Bitcoin surged previous $46,000 for the primary time since final month’s approval of a number of BTC exchange-traded fund (ETF) merchandise by the U.S. Securities and Change Fee (SEC).

StarCrypto information reveals that the main cryptocurrency noticed a 5% enhance inside the final 24 hours, peaking at practically $46,500 as of press time.

StarCrypto Perception reported that the inflow of investments into BTC ETFs, reminiscent of BlackRock’s IBIT, may present substantial momentum to Bitcoin’s market worth. Moreover, Bitcoin’s present value trajectory aligns with its historic market patterns, suggesting potential for additional development, notably post-halving.

Markus Thielen, the founding father of 10x Analysis, highlighted historic tendencies indicating Bitcoin tends to expertise value upticks through the Chinese language New 12 months interval, with festivities commencing by Feb. 10.

“Bitcoin will seemingly rally at the least to the earlier January excessive of round 48,000. As we talked about in our notes, Elliot-Wave’s evaluation indicated that Bitcoin may even rally in direction of 52,000 by mid-March,” Thielen added.

This current value surge has propelled Bitcoin into the highest ten property by market capitalization, reflecting the rising significance of digital property inside the broader monetary panorama.

Concurrently, Ethereum and different outstanding various cryptocurrencies, together with Binance-backed BNB, Solana, Tron, Avalanche, and XRP, demonstrated resilience, registering beneficial properties exceeding 2% through the reporting interval.

The collective market capitalization of cryptocurrencies expanded by 3% inside the previous day, reaching $1.7 trillion.

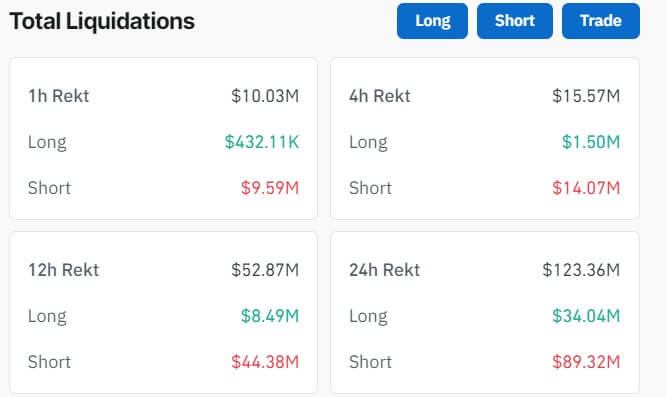

$123 million liquidated

Coinglass information reveals that the value motion liquidated $123 million throughout all property from greater than 38,000 crypto merchants through the previous day. Amongst them, lengthy merchants noticed losses totaling $34 million, whereas quick merchants confronted liquidations of roughly $90 million.