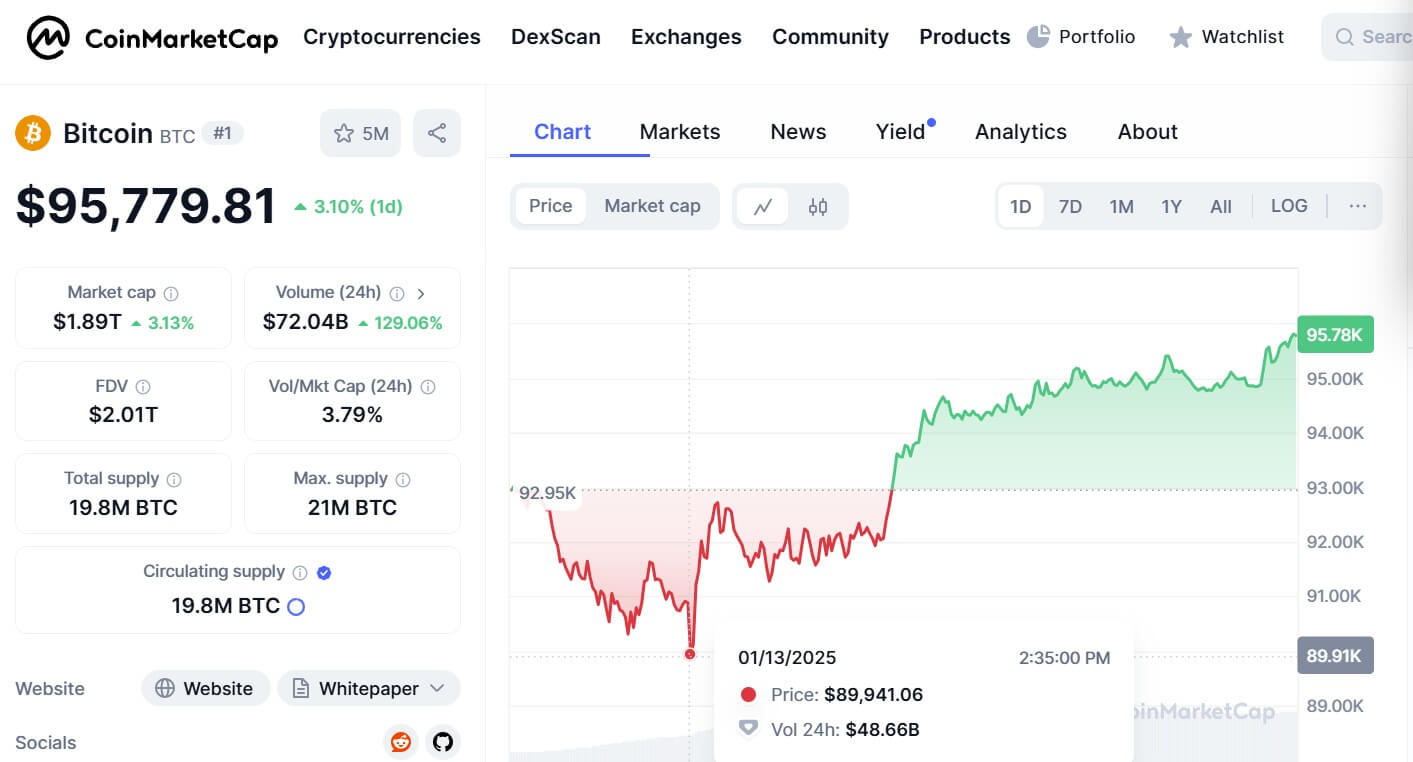

- Bitcoin dropped to $89,900 on January 13, its lowest decline in two months

- James Toledano, COO at Unity Pockets, mentioned one of many causes for the drop is profit-taking after Bitcoin hit $108,000 in mid-December

- The inauguration of President-elect Donald Trump might spark renewed shopping for curiosity, Toledano mentioned

Bitcoin fell under $90,000 for the primary time in two months, dropping 3.6% in 24 hours because the market skilled promoting stress.

Information from CoinMarketCap reveals that Bitcoin’s worth dropped to round $89,900 on January 13. Nevertheless, on the time of publication, it’s buying and selling over $95,000.

In accordance with James Toledano, COO at Unity Pockets, there are a number of explanation why Bitcoin’s worth fell.

“The primary is profit-taking, after hitting a peak of round $108,300 in mid-December, the market has seen an enormous quantity of it, notably following the election of pro-crypto President-elect Donald Trump,” he mentioned to CoinJournal, including:

“Secondly, whereas institutional shopping for has continued contributing to Bitcoin reserves on exchanges hitting a seven-year low, buying and selling quantity stays subdued and this might merely be all the way down to a seasonal slow-down.”

Macroeconomics weigh available on the market

Current evaluation means that bleak financial expectations drive this bearish sentiment. This contains Trump’s tariff plans, the US Federal Reserve’s cautious strategy to rate of interest cuts, and a robust greenback.

Zach Pandl, head of analysis at Grayscale Investments, mentioned to CNBC that:

“I might attribute the drawdown within the final two days largely to the market beginning to recognize that not each side of the Trump coverage agenda goes to be constructive for Bitcoin – and tariffs do introduce some new uncertainty.”

As questions encompass Trump’s forthcoming insurance policies, it might have dampened enthusiasm, which might “result in short-term volatility for an already extremely unstable asset,” mentioned Toledano.

Some analysts imagine Bitcoin can attain between $140,000 and $200,000 by mid-2025, so the present worth motion could seem regarding. But, it doesn’t essentially sign the tip of the bull run.

“The inauguration of President-elect Trump is simply seven days away and might be a pivotal second, with markets anticipating bulletins of pro-crypto insurance policies which may spark renewed shopping for curiosity,” mentioned Toledano. “Institutional accumulation, as mirrored in falling alternate reserves additionally helps the view that demand stays robust regardless of low buying and selling volumes.”