Bitcoin’s (BTC) transient climb above $28,000 through the early buying and selling hours of in the present day led to liquidations of roughly $130 million in positions held on the crypto market.

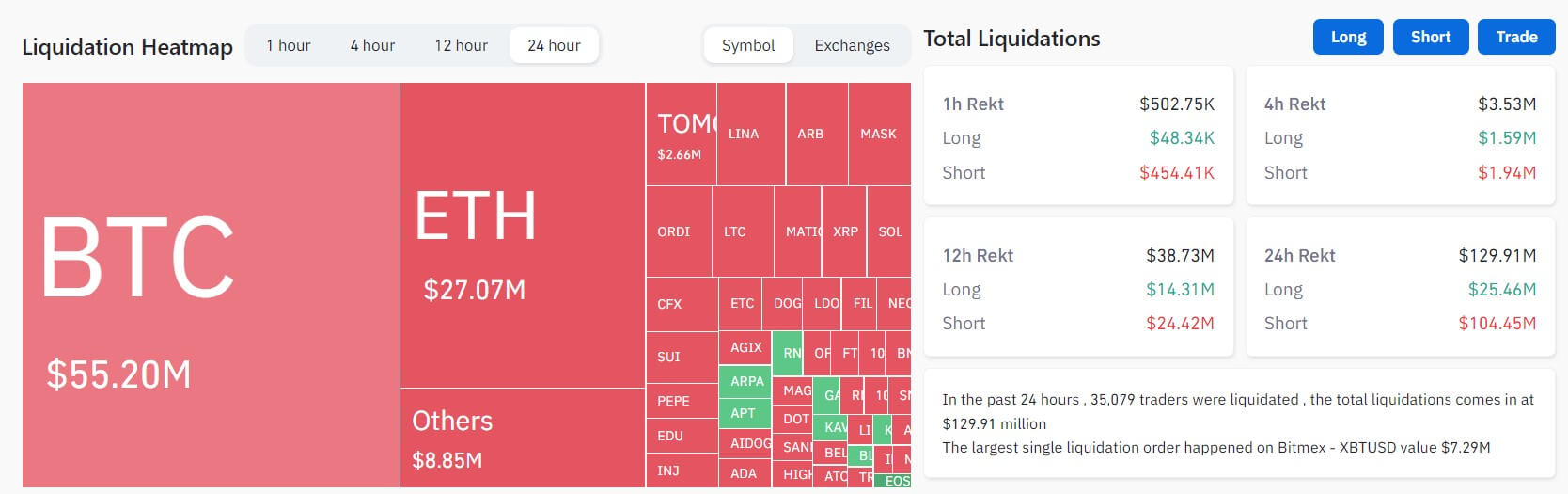

In line with Coinglass information, the flagship digital asset noticed $55 million in liquidations for merchants who held positions in it within the final 24 hours.

Roughly $130 million liquidated

The crypto market noticed $129.91 million liquidated up to now 24 hours, with greater than 35,000 merchants being liquidated.

Information from Coinglass confirmed that brief merchants misplaced $104.45 million, with Bitcoin and Ethereum accounting for over $68 million of those losses.

In the meantime, lengthy merchants skilled $25.46 million in liquidations. The highest two digital property have been liable for greater than 50% of those losses.

Different property equivalent to Dogecoin, BNB, Chainlink, XRP, Litecoin, and Solana skilled lower than $2 million in liquidations, respectively.

Throughout exchanges, a lot of the liquidations occurred on OKX, Binance, and ByBit. These three exchanges accounted for over 70% of the general liquidations, with 99% being brief positions. Different exchanges like Huobi, Deribit, and Bitmex additionally recorded a sizeable quantity of the overall liquidations.

Probably the most vital liquidation occurred on Bitmex – XBTUSD, valued at $7.29 million.

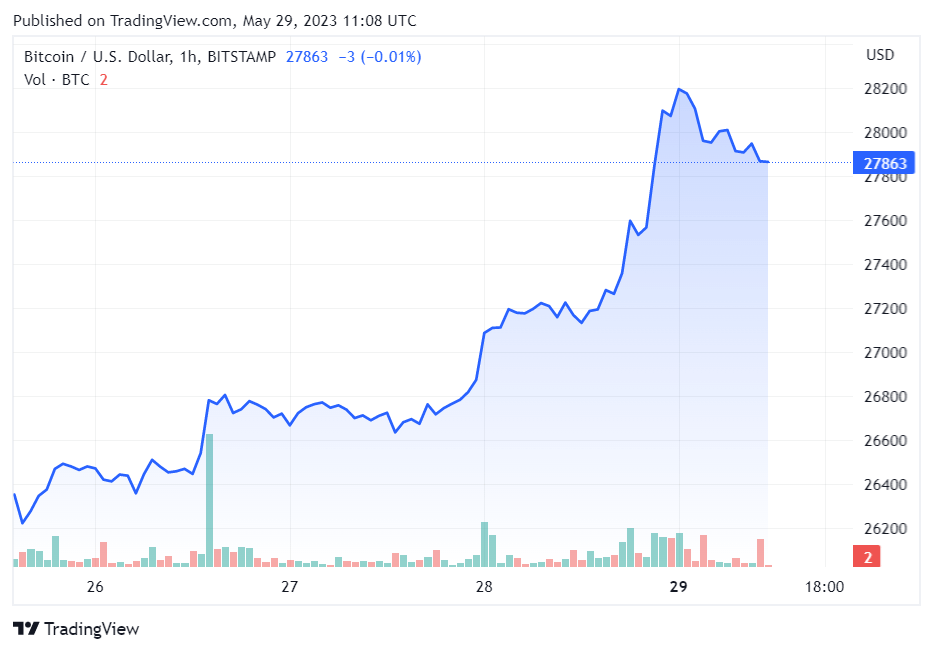

Bitcoin briefly climbs above $28k

Over the last 24 hours, BTC broke the $28,000 stage barrier, peaking at $28,432, in keeping with StarCrypto’s information.

Nevertheless, it has retraced to $27,960 as of press time.

Ethereum (ETH) rose 3%, whereas BNB is up 2%. XRP, Cardano (ADA), Dogecoin (DOGE), and others additionally noticed respectable beneficial properties through the reporting interval.

The rally was fueled by information that the U.S. authorities reached an settlement on its debt ceiling. On Might 28, President Joe Biden described the settlement as a “compromise” and an “vital step ahead that reduces spending whereas defending important packages for working folks and rising the financial system for everybody.”

In a notice shared with StarCrypto, Matrixport’s chief researcher Markus Thielen acknowledged that the debt ceiling settlement means market skeptics will want new causes to keep up a bearish outlook. He added:

“Many traders have been scared in regards to the debt ceiling and the potential default by the U.S. authorities, though the chance of such an occasion is extraordinarily low. Now, they might want to discover one thing else to be bearish about, because the market seemingly rallies.”