Bitcoin’s liquid and illiquid provides are very attention-grabbing and helpful metrics for understanding market traits. Liquid provide refers back to the quantity of Bitcoin available for buying and selling, which means it’s held in wallets that ceaselessly interact in transactions. Extremely liquid provide, a subset, denotes Bitcoin that strikes much more ceaselessly, usually utilized by merchants and exchanges. Illiquid provide, conversely, represents Bitcoin held in wallets that hardly ever transfer cash, suggesting long-term holding habits.

Analyzing these provides offers perception into market sentiment and potential future value actions. A rise in liquid provide normally signifies greater buying and selling exercise and potential promoting stress, whereas an increase in illiquid provide suggests accumulation and a bullish outlook, as holders count on costs to understand.

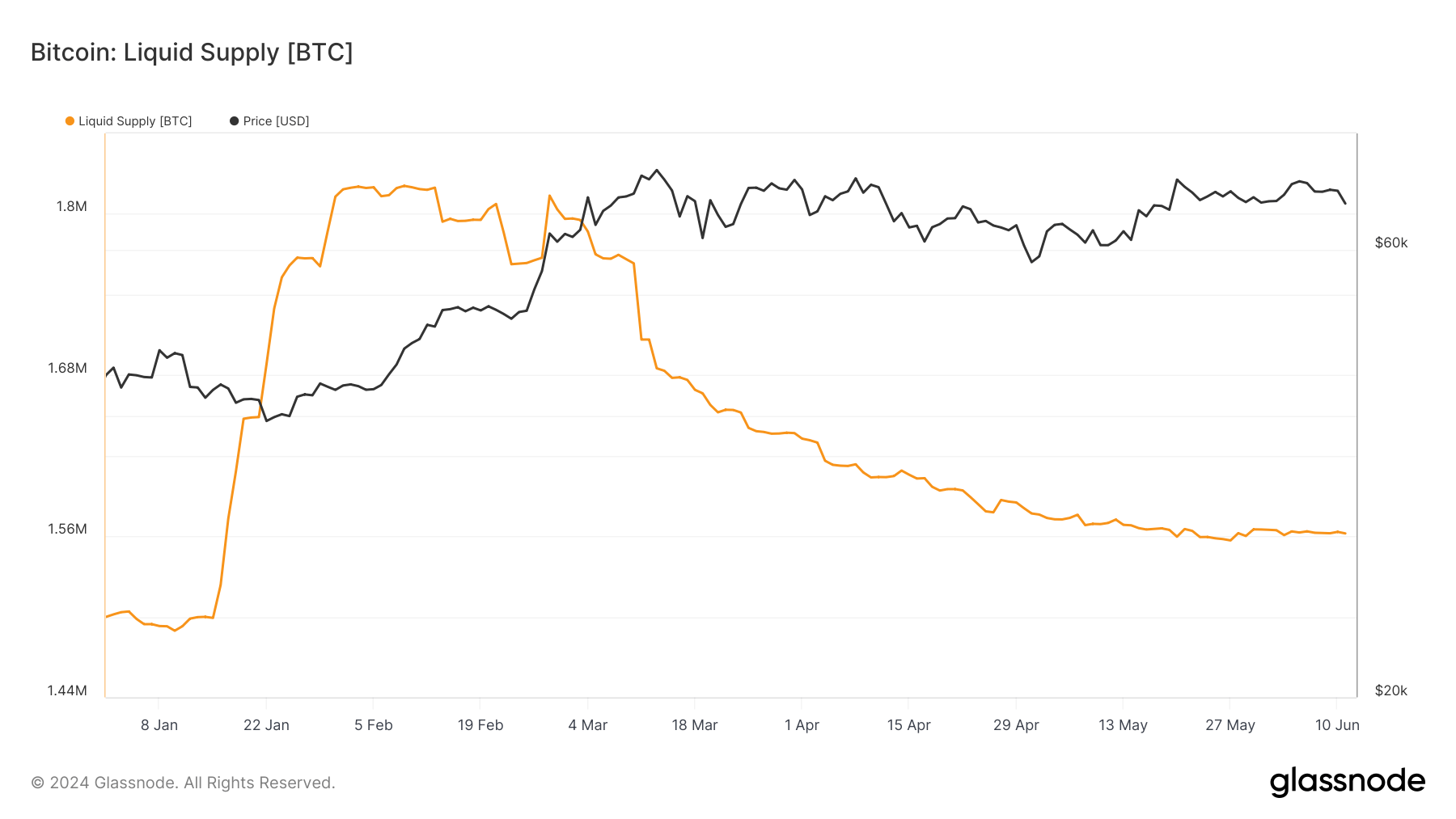

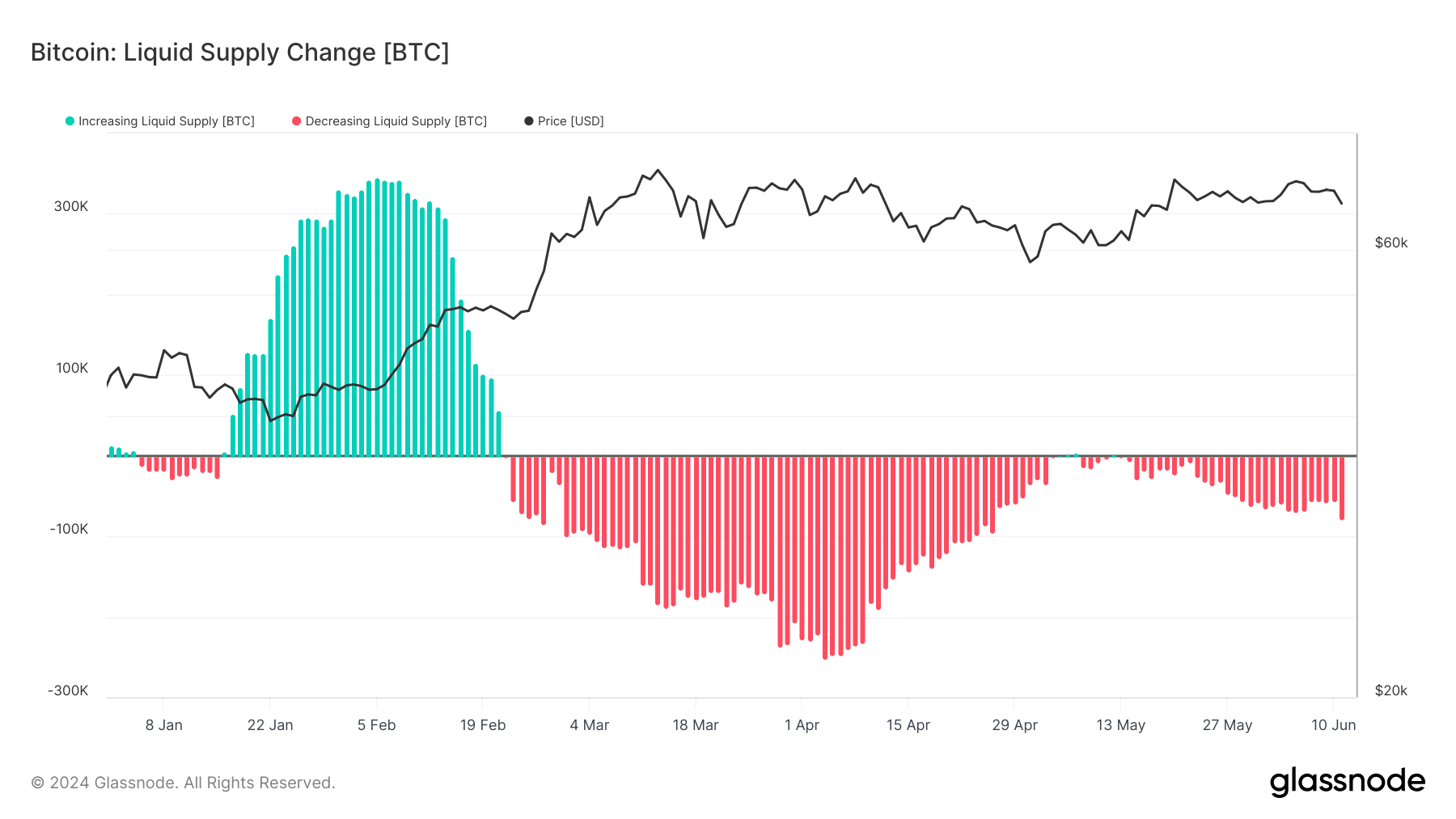

All through this 12 months, we’ve got seen important fluctuations in these provides. The liquid provide was at 1.501 million BTC on January 1 and elevated to 1.813 million BTC by February 28. Nonetheless, there was a constant decline from April onwards, with the liquid provide dropping to 1.562 million BTC by June 11. This discount indicators a lower in readily tradable Bitcoin, indicating diminished promoting stress as fewer cash can be found for fast trades.

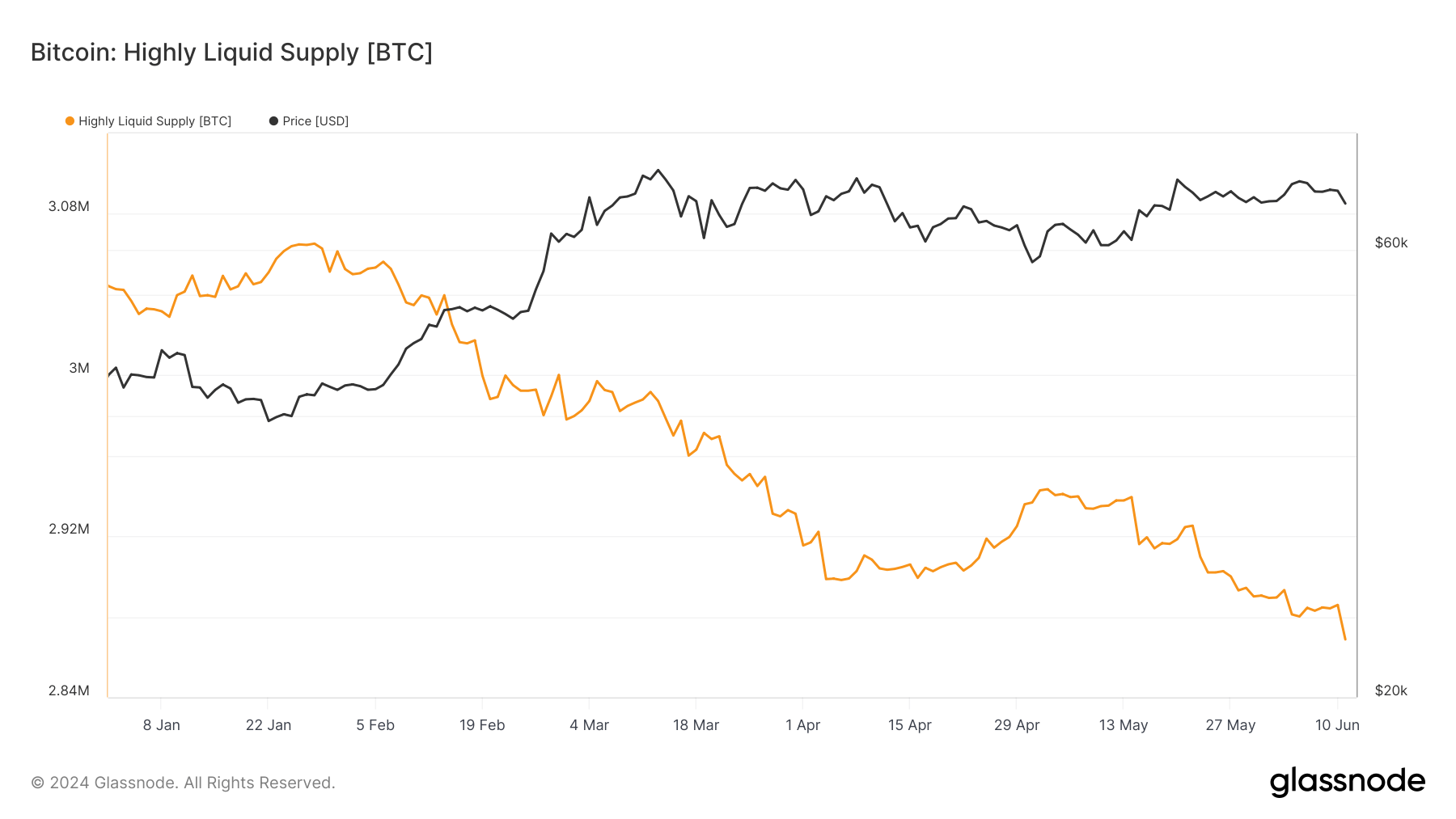

Extremely liquid provide additionally declined, beginning at 3.044 million BTC on January 1 and reaching 2.868 million BTC by June 11. This constant drop over a number of months highlights a discount in probably the most simply accessible Bitcoin, which may imply that lively merchants and exchanges are holding much less, probably because of a shift in the direction of holding or diminished buying and selling exercise.

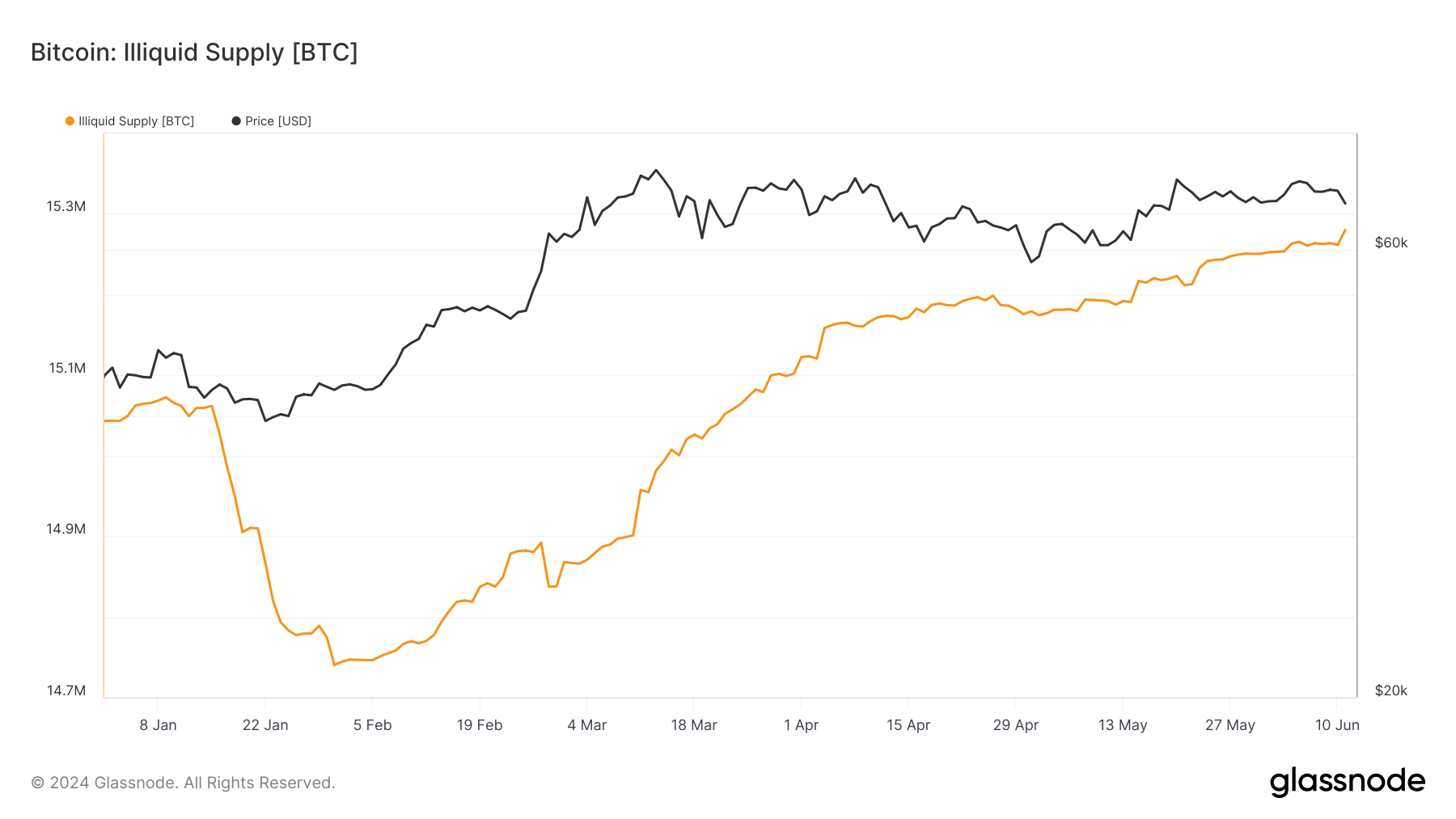

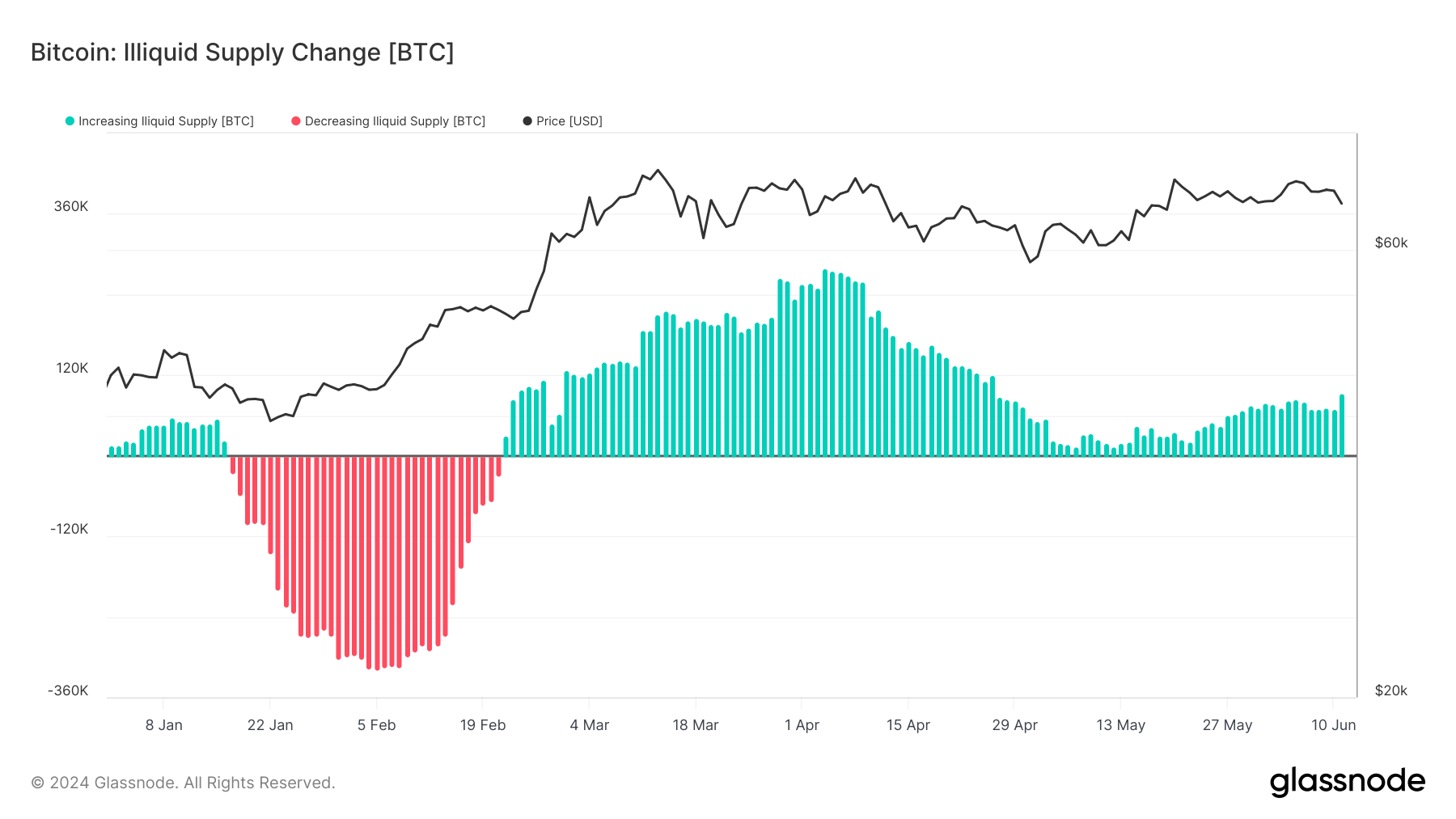

Conversely, the illiquid provide confirmed a gentle enhance. It started at 15.043 million BTC on January 1 and rose to fifteen.280 million BTC by June 11. This pattern of accelerating illiquid provide means that extra Bitcoin is being moved into long-term storage, indicating confidence in Bitcoin’s future worth and a lower within the rapid availability of cash for buying and selling.

The 30-day web change information additional helps these observations. The liquid and extremely liquid provides have been constantly adverse since February 22, with probably the most substantial decline of 252,000 BTC on April 4. As of June 11, the web change stays adverse at -79,306 BTC. This persistent adverse change reinforces the concept that Bitcoin is regularly shifting out of liquid and extremely liquid wallets, decreasing market provide.

However, the illiquid provide’s 30-day web change has been constructive since February 22, with a peak enhance of 279,587 BTC on April 4. As of June 11, this web change stands at +92,834 BTC, indicating a sturdy and ongoing accumulation pattern amongst long-term holders.

The patterns stay constant when evaluating the broader yearly pattern to the previous month. Each the liquid and extremely liquid provides proceed to lower, albeit at a slower tempo, whereas the illiquid provide steadily grows. This continued divergence between liquid and illiquid provides exhibits a market during which extra individuals are inclined in the direction of holding somewhat than buying and selling, reflecting a bullish sentiment.

The submit Bitcoin’s liquid provide lowering whereas illiquid confidence grows appeared first on StarCrypto.