Information analyzed by StarCrypto confirmed a level of relationship between Bitcoin tops and bottoms in relation to these of gold, the S&P 500, and the S&P Case-Shiller Residence Value Index (CSHPI).

Bitcoin versus others

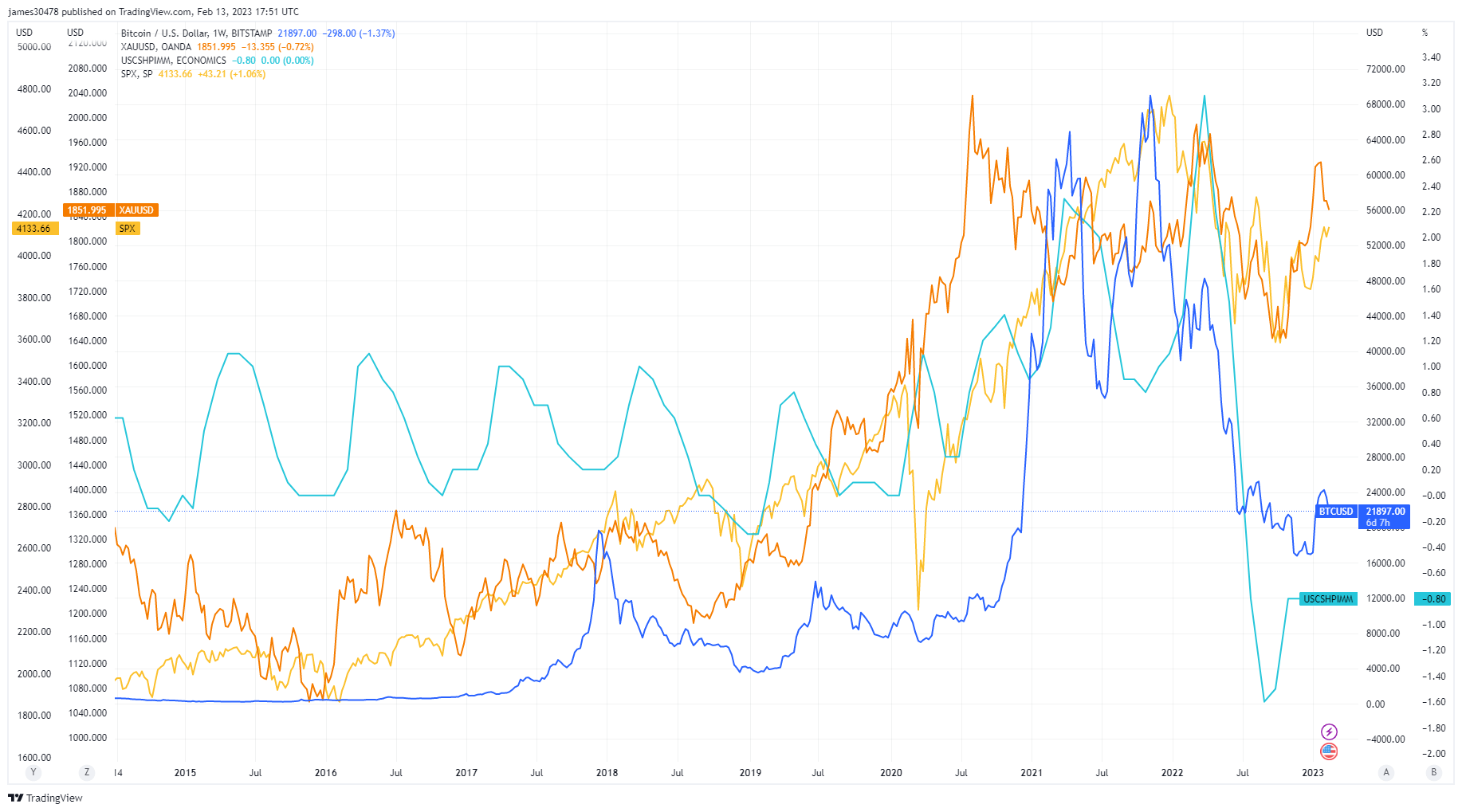

The chart beneath interlays the worth of BTC, gold, the S&P 500, and CSHPI. It was famous that when Bitcoin bottomed through the covid crash in March 2020, the worth of the opposite three belongings/indices additionally bottomed quickly after, aside from CSHPI.

Inspecting the tops on an expanded timeframe additionally reveals combined outcomes for BTC as a number one indicator. Bitcoin topped $69,000 in November 2021, the S&P 500 adopted by the year-end, adopted by the CSHPI, which peaked in January 2022.

Nevertheless, gold had topped at $2,070 round August 2020, some 15 months previous to BTC topping.

In abstract, the information factors to a excessive diploma of bottoming correlation between Bitcoin, gold, and the S&P 500, however not U.S. property. The covid interval was a black swan occasion that may have exerted promote stress amongst liquid asset courses.

Relating to topping, Bitcoin displayed a robust diploma of correlation with the S&P 500 and the CSHPI, however not with gold.