- Bitcoin’s 15.31% rebound to the $60K vary has shifted the Greed and Concern Index from excessive worry to impartial.

- Constructive inflows into Bitcoin ETFs and vital purchases by MicroStrategy have bolstered market sentiment.

- Ethereum choices buying and selling has surged, with over 20,000 contracts focusing on $3,000 by December.

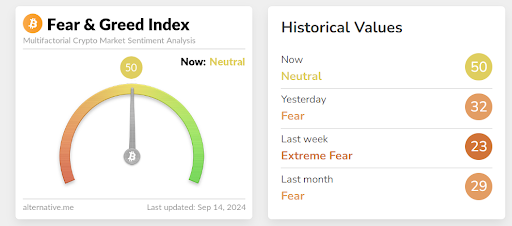

In a outstanding flip of occasions, the crypto market’s greed and worry index has shifted to a impartial stance, shifting away from the extraordinary worry skilled earlier. Current knowledge reveals the worry index now stands at “50,” up from “32” yesterday, which indicated worry, and “23” final week, reflecting excessive worry.

This alteration comes as Bitcoin has bounced again to the $60K value level early right this moment, reaching a day by day peak of $60,656. Bitcoin was final within the $60K vary on August 28, three weeks in the past. Throughout this era, Bitcoin’s value dropped to $52,598 on September 6, contributing to the intense worry sentiment available in the market over the previous weeks.

Basically, Bitcoin has rebounded by 15.31% since that decline, serving to to enhance market sentiment. At press time, Bitcoin hovers simply round $60K because it seeks to defend this newly recaptured threshold.

Bitcoin’s restoration has had a gentle impression on the altcoin market, with a number of high ten altcoins, together with Solana, recording modest good points of round 3% within the final 24 hours. Notably, a number of key occasions this week have influenced the crypto market’s restoration. This contains optimistic inflows into spot Bitcoin exchange-traded funds (ETFs).

Learn additionally: Is Bitcoin’s Inactive Provide Index Predicting a Calm Earlier than the Subsequent Surge?

Current Market Developments Shaping the Restoration

- Constructive Inflows into Bitcoin ETFs: The U.S. Bitcoin spot ETF market noticed $263.2 million in web inflows on Friday, marking a reversal from the earlier week’s web outflows.

- Grayscale Bitcoin Belief (GBTC) Inflows: The Grayscale Bitcoin Belief, beforehand experiencing vital outflows, noticed inflows of $6.7 million on Friday.

- MicroStrategy’s Main Buy: Bitcoin bull MicroStrategy disclosed a further buy of 18,300 BTC, value over $1.1 billion, bringing its whole holdings to 244.8k BTC.

- Surge in Ethereum Choices: Curiosity in Ethereum choices has surged, with over 20,000 contracts purchased focusing on the $3,000 degree by December 27, indicating rising optimism for ETH.

- Political Developments: One other notable spotlight this week was the talk between Donald Trump and Kamala Harris. Though the talk didn’t deal with cryptocurrency, Harris’s rising prominence was evident, with present polls giving her simply over a 50% probability of changing into the primary feminine President.

- Inflation Knowledge Influence: This week’s inflation knowledge confirmed the August Client Worth Index (CPI) at 2.5%, assembly expectations and elevating the prospect of a 25 foundation level fee minimize to 85%.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.