall MVRV ratio all through the interval, reflecting that short-term holders have been both at break even or experiencing minimal unrealized earnings.

Whereas this may be interpreted as STHs having much less affect in the marketplace’s path, the cohort has seen constant accumulation all through this cycle and is chargeable for growing quantities of buying and selling quantity. This reveals that regardless of their increased acquisition value and decrease unrealized revenue, the sheer measurement of the cohort and the worth it creates actually have a big affect in the marketplace.

Glassnode’s knowledge confirmed that the elevated LTH MVRV ratio created the potential for elevated promoting stress throughout worth peaks as long-term traders offload their holdings at very enticing profit-taking ranges. When coupled with STHs’ minimal unrealized beneficial properties, this knowledge signifies a market pushed primarily by veteran traders’ actions and sentiment, with short-term holders taking part in a extra reactive position.

Wanting ahead, the developments noticed recommend a heightened sensitivity to shifts in long-term holder conduct. Ought to LTHs proceed to carry regardless of excessive unrealized earnings, it might sign a powerful perception in additional upside potential, probably stabilizing the market throughout pullbacks.

Nonetheless, important sell-offs by this group might result in sharp corrections, particularly if accompanied by a rising basic MVRV ratio and Z-score, indicating overvaluation.

The submit Bitcoin’s MVRV ratio reveals LTHs transfer the market whereas STHs react appeared first on StarCrypto.