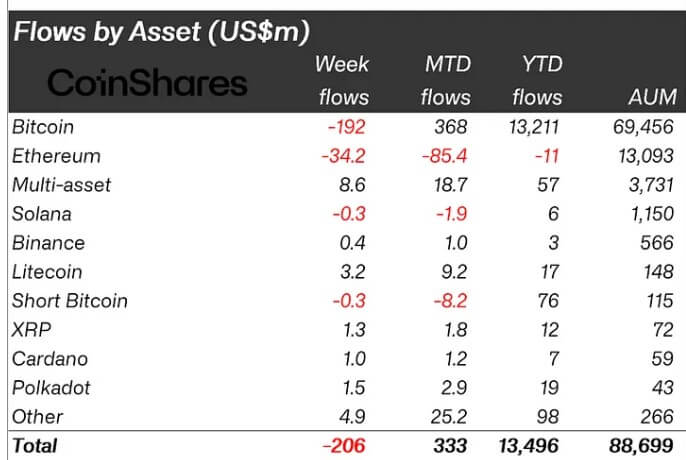

Crypto-related funding merchandise noticed their second consecutive week of outflows in April, with roughly $206 million leaving the market, per CoinShares‘ current weekly report.

Regardless of Bitcoin’s current halving, which generally generates pleasure out there, investor curiosity within the main digital asset remained subdued, evidenced by outflows totaling $192 million.

Conversely, short-term traders seized the chance introduced by the halving occasion to strengthen their positions, injecting $300,000 into the market.

What’s fuelling the outflows?

In the course of the previous week, StarCrypto reported that US-based Bitcoin (BTC) exchange-traded funds (ETFs) skilled 5 consecutive days of outflows. These outflows had been primarily pushed by Grayscale’s GBTC, ProShares BITO, and Ark 21 Shares’ ARKB.

James Butterfill, the Head of Analysis at CoinShares, elucidated that these outflows signify a dwindling curiosity amongst ETP/ETF traders. The development stems from speculations that the Federal Reserve might select to delay charge cuts additional.

Moreover, Butterfill identified a parallel decline in buying and selling volumes of ETPs, which clocked in at $18 billion final week. He emphasised that these volumes now symbolize a lesser share of whole BTC volumes, marking a shift from 55% a month in the past to twenty-eight%.

Altcoins draw curiosity

Buyers are more and more favoring lesser-known altcoins over main cryptocurrencies like Solana and Ethereum.

In response to the report, altcoins resembling Chainlink, Polkadot, Litecoin, Cardano, and XRP collectively attracted over $7 million in inflows final week.

In the meantime, Ethereum has continued its downward development, with final week marking the sixth consecutive week of outflows totaling $34 million. Its month-to-date circulate stays detrimental at $85 million, with a year-to-date circulate additionally in detrimental territory, amounting to $11 million.

Solana skilled extra modest outflows of $300,000, whereas blockchain equities recorded their eleventh consecutive week of outflows, reaching $9 million.

Butterfill attributed the outflows from blockchain equities to investor considerations concerning the influence of mining halving on mining corporations.