Bitcoin’s (BTC) temporary soar towards $30,000 led to greater than $106 million in liquidations for brief merchants within the final 24 hours, based on Coinglass information.

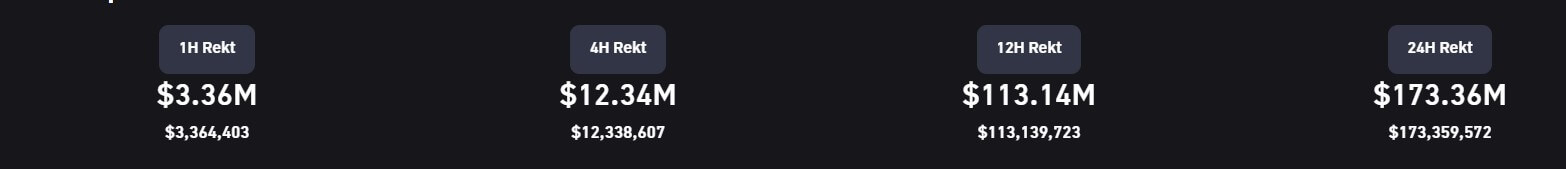

The general crypto market noticed $173 million in liquidation through the interval, principally from merchants holding quick positions in opposition to BTC and different cryptocurrencies.

A lot of the liquidations occurred on Huobi, Binance, and OKX. The three exchanges accounted for nearly 80% of the general liquidations — of which 87% had been quick positions. Different exchanges like Bybit, CoinEx, and Bitmex additionally recorded a sizeable quantity of the full liquidations.

Based on Coinglass, 31,113 merchants had been liquidated — with probably the most important liquidation being an $11 million BTC-USDT quick place on Huobi.

Different liquidated belongings embrace Ethereum (ETH) and Litecoin (LTC) — with $29 million and $2.8 million, respectively. Others like Solana (SOL) noticed $2.64 million in liquidation, whereas Arbitrum (ARB) recorded $2.27 million.

BTC briefly spikes above $30,000

In the meantime, Bitcoin rose by 6.4% within the final 24 hours to succeed in $30,000 for the primary time in nearly a yr, based on StarCrypto information.

Within the final 24 hours, the flagship asset noticed extra inflows than outflows on exchanges. Based on Glassnode information, $757.7 million BTC was despatched to exchanges, whereas $734.4 million was withdrawn. This led to a constructive netflow of $25 million.

In the meantime, the favorable value motion seems to have drawn extra retail merchants to the asset as extra addresses are holding not less than 0.1 BTC than ever earlier than — reaching a new all-time excessive of 4,307,269 earlier immediately, based on Glassnode information.

The improved value efficiency coincided with a current assertion from U.S. presidential candidate Robert Kennedy who mentioned cryptocurrencies like Bitcoin may defend holders from authorities overreach and central financial institution digital currencies (CBDCs)

Kennedy mentioned:

“Cryptocurrencies like Bitcoin give the general public an escape route from the splatter zone when this bubble invariably bursts.”

The put up Bitcoin’s $30k value spike liquidates over $170M appeared first on StarCrypto.