Regardless of Bitcoin not too long ago breaking via the $28,000 resistance degree, the crypto market has been comparatively flat for the previous month. The dearth of volatility within the traditionally aggressive market has been an underlying development evident in a number of on-chain metrics.

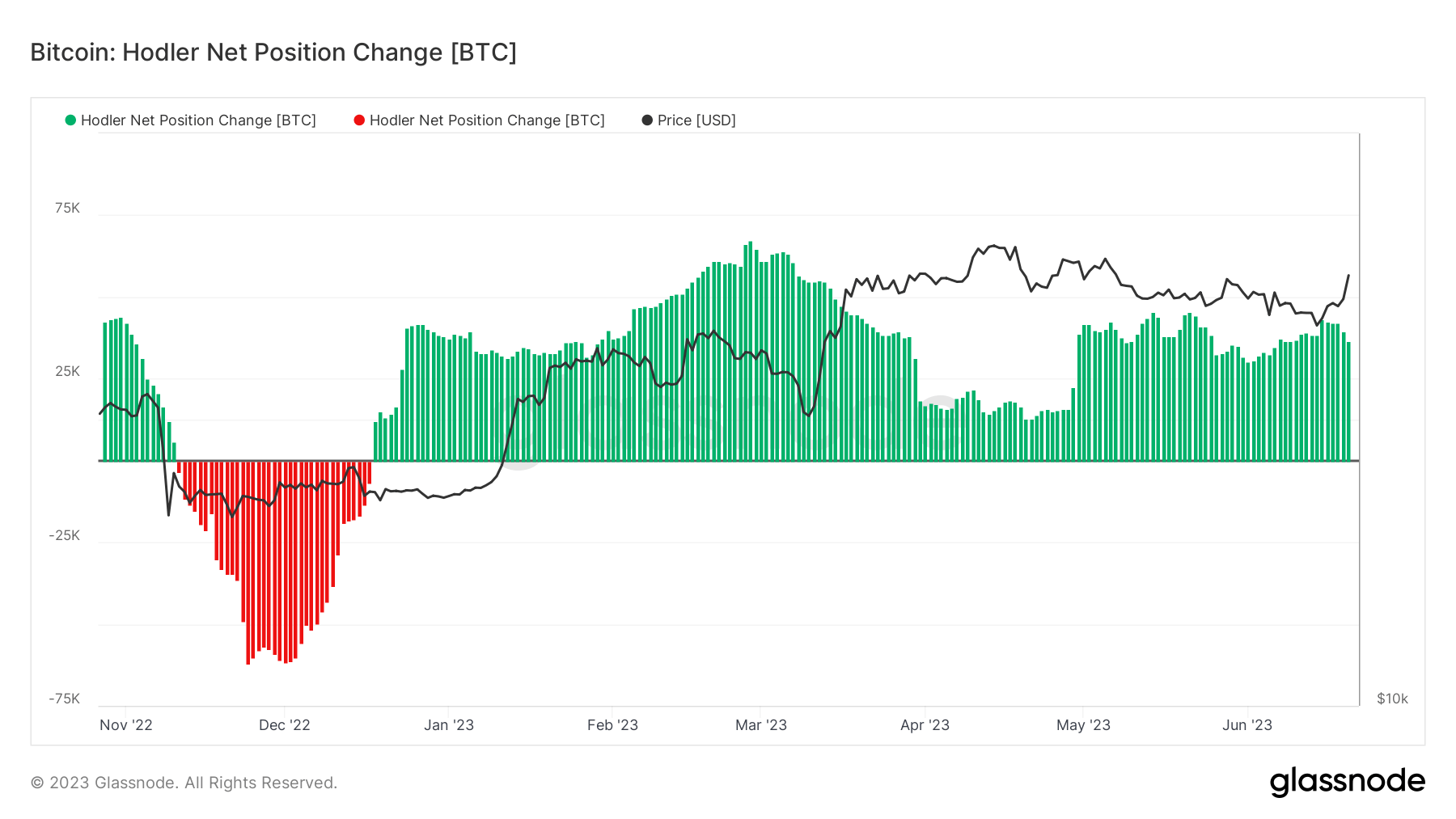

Bitcoin hodlers have been capitalizing on this sideways worth motion, persevering with the regular accumulation that’s been the dominant development this 12 months. Information from Glassnode confirmed steady development in hodler internet positions, with a mean of 36,500 BTC being added to their balances each month.

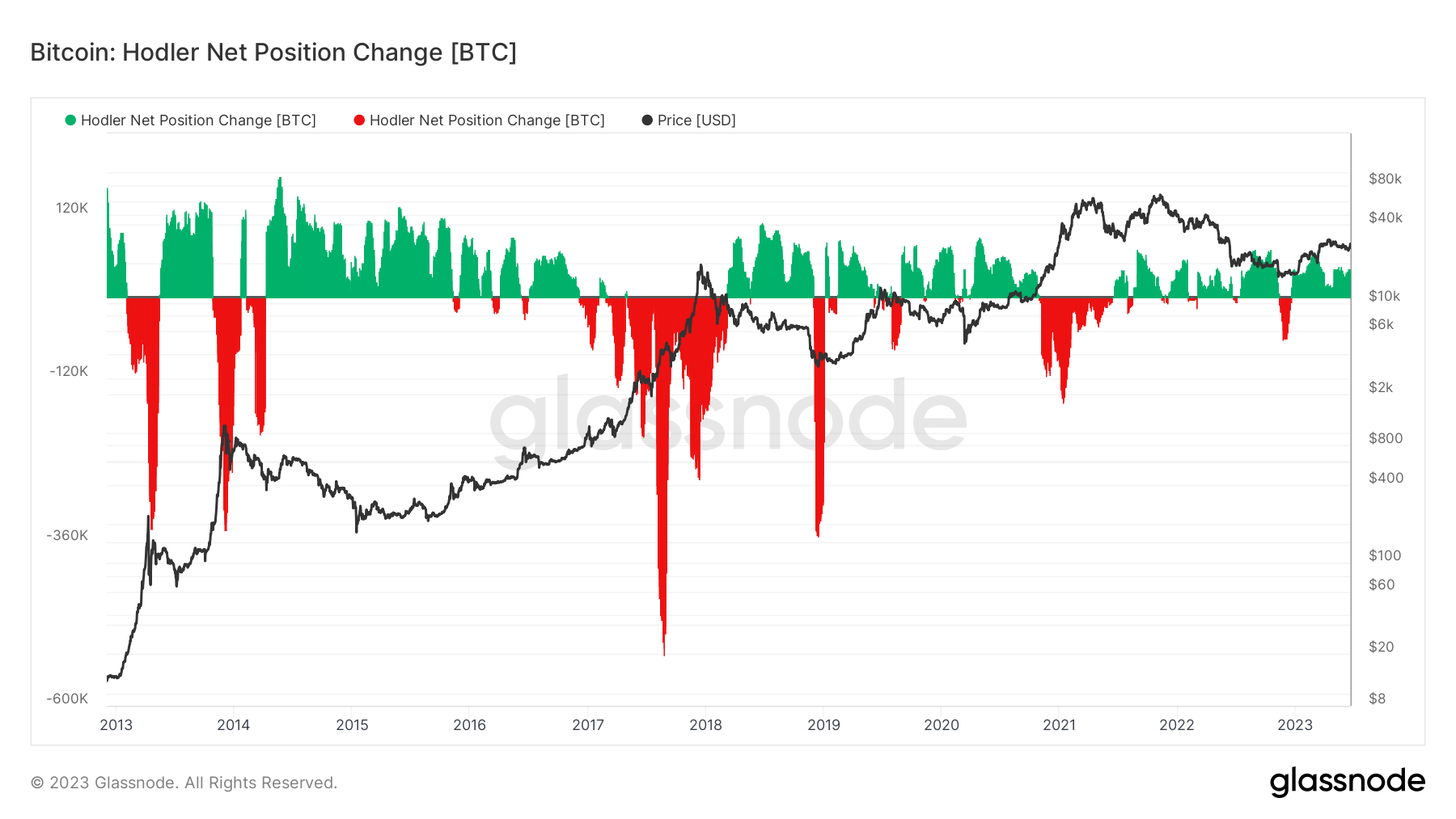

This accumulation section shouldn’t be a brand new growth. As an alternative, it has been a sluggish and regular march starting in June 2021. Historic information exhibits two comparable accumulation intervals — one spanning from April 2014 to December 2016 and one other from March 2018 to October 2020. With each intervals lasting roughly two years and 7 months, historic patterns recommend it might be at the very least six months earlier than the market sees one other hodler distribution cycle.

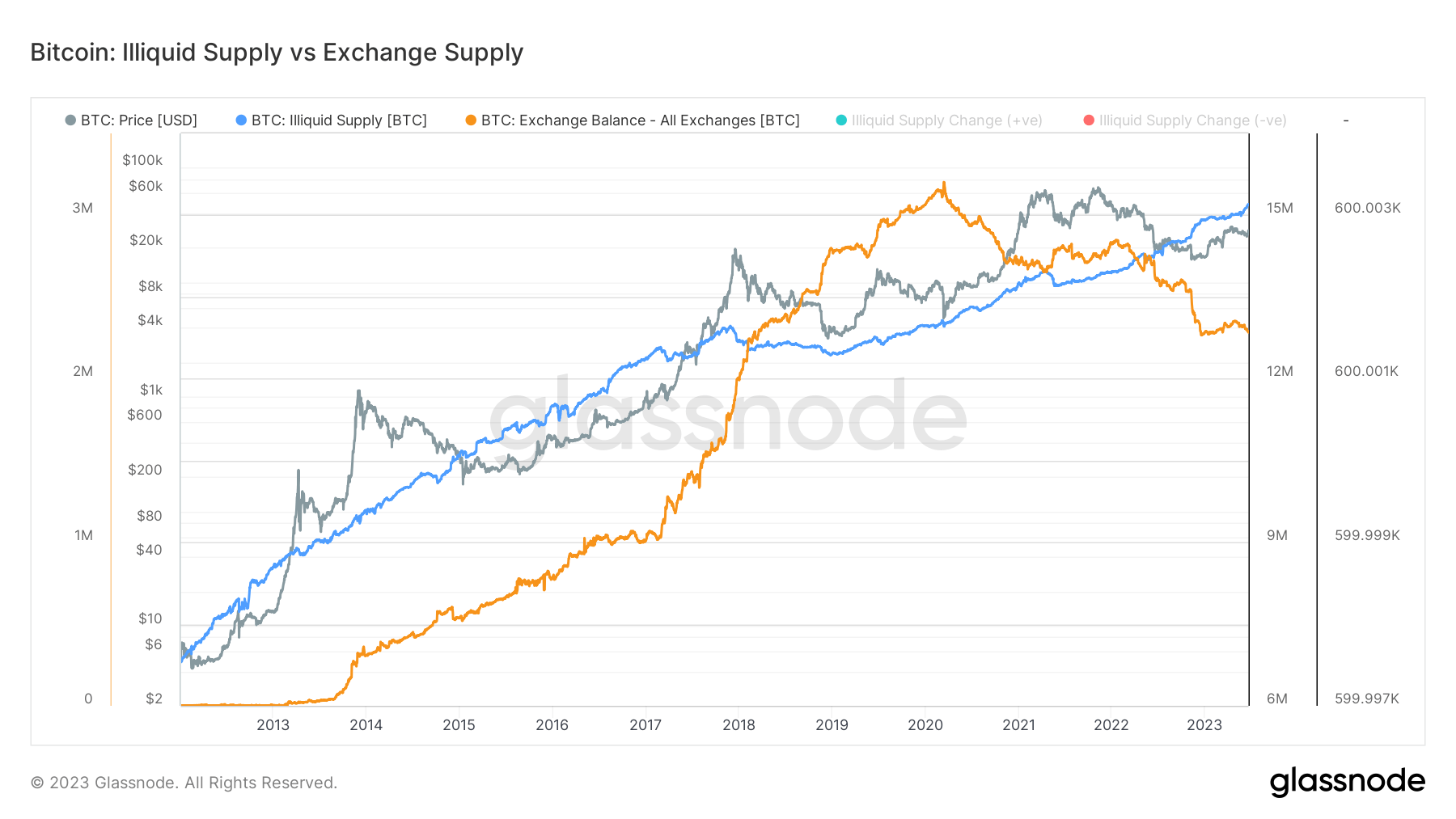

This improve in hodler accumulation can be seen in Bitcoin’s illiquid provide, or the quantity of Bitcoin that’s not readily available for purchase, promote, or commerce. On June 20, Bitcoin’s illiquid provide reached its all-time excessive of 15.2 million BTC. This represents 78% of Bitcoin’s circulating provide on June 20.

There was a 2.2 million BTC improve within the illiquid provide for the reason that starting of 2020, exhibiting a 17% improve. Whereas this 12 months has solely seen a 2% rise in illiquid provide, the seemingly small quantity equates to over 298,600 BTC added to illiquid wallets.

The quantity of Bitcoin held on exchanges remained comparatively flat for the reason that starting of the 12 months, posting a 0.85% lower. Nonetheless, the drop turns into a lot steeper when zooming out — for the reason that starting of 2020, the quantity of Bitcoin held on exchanges decreased by 25%.

The publish Bitcoin’s illiquid provide hits all-time excessive as hodlers proceed to build up appeared first on StarCrypto.