- Bitcoin examined the $92,000 degree yesterday after falling from a weekly excessive of $102,000 as promote pressures mounted.

- Macroeconomic elements trigger doubts in regards to the market power as sticky inflation turns into a priority.

- Spot crypto ETFs logged massive outflows on Wednesday following the discharge of the Fed assembly notes.

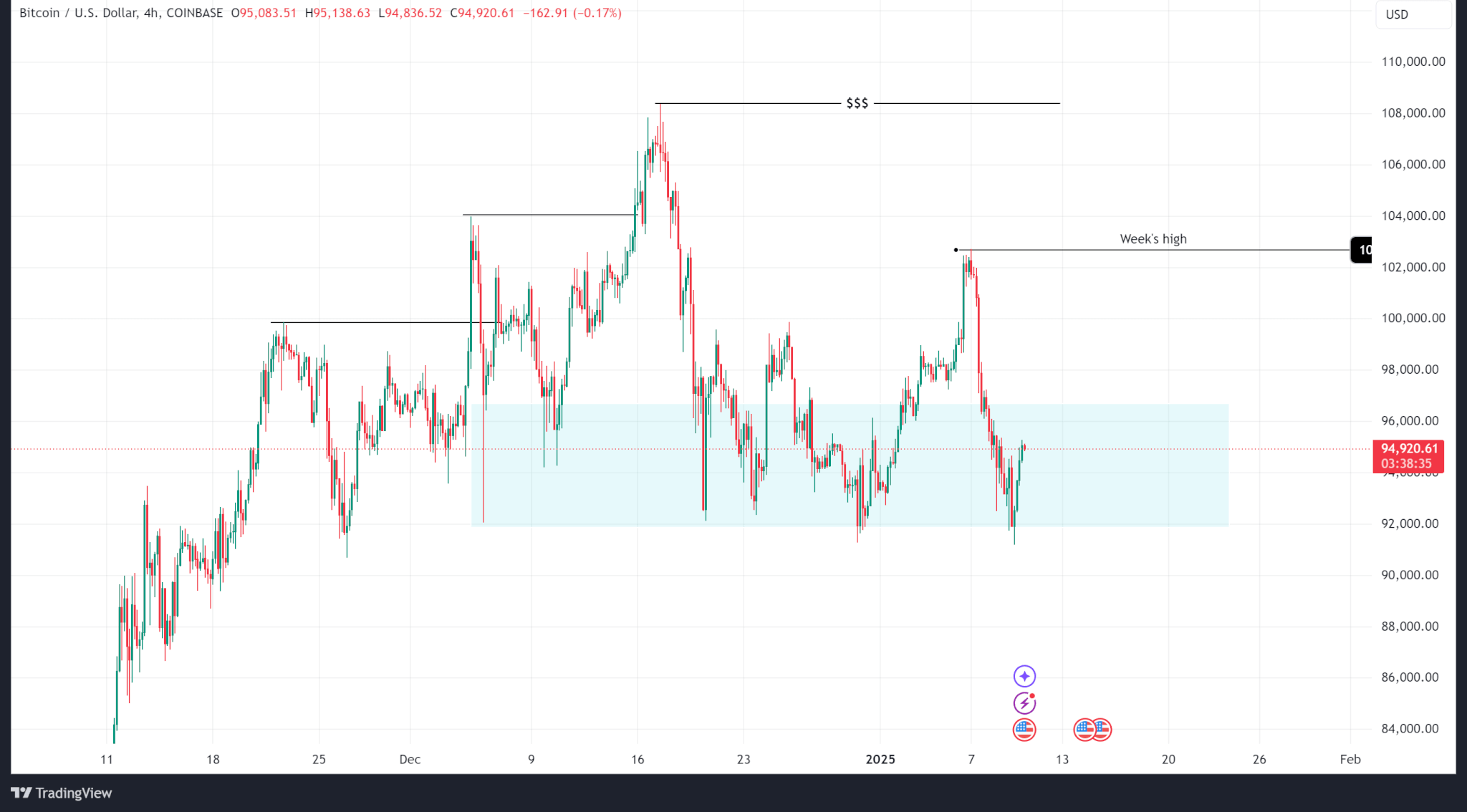

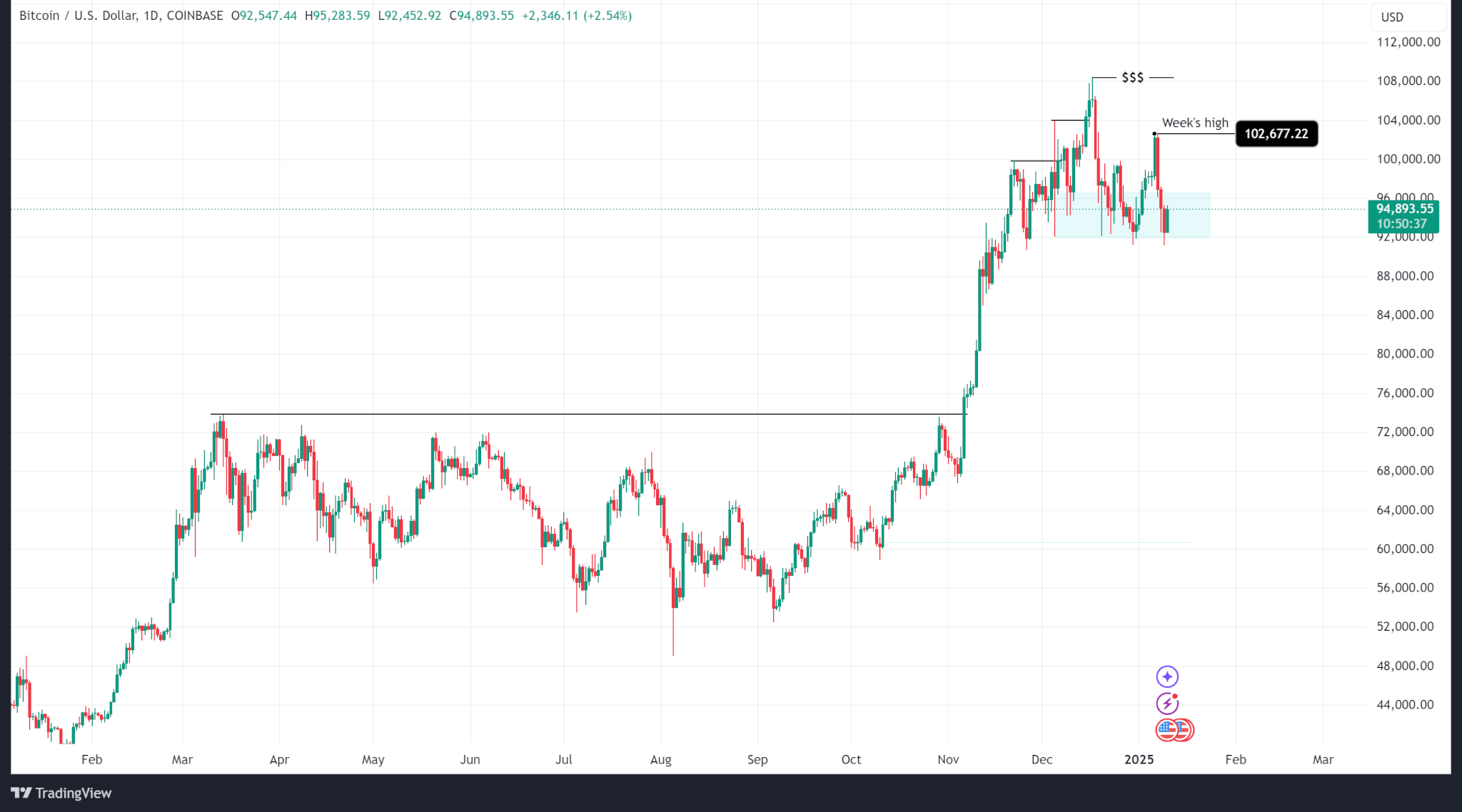

Bitcoin’s worth has fallen from a excessive of $102,667 reached on Tuesday, Jan. 7 to $94,890.00 as of publishing, however stays throughout the final H4 demand zone.

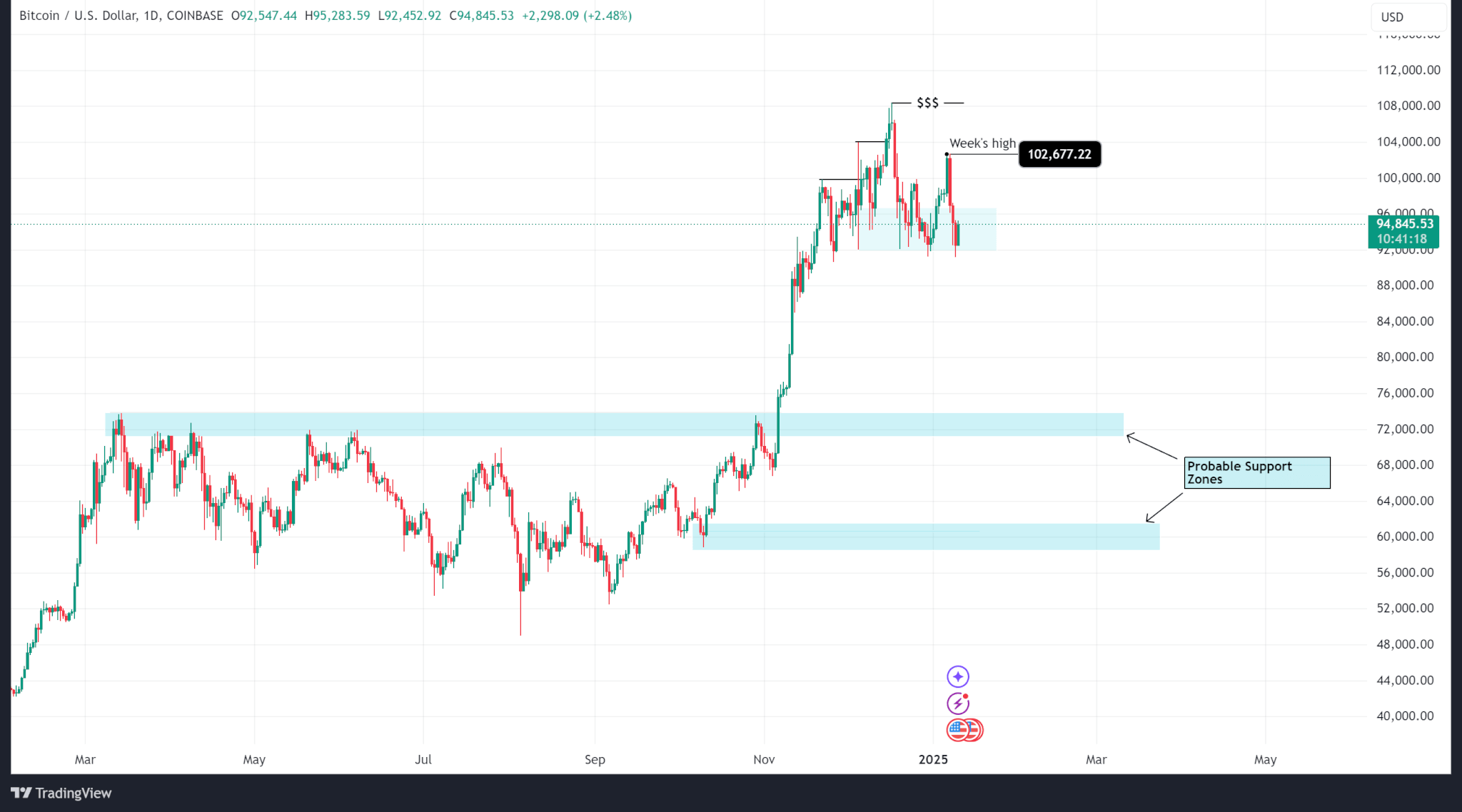

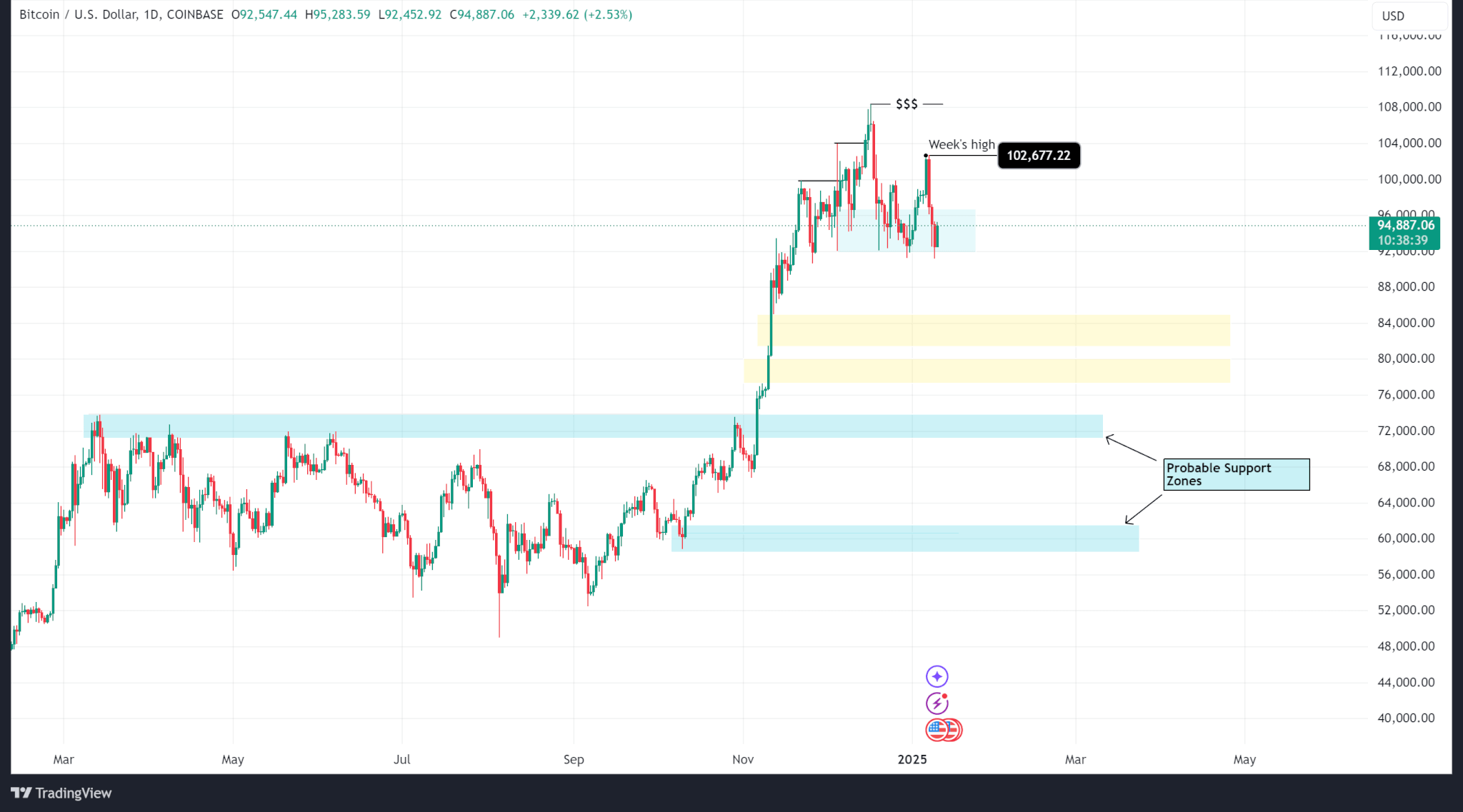

Whereas the demand zone between $92,000 and $97,000 often is the final assist degree on the H4 timeframe, a broader market view exhibits that BTC is in a premium zone on the every day time-frame, so a push under $92,000 nonetheless places the value in bullish territory general.

The most effective technical purchase ranges can be both on the final break of construction on the every day time-frame or on the 50% Fibonacci degree from the bottom level to the break.

There are two truthful worth gaps from which the value might react. Whereas they aren’t main zones, they may assist a continuation again to the exterior excessive at $108,000 or a quick reduction rally earlier than continued promote to the primary possible assist zone.

That is all predicated on Bitcoin breaking under the $91,000 degree.

In the meantime, spot crypto ETFs recorded outflows on Wednesday, Jan. 9 after the discharge of the Fed assembly minutes which exhibits that the Fed is cautious about inflation and the results of Trump’s incoming insurance policies.

BTC ETFs bled $568.8Mn on Wednesday whereas ETH ETFs misplaced $159.4Mn with the largest outflows from Constancy ($258.7Mn for BTC and $147.7Mn for ETH).