- Bitcoin has skilled a chronic interval of value fluctuations regardless of earlier all-time highs

- Bitcoin’s RSI at 46.86 signifies impartial momentum, suggesting neither overbought or oversold circumstances.

- The Crypto Worry & Greed Index has risen by 7.14%, indicating a shift in direction of extra constructive market sentiment.

Bitcoin Journal Professional, a Bitcoin analyst, not too long ago famous that Bitcoin, regardless of reaching new all-time highs earlier this yr, has since skilled a multi-month uneven drawdown. This has led to rising investor issues in regards to the sustainability of the present bull market.

Bitcoin’s value presently stands at $59,337.38, with a 24-hour buying and selling quantity of $31.54 billion, reflecting a 0.84% enhance within the final 24 hours. The market cap is $1.17 trillion, with a circulating provide of 19,742,653 BTC out of a most provide of 21 million cash.

A number of technical indicators present perception into Bitcoin’s present market sentiment. The Relative Power Index (RSI) is at 46.86, suggesting impartial momentum, whereas the Shifting Common Convergence Divergence (MACD) line barely above the sign line hints at potential bullish momentum.

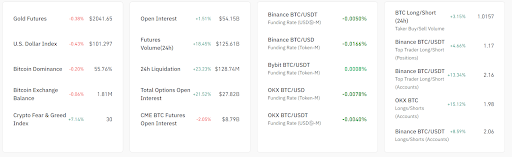

Bitcoin’s market dominance has decreased by 0.20%, indicating that Bitcoin’s share relative to different cryptocurrencies has barely diminished. Moreover, the trade stability has dropped by 0.06%, suggesting that extra Bitcoin is being withdrawn from exchanges, which can sign elevated holding or transferring exercise.

Furthermore, the Crypto Worry & Greed Index has risen by 7.14%, pointing to a shift in direction of extra constructive sentiment amongst traders. Considerably, the open curiosity in Bitcoin futures and choices has elevated by 1.51% and 21.52%, respectively, highlighting heightened buying and selling exercise and potential market volatility.

Moreover, the 24-hour futures buying and selling quantity has surged by 18.45%, underlining a spike in market exercise. Apart from, funding charges for BTC/USDT pairs on main exchanges like Binance, Bybit, and OKX stay constructive, indicating ongoing bullish sentiment. Notably, the vast majority of prime merchants on these platforms are presently holding lengthy positions, additional reinforcing the optimistic outlook.

Changellyblog predicts that Bitcoin may hit a excessive of $73,150.86 in September 2024, based mostly on their evaluation of Bitcoin’s value traits. Nonetheless, there’s additionally a risk that the worth may dip to $61,782.28, with the common value for September 2024 anticipated to be round $67,466.57.

Trying additional forward, after analyzing Bitcoin’s value actions in earlier years, it’s projected that in 2025, the bottom value of Bitcoin may very well be round $99,191. The best anticipated BTC value would possibly attain roughly $120,014, with a median buying and selling value of round $102,727 in 2025.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.